According to a Recent Study/Survey … End-of-June 2018 Edition

27 Min Read By MRM Staff

This edition of Modern Restaurant Management (MRM) magazine’s “According to …” research roundup features amazing insights from five years of DoorDash data, hot summer food trends from BiteSquad and eating on the road.

Five Years of DoorDash

When it comes to celebrating our highs or comforting our lows, nothing is more powerful than enjoying a delicious meal with loved ones. As our friends at DoorDash celebrate their fifth anniversary, they’ve compiled some incredible data— meal milestones, and all the trends in between.

The United States is one of the few places on the planet where you can experience a massively diverse range of international cuisine. So it’s no surprise that every city in the nation has its own global favorite. According to their data, here’s the cuisine that tops each city’s list.

New York — Chinese

Los Angeles — Japanese

San Francisco — Mexican

Chicago — American (Pizza)

Dallas — BBQ

Washington D.C. — Middle Eastern

Miami — Latin American

Atlanta — Southern (Fried Chicken)

Boston — Italian

Seattle — Thai

This is America

Hamburgers, fries and wings — these all-American comfort classics have seen more than their fair share of homes across the continent. Since 2013, you’ve eaten 8.5 million orders of french fries, eight million hamburgers and four million orders of wings.

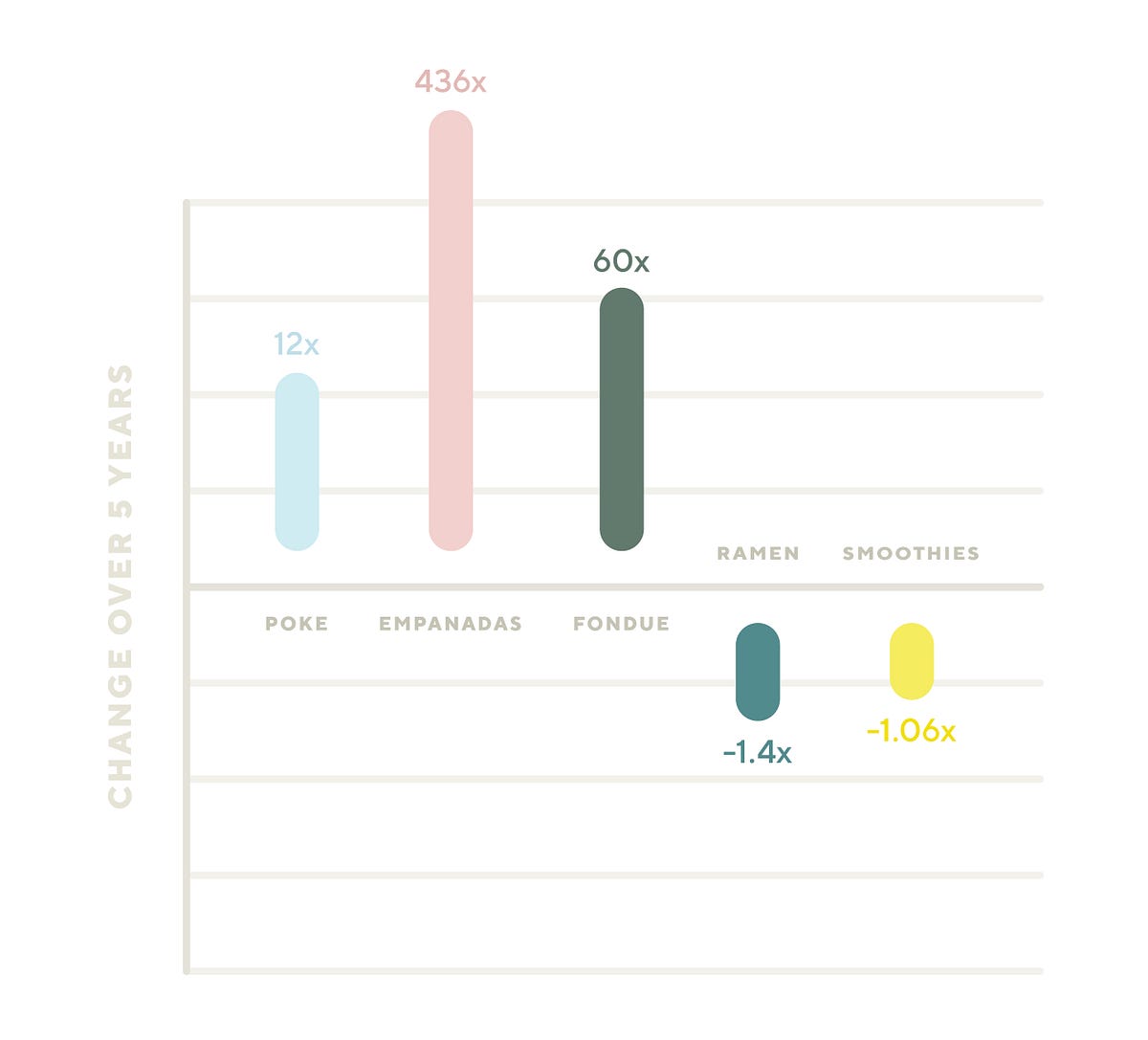

The fresh, global-inspired poke trend shows no signs of slowing down. Poke orders increase 12X over the last 5 years — but some other unlikely international players have exploded, too. Take empanadas. Orders for the portable, Latin American pockets of deliciousness spiked 436X since 2013. And then there’s the unexpected rise of gooey fondue, orders of which increased by 60X. Turns out pizza and grilled cheese sandwiches have some stiff competition for the cheesy crown.

Could ramen be on its way out? The rich broth ‘n noodle staple of college campuses everywhere has seen a 40 percent decrease, while liquid lunchers are showing signs of smoothie fatigue — orders for the blended beverages are down 6 percent. Take them down, group orders all around — and you’ve got 97 friends with bubble tea in their hands. That’s right, our largest group order ever consisted of 97 individual orders of bubble tea for the Bioengineering Center at Stanford University one evening — late-night finals fuel, anyone?

As the Philadelphia Eagles defeated defending champs New England Patriots during Super Bowl 2018, you ordered —

16,000 orders of wings

10,000 pizzas

3,000 orders of nachos

And about those Philly cheesesteaks…we saw orders for the iconic sandwich double during the Super Bowl nationwide on game day compared to the average.

When it comes to baseball, the competition is just as fierce among the fans…and boy did the Cubs’ fans bring their a-game. That’s right, Chicago Cubsfans — you ordered 12x more food than Cleveland Indians fans on the day your team clinched an epic World Series victory in 2016.

The real magic of the holidays — whether cultural, religious, or “just because” — is spending time with friends and family. At DoorDash, those gatherings always involve plenty of food. In 2017, we saw orders for Chinese food triple (3X) on Christmas, with Manhattanitescarrying the team by ordering 5X more Chinese food than their annual average.

In 2018, we helped single ladies celebrate “Galentine’s Day” by stocking their parties with over 6,000 orders of booze — nearly 20 percent more alcohol than on Valentine’s Day. And those happily paired off? On Valentine’s Day this year, chocolate sales quadrupled.

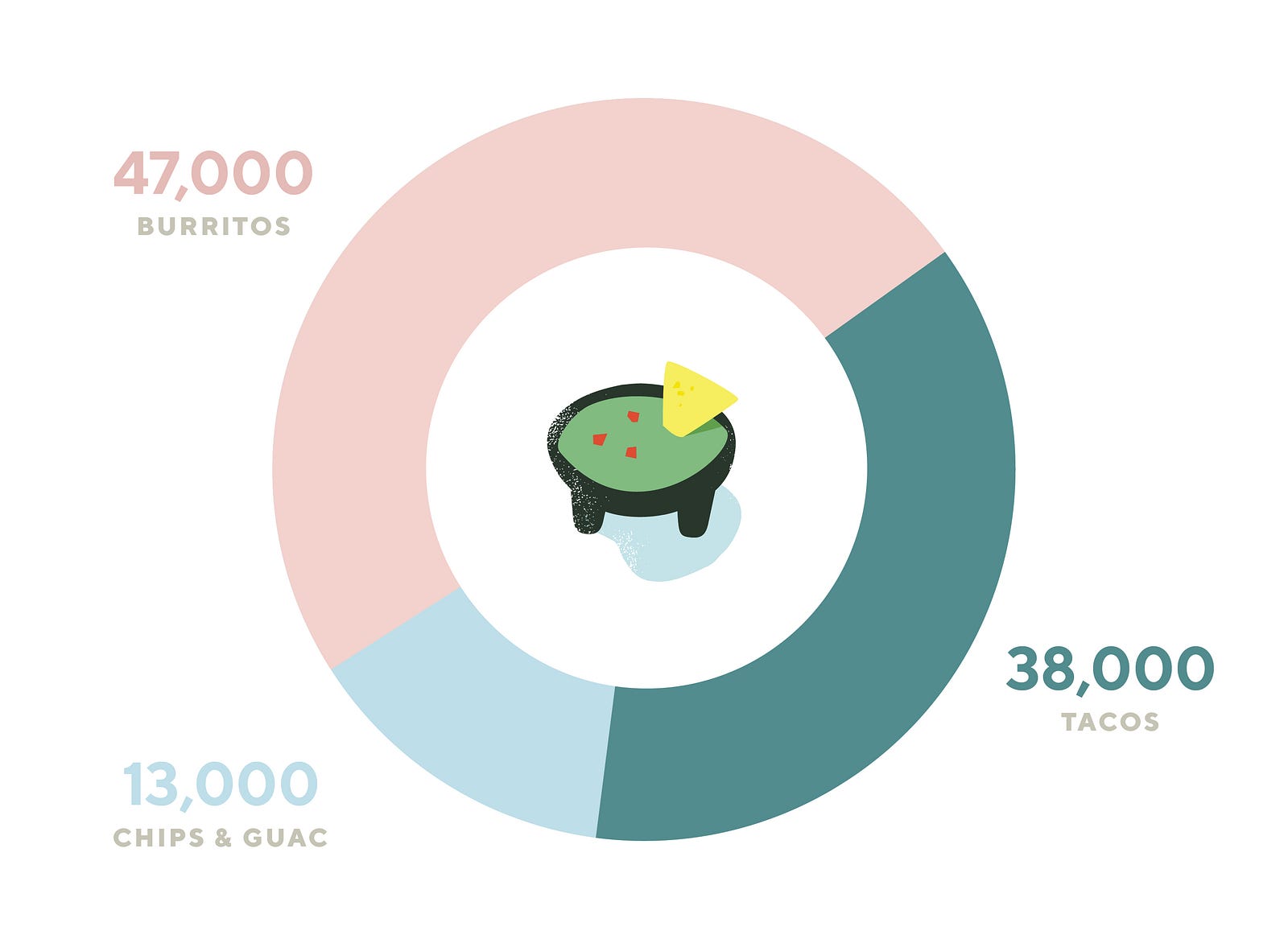

On everyone’s favorite Mexican food feast day this year, Dashers delivered a whopping 47,000 burritos, 38,000 tacos and 13,000 orders of chips and guacamole. Compare that to the quintessential American food fest, Memorial Day — 25,000 burgers, 1,500 hot dogs and 4,800 beers were ordered this year alone!

Whether it’s a cultural event or a TV moment watching history in the making, we love any excuse to rally around food and libations.

During the royal wedding that captivated the world on May 19, Americans across the country woke up early that Saturday morning to watch the ceremony between Prince Harry and Meghan Markle unfold. We saw 50 percent more people order breakfast.

And speaking of English occasions, we saw orders for fish & chips quadruple during the impending Brexit vote in March 2017.

Did someone say elections? Let’s not forget our own, which turned into one of the biggest national drinking days of the year. On Election Day in 2016, 90 percent morepeople ordered liquor on DoorDash and 50 percent more ordered wine, compared to other Tuesdays in November and October.

And for the TV event we’ve all got our calendars marked for — Shark Week — who doesn’t crave the very thing you’re watching? Yep, turns out we eat what we see. You ordered 66,000 orders of fish last year during Shark Week. (Trust us, that number is not fishy at all).

Over the last five years, Dashers (aka delivery drivers) have traveled 340 million miles. You could circle the globe 13,600 times or take more than 700 round-trip flights to the moon and back.

The largest tip a Dasher has received for one single order was $900!

Since January 2018, 17,000 pounds of food from partner restaurants have been saved from landfills and redistributed to food pantries — that’s heavier than two adult elephants!

In celebration of their anniversary, DoorDash donating 50,000 meals in partnership with Feeding America® to feed people in need across the country.¹ But that’s not all. By the end of 2018, committed to increasing the volume of food rescued each month by 5X!

Hot Food Trends for Summer 2018

Bite Squad released its curated list of foods forecasted to be sizzling hot for delivery this summer. Globally-inspired street foods, plant-based barbecue favorites and creative and colorful ice cream are among the top predictions.

Bite Squad’s top five trends for summer 2018 include:

Street Food – International foods and flavors continue to take center stage this summer with street food as the main star. This informal and easy-to-eat cuisine, with standouts like tacos, satay and gyros, is perfect for simple summertime noshing.

A must try: Mexican street corn, or elote, which is corn on the cob slathered in crema or mayonnaise, and topped with cotija cheese and cayenne (look for it at local Mexican restaurants, or try it as a side from Chili’s). And jump on the tahini train (this paste made from sesame seeds is one of 2018’s most popular condiments) with an order of falafel with tahini sauce, a Mediterranean menu essential.

Poke – Waves of poke-centric restaurants have opened across the U.S. over the past year, and this Hawaiian specialty has quickly become a restaurant chain staple. Consisting of cubed, fresh raw seafood, tossed in soy sauce and sesame oil and served over rice, poke (pronounced “po-kay”) makes for a light and healthy meal – ideal for hot summer nights!

Plant-Based BBQ – With plant-based diets and veganism on the rise in 2018, we’re seeing backyard barbeque favorites go meatless on menus this summer. Veggie burgers and vegan dogs will have a regular seat at the picnic table, while smoky seitan “ribs” and tangy jackfruit “pulled pork” capture the flavor and feel of classic BBQ fare.

Pickled Everything – Move over sriracha and bacon, Americans are puckering up for pickles as they have their moment in the flavor spotlight. From burgers and tacos piled with pickled onions, to an uptick of kimchi (a Korean condiment of salted and fermented veggies), to the new Pickle Juice Slush from Sonic, restaurants are making it easy for folks to get their pickle fix this summer.

Ice Cream – The summer essential is cooler than ever this season with soft serve and Thai-style rolled ice cream trending, and brightly-colored scoops with creative ingredients and flavors (think matcha, charcoal, turmeric) popping up on Instagram feeds across the country! And with ice cream sandwiches and sundaes never going out of style, there are countless ways to indulge in this sweet summertime dessert.

QSR Marketers Plan and Location Data

More than two-thirds of QSR marketers, some 69 percent, plan to increase their use of location data over the next two years, according to research commissioned by location intelligence company, Cuebiq. The findings, released today, are detailed in the white paper “Navigating Location Intelligence: Critical Impacts for QSR Marketers” based on the proprietary study completed by 451 Research, an information technology research and advisory company.

Among QSR marketers, loyalty programs will drive the adoption of location intelligence, as three in four marketers stated that enhancing loyalty programs is the “most likely” use case for location data.

“Detailed knowledge of competitor interactions and customer behavior provided by location intelligence will drive the next generation of loyalty program,” says Antonio Tomarchio, CEO of Cuebiq. “Loyalty programs have rarely gone beyond reward points based on purchases. However, knowledge about what other services customers value opens the door to more effective loyalty programs that can vary by locale and merge with co-branding, shopper marketing and other partnership arrangements.”

The research, conducted in April of 2018 among North American marketers and CRM managers in large companies primarily within four vertical markets (automotive, retail, quick-service restaurants and banking), also found that:

- 58 percent of QSR respondents said they were likely to use location data for competitive intelligence- the top-ranked choice for potential applications, although one that’s infrequently deployed.

- About half (56 percent) of QSR marketers said they are in the process of evaluating or already using location data, compared with just 43 percent in the overall study. Interestingly, this group has less confidence in their ability to measure the impact of location intelligence compared to other industries (41 percent of QSRs rating themselves highly, versus 46 percent of the all-industry sample).

- 64 percent of respondents believe that their companies are in the early stages of creating marketing campaigns that link online and offline behavior. Slightly more (66 percent) claim that their organization has the knowledge and maturity to measure the performance of each restaurant or retail location.

- 69 percent of QSR marketers agree that location is key to understanding why and how customers interact with businesses. 62 percent have found that location-based data has been useful or relevant in improving marketing performance.

“Being able to quantify desired outcomes (i.e. more visits, higher sales per visit, etc.) is one of the key markers of success, especially among brick and mortar businesses like QSR,” said Tomarchio. “Marketers should slowly integrate location intelligence into a single application and expand gracefully. By allowing for the creation of demonstrable results on a smaller scale, it will make it easier for marketers to pull resources in support of programs that use data in more context down the road.”

Cuebiq commissioned the study with 451 Research to identify recommendations that will help marketers effectively map the complete customer journey. The report is based on primary research survey data, assessing the market dynamics of a key enterprise technology segment through the lens of the “on the ground” experience and opinions of real practitioners- what they are doing and why they are doing it.

A copy of the white paper can be downloaded here.

Food Gifting Market Grows

The U.S. food gifting market continues to grow. Market research firm Packaged Facts forecasts sales to rise by 4 percent in 2018, based on findings published in the report Food Gifting in the U.S.: Consumer and Corporate, 6th Edition. Among major growth drivers, usage occasion innovation is providing more consumers more reasons to give the gift of food to themselves or to someone else.

To be sure, the winter holidays remain a food gifting mainstay: some 54 percent of those who have purchased food gifts for others in the last 12 months have done so for the winter holidays. And birthdays, Valentine’s Day, and Mother’s Day remain popular food gifting occasions. Everyday gifting occasions also resonate. Some 23 percent of those purchasing food gifts for others have done so to say thank you, for example.

Given the outsized importance major holidays and tradition play in their market, food gifting marketers need to continue inventing and reinventing food gifts and to keep a watchful eye for ways to broaden holiday-related purchase rationales. Lindt helps show the way. For Valentine’s Day, Lindt spun the long-held assumptions about holiday participants on its head, framing Valentine’s Day as a way “to share love,” giving it room to market “Galentine’s Day.” By pairing chocolates with craft beer, Chuao Chocolatier blurs traditional lines, including more males as target recipients in the bargain. Meanwhile, EHChocolatier markets Halloween chocolate for the adults in the house. Each marketer succeeds in expanding on occasions for use.

Occasion expansion doesn’t stop there. With culinary botanicals, Harry & David seamlessly blends the floral category with the food category, filling a market niche and helping to create a new product category. Meanwhile a raft of chocolate marketers are positioning chocolate products as giftable snacks, and Chuao Chocolatier even offers a line of indulgent breakfast options, breaking into new dayparts. And who needs an occasion, when making, eating or learning about the product becomes the occasion? Tours, classes, and sponsored events provide the means to do so.

Indeed, industry innovation may be at a peak, driven not only by occasion expansion but also by healthy indulgence, sustainability and fair trade, storytelling, celebrity, aspirational experiences, gourmet and artisan, customization and personalization, and (of course) tradition.

The result is a market that remains steadily bound to major occasions where food gifting has found a consistent home, while moving beyond seasonal reliance and opening up more ways to court the younger consumers needed to keep it healthy.

Protein Power

The Protein Industry is seeing extra “bite” as the concept of “craft meats” takes hold, according to the Consumer & Retail Insider, an industry report released by Brown Gibbons Lang & Company (BGL).

Macro trends of population growth and rising disposable income have contributed to an increase in meat consumption. Rising demand, coupled with healthy living trends and a craving for all things natural and organic, are refining palates for artisan meats. As quality, authenticity, and transparency gain increasing appeal among today’s discriminating consumers, changing food preferences are taking niche protein markets mainstream.

The craft meats concept has attracted investor interest in line with favorable demand trends, illustrated by recent transaction activity in the space:

- Natural and grassfed beef producers have been acquisition targets, with Blue Apron (BN Ranch), Marubeni Corporation (Creekstone Farms), Verde Farms (Estancia Beef), and High Street Capital (Open Range Beef) among the investors to complete recent deals. The Grassfed Beef market has sustained double-digit growth with rising demand projected to propel market penetration.

- Hormel Foods set its sights on charcuterie-style meats with the $850 million acquisition of Columbus Manufacturing, paying a premium valuation at approximately 13.0-15.0x projected 2018 EBITDA, including synergies. The deal marks the largest in Hormel’s history. Artisan cured meats have been cited as a thriving niche market and appealing to today’s millennial “foodie” culture.

- Direct-to-consumer platforms in craft meats are attracting investor capital. This May, Crowd Cow raised $8 million in a Series A funding led by Fuel Capital and Madrona Venture Group. The rapidly growing e-commerce startup pledges quality and transparency, delivering premium grassfed beef from farm to fork through an innovative crowdsourcing model.

Access the full Investors Feast on Craft Meats report from our Food and Beverage industry experts.

Fast Food Forecast

Global Fast Food Market is expected to grow at a significant CAGR in the upcoming years as the scope and its applications are rising enormously across the globe. Fast food is termed as a food that is easily served and prepared and is a cost effective alternative to traditional food. It consists of high calories, saturated fat, salt, and sugar. These foods are prepared in a way that they look delicious so one can ask for more. Rising working people populace special women, expansion of fast food chains, growing urbanization, and rising disposable income are documented as major factors of Fast Food Market that are estimated to enhance the growth in the years to come. However, growing obese populace, low in nutrition, and rising importance of healthy health among customers are the factors that may restrain overall market in the coming years. Fast Food Market is segmented based on type, form, product type, application, and region.

Types such as hot dog, pizza, burger, sandwich, French fries, taco, chicken nuggets, falafel, popcorn, and others classify Fast Food Market. Forms such non-vegetarian fast food and vegetarian fast food classify Fast Food Market. Product types such as western-style fast food, Chinese-style fast food, and others classify Fast Food Market. Applications into dine-in, takeout, and others classify Fast Food Market. Fast Food Market is segmented geographically into Americas (North America, South America, Latin America), Europe (Eastern Europe, Western Europe), Asia Pacific, Latin America, Middle East and Africa. Globally, North America accounted for the substantial market share and is estimated to lead the overall market in the coming years. This may be because of high demand for fast food from consumers as changing lifestyle, growth in working women’s, and rapid expansion of fast food centers in the region.

The United States is a major consumer of Fast Food in the region. Instead, Europe and the Asia Pacificare also estimated to have a positive influence on the future growth. Europe is the second largest region with significant market share. However, Asia Pacific is estimated to grow at fastest pace with the highest CAGR in the foremost period. The aspects that may be ascribed to the growth comprise growing corporate culture and hectic lifestyle. The developing countries like India and China are the major consumers of Fast Food in this region. The key players of Fast Food Market are Dunkin’ Donuts, McDonald’s, Taco Bell, KFC, Wendy’s, Subway, Papa John’s, Pizza Hut, Dairy Queen, Starbucks, Dunkin’ Donuts, Burger King, and Domino’s Pizza. These players are concentrating on inorganic growth to sustain themselves amongst fierce competition. As companies all over the world have to believe that alliance with a market would permit them proportional market existence and authority to declare the leadership position.

Both full-service and fast food restaurants are revamping their menus and rolling out more mobile ordering options, to the delight of diners. Customer satisfaction with the Accommodation and Food Services sector overall rises 1.8 percent year over year to a score of 79.4 on the American Customer Satisfaction Index’s (ACSI®) 100-point scale. According to the ACSI Restaurant Report 2018, full-service restaurants jump 3.8 percent to an ACSI score of 81, while fast food establishments gain 1.3 percent to a score of 80.

“As the economy improves, consumers have more money to spend, and they’re dining out more,” said David VanAmburg, Managing Director at ACSI. “At the same time, restaurants are adapting their menus and technology in line with shifting consumer preferences, as millennial tastes for fresh food, mobile ordering, and automated kiosks take hold. The bottom line: Restaurants are working hard to please consumers, and the latest ACSI scores show that it’s paying off.”

Full-service restaurants bounce back from 2017 slump

Texas Roadhouse takes over the lead with a score of 83, up 1 percent over last year. It edges out Cracker Barrel, which falls 4 percent to 81 to tie Darden’s LongHorn Steakhouse for second place.

LongHorn’s score of 81 represents a leap of 5 percent, which takes the steakhouse from below average to among the top full-service restaurants. The restaurant’s reduced menu options and larger steak sizes seem to have paid off in customer satisfaction.

Third place goes to Olive Garden, which dips 1 percent to 80. Outback Steakhouse, Red Lobster, Red Robin, and TGI Fridays all tie at 79, below the industry average. Outback and Red Lobster lose 1 percent and 2 percent respectively, while TGI Fridays jumps 4 percent, a result fueled by a menu overhaul and a return to its roots as a bar.

Red Robin has the biggest gain in the industry, soaring 8 percent to 79. Its focus on menu innovation, online ordering, and call center support helped fuel a 40 percent increase in off-premises sales in the first quarter year over year and resulted in major gains in customer satisfaction.

Applebee’s, Chili’s and Ruby Tuesday tie at 78, with Denny’s just a point behind in last place at 77.

Full-service restaurants make big gains in both food quality (up 4 percent to 87) and food variety (up 4 percent to 86), both of which cater to changing consumer taste preferences for healthier options and customization. Order accuracy remains a strong point for the industry with a score of 89, a 2 percent rise over last year, and restaurant staff are said to be courteous and helpful, with a score of 87, also up 2 percent.

Chick-fil-A, Starbucks, KFC: How fast food players fared

Chick-fil-A holds onto its lead atop all fast food restaurants, with an unchanged score of 87. This is well above the industry average and head and shoulders above the next major competitor, Panera Bread, which falls 1 percent to a score of 81.

Subway and Arby’s both fall 1 percent to scores of 80 and 79, respectively.

Starbucks gains 1 percent to tie Dunkin’ Donuts at an ACSI score of 78 after Dunkin’ Donuts sheds 1 percent to lose its lead from last year.

KFC slips 1 percent to a score of 77.

Pizza purveyors get competitive

Papa John’s and Pizza Hut are in a dead heat among fast food pizza restaurants, tied at 80. While Papa John’s dips 2 percent year over year, Pizza Hut surges 5 percent for the biggest ACSI gain in the industry—likely the result of a new rewards program, and investments in equipment, technology, and marketing.

Domino’s is closing in on the top two, rising 1 percent to 79, while Little Caesars, the fourth-largest pizza maker, trails with a score of 77, down 1 percent this year.

Chipotle vs. Taco Bell: No contest

Chipotle Mexican Grill stands steady at 79, leveling off after a 6 percent plunge in 2016. While its financials continue to improve, the fast-casual chain’s customer satisfaction hasn’t bounced back as quickly from the company’s food safety crisis.

Taco Bell sits well below Chipotle at 74, after dropping 3 percent compared to last year. Its score also places it well below its fellow Yum! Brands chains, KFC and Pizza Hut.

Which fast food burger joint leads in customer satisfaction?

Overall, burger chains inhabit the lower end of the fast food industry. This year, Wendy’s rises 1 percent to a 77 to overtake Burger King, which falls 1 percent to 76.

Jack in the Box slips 1 percent to 74, while McDonald’s remains in last place among burger chains and fast food restaurants overall, with a score of 69 for the third straight year.

In general, customer satisfaction among burger chains has remained largely flat, at a level well below the industry average. As they invest in automated kiosks and mobile fast-pass lanes, it will be interesting to see if there’s a resulting rise in customer satisfaction.

The ACSI Restaurant Report 2018 is based on 22,522 customer surveys collected between June 19, 2017, and May 29, 2018. The full report is available for download here.

The Importance of a Local Coffee Shop

Purplebricks Group commissioned a national study* asking Americans to share their opinions on a number of topics related to real estate. Feedback ranged from property dealbreakers, such as crazy neighbors, to how crucial it is to live near their favorite coffee shop.

What’s that Smell? 80 percent surveyed said they would run from a property when searching for a new home if encountering issues such as seeing mold (69 percent), sensing odd smells (56 percent) or finding the home to be filthy (25 percent).

Within the study, Purplebricks also uncovered the unique compromises men and women would make when faced with house hunting woes.

The study also found what qualities are most important when searching for a new home, as well as how people feel when disappointed by a new prospect. Findings include:

“We conducted this survey in an effort to have an even better understanding of what matters to today’s buyers and sellers,” said Jonathan Adler, Chief Marketing Officer, Purplebricks. “It’s our job as the real estate expert to identify the needs of each client, and what really stood out to us is that buyers and sellers are tired of paying 5-6 percent commission. These results only reinforced that Purplebricks is exactly what consumers are wanting in today’s real estate market.”

Cold Brew Popularity

On the heels of ready-to-drink (RTD) coffee and iced coffee growth, cold brew coffee has become commonplace across the foodservice spectrum, according to Office Coffee Service in the U.S.: Market Trends and Opportunities, 3rd Edition, a report by market research firm Packaged Facts.

Iced coffee beverages broaden the coffee playing field, satisfying refreshment-based consumer needs by carrying the beverage well beyond its morning daypart stronghold. Cold brew’s promise of smoother taste and lower acidity—along with its premium positioning, higher price points, and enthusiastic younger consumers—build on iced coffee’s base and help keep the coffee market humming along.

Once the more exclusive darling of independent coffeehouses, dispensed cold brew variants are increasingly available across all restaurant types, and at some convenience stores, it has become a staple coffee product. From Starbucks and Dunkin’ Donuts to Jamba Juice to ampm, cold brew is on tap. And look inside the average convenience store or supermarket cooler, and you’ll see a cold brew beverage. Blue Bottle Coffee and Chameleon Cold-Brew are now under Nestlé’s wing, and Stumptown Coffee Roasters has been a part of JAB Holding Company since 2015, giving these super-premium, niche brands the marketing and distribution muscle needed to push them into the mainstream, joining industry leader Starbucks and a host of other emerging brands in a fast-moving stream that is crowding the RTD cooler.

For office coffee service operators, cold brew has historically posed challenges related to refrigeration needs and shorter shelf life, making it harder for it to crack the workplace. While the flurry of RTD cold brew launches gives them bottled options, office coffee service operators are also marketing other viable options, such as growlers, kegs concentrates, and kits replete with filters, coffee, and serving pitchers, bringing the option to more offices across the country.

Every major office coffee service provider can now boast cold brew capability. Canteen offers a variety of cold brew coffee brands and kegerators, while Farmer Brothers markets is eponymous Artisan Collection Cold Brew Coffee by Farmer Brothers, and Red Diamond markets Fitz Cold Brew.

Cold brew’s rise is also revealed by office coffee service providers’ bottom lines. Cott Corporation’s Coffee, Tea and Extract Solutions segment grew at a 38 percent annual average rate during 2013-2017, driven by growth in the cold brew segment. Royal Cup has even taken a step into retail, launching a line of ready-to-drink cold brew coffees there.

Cold brew is a win-win for RTD retail, foodservice, and OCS, offering just enough of a twist on tradition and more than enough super-premium backstory to push price points upward and even convert new customers to a saturated market by volume.

Local Food Shopping Habits

As the longest growing day of the year kicks off the start to summer today, the search for the freshest local food is on. Forager, whose digital procurement web and payments application connects local farmers with grocers and co-ops to bring consumers locally grown food, announced the results of a new survey looking at the local food buying habits of New England and Upstate New York consumers.

More than 84 percent of respondents are shopping for local foods in stores, with vegetables (70 percent) like fresh greens and cucumbers, and fruit (47 percent) such as strawberries and tomatoes, at the top of consumers’ wish lists. In fact, nearly 40 percent of respondents cited spending at least $50 or more a week on local food. And not only are consumers buying local because it tastes better (77 percent), but they also feel compelled to support the local economy and its farmers (94 percent) and the health of the planet (61 percent).

“With summer upon us, shoppers are prioritizing local, seasonal foods to take advantage of the bounty of this peak growing season,” said David D. Stone, CEO and founder, Forager. “An analysis of our own customer’s buying habits in their grocery stores and co-ops shows the same demand as seen in the survey, with asparagus, strawberries, arugula and other lettuces in the top of our purchase categories.”

The survey results reflect a burgeoning trend of consumers demanding fresh and healthy foods, with the local food segment expected to reach $20 billion by next year, growing much faster than the overall food and beverage market. Yet, despite the increased demand, respondents to the survey cite dissatisfaction with the local offerings at their conventional grocers, as well as challenges to buying local.

More than 54 percent of Forager’s survey respondents point to limited offerings in the stores as a significant barrier to buying local. This despite previous research indicating that the majority of grocers believe they are satisfying consumers’ demand for fresh food. The disconnect comes down to challenges facing both grocers/buyers and farmers/producers. For grocers, the traditional process of finding and doing business with multiple local farmers has historically been expensive, inefficient, manual, and error-prone. Farmers also struggle with inefficient processes like sharing their products and updating their availability.

Recognizing this, Forager’s innovative digital procurement platform removes these barriers to sourcing fresh, healthy foods to help consumers put more local food on their tables this summer—and every season. With 12,000 unique local products in its online digital catalogue, the platform is the largest of its kind in New England.

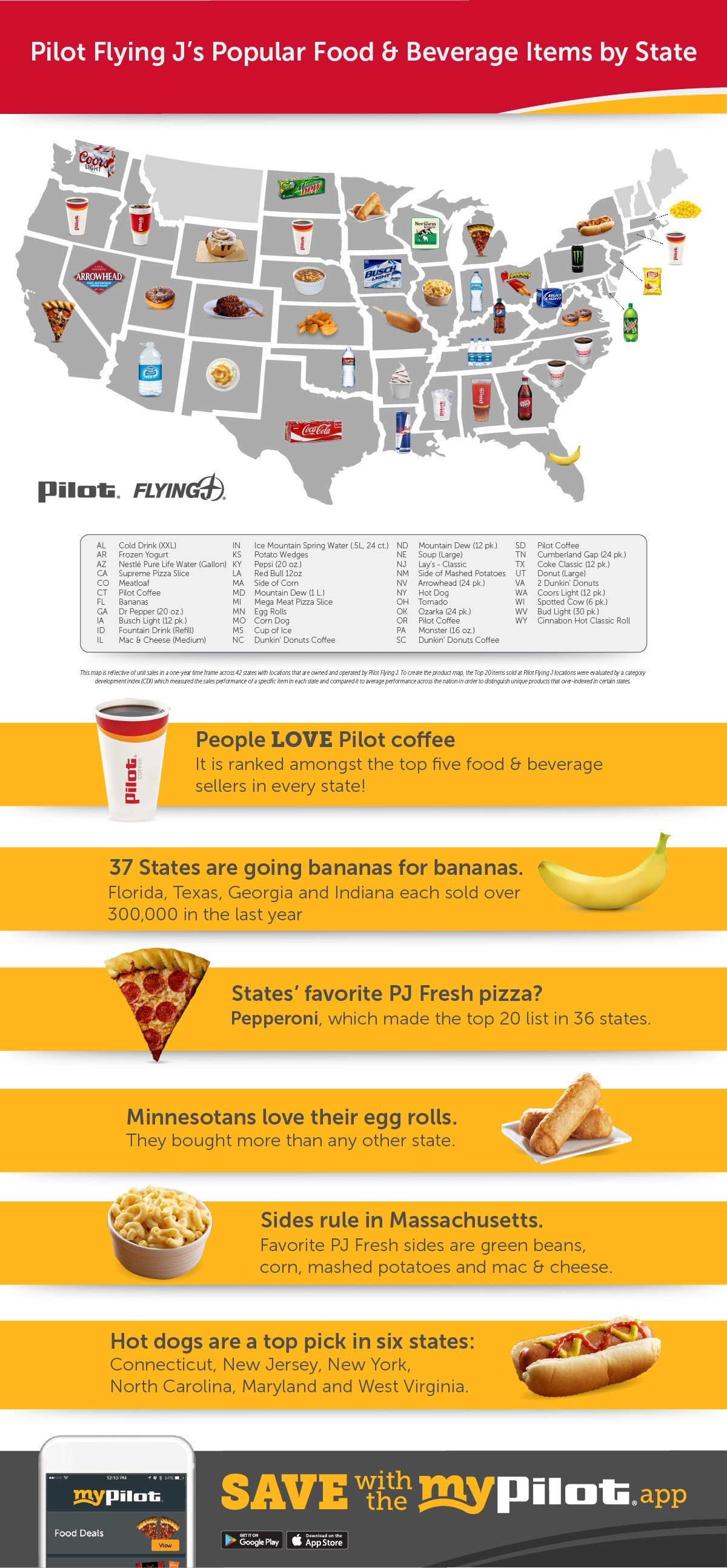

Eating on the Road

Millions of Americans hit the road over the summer, but before they can enjoy beaches and bonfires, parents are bracing themselves for the No. 1 source of stress on family road trips:* where to stop to eat. In honor of one of the top summer travel weeks over the July 4 holiday, Pilot Flying J, the largest network of travel centers in North America, rounded up surprising popular food and beverage items by state.

To see how travelers’ tastes differ across the U.S., Pilot Flying J analyzed the top 20 most popular food and beverage items from its 2017 sales data by state and identified interesting best sellers. Here are a few states’ favorite flavors:

- People love Pilot Coffee – it ranked among the top five food and beverage sellers in every state

- 37 states are going bananas for bananas –Florida, Texas, Georgia and Indiana each sold over 300,000 in the last year

- States’ favorite PJ Fresh pizza flavor? Pepperoni, which made the top 20 list in 36 states

- Minnesotans love their egg rolls – they bought more than any other state

- Sides rule in Massachusetts – favorite PJ Fresh sides are green beans, corn, mashed potatoes and mac and cheese

- Hot dogs are a top pick in six states, including Connecticut, New Jersey, New York, North Carolina, Maryland and West Virginia

“It’s clear our guests have diverse tastes across the country,” said Whitney Haslam Johnson, chief experience officer for Pilot Flying J. “As a mother of three, I understand the need for variety and choice, especially on the road. Fortunately for summer travelers, Pilot Flying J’s large assortment of food and beverage offerings provide solutions for their road trip cravings, no matter what their tastes.”

Reshaping the Cheese Industry

A growing preference for natural, authentic cheeses and continued demand for convenience are reshaping the cheese industry, as reported in Cheese: U.S. Market Trends and Opportunities from market research firm Packaged Facts.

In recent years, marketer positioning of cheese as a natural and protein-packed alternative to processed snacks in the shelf-stable aisles have made cheese a growing contender for the snacking dollar. Brands have been capitalizing on this opportunity by packaging their cheese in more convenient forms for on-the-go snacking for adults and children.

The evolution of cheese into a packaged snack food option has led to the introduction of different types of cheeses, sometimes with newfangled flavor profiles. Natural cheeses positioned as wholesome and sustainable (organic, local, grass-fed) yet still indulgent and flavorful have resonated with today’s consumers. While the cheese market remains dominated by large producers, demand for novel and artisanal cheeses has allowed smaller label cheeses to claim their place at the table. In addition, store brands remain a market force, accounting for over 40 percent of dollar sales, according to this Packaged Facts report.

“Product assortment balance is important,” says David Sprinkle, research director for Packaged Facts. “While artisanal and more specialized cheeses are becoming more popular, that doesn’t mean that people are dropping standards such as cheddar and mozzarella, which continue to account for the bulk of market growth.”

Best Outdoor Dining in Canada

As we approach the first official day of summer and prime season for patio dining, OpenTable unveiled the 100 Best Restaurants for Outdoor Dining in Canada for 2018. The list ensures that diners across the country can find all the gorgeous patios and refreshing menus to enjoy some summer sunshine.

Restaurant patios across the country have made their way onto this year’s list, with Ontario eateries claiming the greatest number (41) of honourees, followed by British Columbia with 30 and Albertawith 17. Quebec (8) and Manitoba (4) are also represented.

“The longest day of the year marks open season on Canada’s patios. The option to enjoy food and drink in an al fresco setting makes the experience that much more memorable,” said Caroline Potter, Chief Dining Officer at OpenTable. “This list is a delicious resource for locals and travelers seeking to make the most of their summer eating adventures.”

The list includes a variety of different outdoor dining options, from the ocean view patio at Vancouver’sTeahouse in Stanley Park and the charming hidden back patio at Toronto’s Sidecar, to the relaxing lakeside patio at Wellington’s Drake Devonshire Inn.

Canada’s 100 Best Restaurants for Outdoor Dining list is generated solely from more than 550,000 restaurant reviews collected from verified OpenTable diners between May 1, 2017 and April 30, 2018. All restaurants with a minimum “overall” score and number of qualifying reviews were included for consideration. Qualifying restaurants were then scored and sorted according to the percentage of reviews for which “outdoor dining” was selected as a special feature.

Based on this methodology, the following restaurants, listed in alphabetical order, comprise the 100 Best Restaurants for Outdoor Dining in Canada for 2018 according to OpenTable diners.

19 Okanagan Grill + Bar – West Kelowna, BC

Alloy – Calgary, AB

Amsterdam Brewhouse & Restaurant – Toronto, ON

Arms Reach Bistro – North Vancouver, BC

Arôme – Casino du Lac Leamy – Gatineau, QC

Barsa Taberna – Toronto, ON

The Bauer Kitchen – Waterloo, ON

The Bavarian Inn Restaurant – Bragg Creek, AB

The Beach House – West Vancouver, BC

The Beach House Restaurant – Victoria, BC

Berkeley North – Hamilton, ON

Bistro Nolah – Dollard-Des-Ormeaux, QC

Bonterra Trattoria – Calgary, AB

Bow Valley Ranche Restaurant – Calgary, AB

Brasserie T! – Montréal, QC

The Butchart Gardens – The Dining Room – Brentwood Bay, BC

Cafe Belong – Toronto, ON

Chabrol Café – Toronto, ON

Chop Steakhouse & Bar – Vaughan – Woodbridge, ON

Chula Taverna Mexicana – Toronto, ON

Cilantro – Calgary, AB

CinCin Ristorante + Bar – Vancouver, BC

Deane House – Calgary, AB

Dolcetto – London, ON

Drake Devonshire Inn – Wellington, ON

Earls Kitchen + Bar – King Street – Toronto, ON

Earth to Table: Bread Bar – Guelph, ON

Edible Canada at the Market – Vancouver, BC

El Catrin – Toronto, ON

Elbow Room – Calgary, AB

Estia – Toronto, ON

F’Amelia Ristorante – Toronto, ON

Fayuca – Vancouver, BC

Firestone Restaurant and Bar – Lethbridge, AB

Fishbone By The Lake – Stouffville, ON

The Glass Monkey – Edmonton, AB

Glo Restaurant + Lounge – Victoria, BC

Grapevine Restaurant and Patio at Gray Monk Estate Winery – Lake Country, BC

Harpers Landing – Oakville, ON

Hart House Restaurant – Burnaby, BC

Hillside Winery & Bistro – Penticton, BC

Hooded Merganser at Penticton Lakeside Resort – Penticton, BC

Hoogan & Beaufort – Montréal, QC

Il Buco – Barrie, ON

Italian Farmhouse Restaurant & Bar – Bragg Creek, AB

Juniper Bistro – The Juniper Hotel – Banff, AB

The Keg Steakhouse + Bar – Windsor Riverside – Windsor, ON

The Keg Steakhouse + Bar – Yaletown – Vancouver, BC

Kitchen76 at Two Sisters Vineyards – Niagara-on-the-Lake, ON

La Roca – Winnipeg, MB

Lake House Restaurant – Vineland, St. Catharines, ON

Lavelle – Toronto, ON

Le Chien Noir – Kingston, ON

Liquidity Bistro – Okanagan Falls, BC

Lov de la Montagne – Montréal, QC

Lure Restaurant & Bar – Delta Victoria Ocean Pointe – Victoria, BC

Maison Boulud – Montréal, QC

The Manor Casual Bistro – Edmonton, AB

The Marc – Edmonton, AB

Mettawas Station Mediterranean Restaurant – Kingsville, ON

Miijidaa Cafe + Bistro – Guelph, ON

Miradoro at Tinhorn Creek Winery – Oliver, BC

ONE Restaurant – Toronto, ON

Oxley Estate Winery – Harrow, ON

Pat Quinn’s Restaurant & Bar – Delta, BC

Peller Estates Winery Restaurant – Niagara-on-the-Lake, ON

Pineridge Hollow – RM of Springfield, MB

Pizzeria Gusto – Winnipeg, MB

Prairie’s Edge – Winnipeg, MB

Proof Kitchen and Lounge – Waterloo, ON

Provence Marinaside – Vancouver, BC

Pure Spirits – Toronto, ON

Quails’ Gate Estate Winery – Old Vines Restaurant – Kelowna, BC

Ravine Vineyard Winery Restaurant – Niagara-on-the-Lake, ON

Restaurant at Peninsula Ridge – Beamsville, ON

The Restaurant at Redstone – Beamsville, ON

River Café – Calgary, AB

Robba da Matti (Yaletown) – Vancouver, BC

Salmigondis – Montréal, QC

Cibo Centre Street – Calgary, AB

Seasons in the Park – Vancouver BC

Sidecar – Toronto, ON

Smack Dab – Kelowna, BC

Sole Restaurant – Waterloo, ON

Sonora Room Restaurant – Burrowing Owl Estate Winery – Oliver, BC

Spencer’s at the Waterfront – Burlington, ON

Tap Restaurant – Surrey, BC

Tapas Restaurant – Canmore, AB

The Teahouse Restaurant – Vancouver, BC

Terrace Restaurant, Mission Hill Family Estate – West Kelowna, BC

Treadwell Farm-to-Table Cuisine- Niagara on the lake – Niagara-on-the-Lake, ON

Trius Winery Restaurant – Niagara-on-the-Lake, ON

Uli’s Restaurant – White Rock, BC

Vieux-Port Steakhouse – Montréal, QC

Villa Rosa Ristorante – Penticton, BC

Vineland Estates Winery Restaurant – Vineland, ON

Vineyard Terrace Restaurant at CedarCreek Estate Winery – Kelowna, BC

Violino Gastronomia Italiana – Edmonton, AB

Wildcraft – Waterloo, ON

Zees Grill – Niagara-on-the-Lake, ON

The World’s Best Restaurants

The restaurant world gathered in June for The World’s 50 Best Restaurants 2018 awards, sponsored by S.Pellegrino & Acqua Panna, held at Palacio Euskalduna in Bilbao, Spain. The awards, which saw 23 countries across six continents honoured with a place on the list, culminated with the announcement of a new No.1, with chef patron Massimo Bottura taking to the stage to collect the award for his Modena restaurant, Osteria Francescana.

Osteria Francescana, which previously held the No.1 position in 2016, was joined in the top three by El Celler de Can Roca (No.2), in Girona, Spain, and Mirazur (No.3), in Menton, France. The top spot for Osteria Francescana is testament to Bottura’s continued commitment to driving forward the restaurant’s unique character. The discreet Modena restaurant serves Bottura’s contemporary cuisine, which challenges and reinvents Italian culinary tradition while making use of the finest produce from the Emilia-Romagna region.

William Drew, Group Editor of The World’s 50 Best Restaurants, said: “We applaud all those involved in this list of inspiring restaurants, which is constantly redrawing and reflecting the global gastronomic map. We are also thrilled to see Osteria Francescana return to the top spot in The World’s 50 Best Restaurants ranking this year.”

Spain boasts seven restaurants on the list, including three in the top 10: El Celler de Can Roca (No.2); Mugaritz (No.9) and Asador Etxebarri (No.10). The USA follows closely with six restaurants on the list, including last year’s winner Eleven Madison Park in New York (No.4).

France has five restaurants on the list, with two in the top 10: Mirazur in Menton (No.3) and Arpège (No.8) in Paris, and the UK and Italy are represented by four restaurants each. Peru, with three restaurants in the list, includes two in the top seven alone: Central (No.6) and Maido (No.7), both in Lima.

Having received the Miele One To Watch Award in 2017, Disfrutar in Barcelona continues its rise by winning the 2018 Highest New Entry Award, sponsored by Aspire Lifestyles, debuting at No.18. Meanwhile Den, in Tokyo, Japan, picks up the 2018 Highest Climber Award, sponsored by Lavazza, having jumped from No.45 to No.17 in just one year.

Odette in Singapore is another notable new entry at No.28, having opened less than three years ago. Hiša Franko, Slovenia’s first restaurant on the list, debuts at No.48, representing another triumph for Ana Roš, the 2017 winner of The World’s Best Female Chef Award.

Mikla in Istanbul (No.44) represents Turkey’s first restaurant on the list since 2002, and Maaemo in Oslo(No.35) brings Norway back onto the list for the first time since 2003. Lyle’s in London is also a newcomer, debuting at No.38. Nihonryori RyuGin, from Tokyo, Japan (No.41), Schloss Schauenstein from Fürstenau, Switzerland (No.47) and The Test Kitchen from Cape Town, South Africa (No.50) have all re-entered the list.

Dan Barber of Blue Hill at Stone Barns in Pocantico Hills, USA (No.12), wins the Chefs’ Choice Award, sponsored by Estrella Damm. The Chefs’ Choice Award is bestowed on an individual believed by their peers to have made the most significant contribution to the industry over the last year and is a testament to Barber’s innovative work and commitment to the debate around food ethics.

The Ferrari Trento Art of Hospitality Award goes to Geranium from Copenhagen, Denmark (No.19). Co-founder Søren Ledet, an award-winning chef, made the transition from the kitchen to the restaurant floor when founding Geranium and as the sommelier and front of house manager has propelled the restaurant to the highest standards of hospitality.

Azurmendi from Larrabetzu in the Biscay region of Spain (No.43) wins the Sustainable Restaurant Award, sponsored by Dekton® by Cosentino. Led by head chef Eneko Atxa, Azurmendi previously won this award in 2014 and this year’s achievement recognises the restaurant’s continual improvements in sustainable practices. These include planting 800 trees around the restaurant and developing a project with local families and bars to turn their organic waste into compost for the region’s farmers.

French sensation Cédric Grolet receives The World’s Best Pastry Chef Award, sponsored by Sosa. Head pastry chef at Le Meurice, Paris, part of The Dorchester Collection, Grolet has this year spearheaded Le Meurice’s Pastry Boutique and continues to create waves by integrating gastronomy and art with his unique pâtisserie and trompe l’oeil fruit creations.

The World’s 50 Best Restaurants list is independently adjudicated by professional services consultancy Deloitte. This adjudication ensures that the integrity and authenticity of the voting process and the resulting list of The World’s 50 Best Restaurants 2018 is protected. The list is voted for by more than 1,000 international restaurant industry experts and well-travelled gourmets who make up The World’s 50 Best Restaurants Academy. The Academy comprises 26 separate regions around the world, each of which has 40 members, including a chairperson. None of the event’s sponsors has any influence over the voting process.

Hot Spot for Foodies

Paris (27 percent), Tokyo (23 percent) and Rome (22 percent) have topped a list of the hottest spots on earth for foodies, according to the Hotels.com® Tasty Travels* report.

Paying tribute to these delicious destinations, Hotels.com has collaborated with food artist Carl Warnerto bring foodies’ favorite hangouts to life, using each city’s famous food ingredients – Parisian buildings made of cheese, the Pantheon made of pasta and Mount Fuji made of seaweed. Every city looks good enough to eat.

|

Top 7 Foodie Cities |

|

Nearly two thirds of American millennials (60 percent) admitted a destination’s cuisine is the biggest deciding factor when picking where to travel, with beautiful beaches (43 percent), the shopping scene (20 percent) and special offers (9 percent) being less appetizing. The younger generation in the U.S. is now even more focused on munching delicious local delicacies on vacation (65 percent) than visiting landmarks (49 percent) and exploring the outdoors (34 percent).

It’s food over friends these days, as 78 percent of millennial U.S. travelers admit they prefer to snap their food instead of their friends’ faces (36 percent) for Instagram #sorrynotsorry. The research also found a gut-busting rise in food photography on social media, revealing that during a week-long vacation, U.S. millennial travelers snap on average 128 photos, of which 15 percent are of food.

The Hotels.com survey also revealed that pizza (33 percent) is the food American millennials are most likely to post on social media, followed by juicy steak (25 percent) and burgers and beers (18 percent). And they don’t play it safe with their food choices either, nearly one in four Americans claimed they’d love to try shark burgers (24 percent) and nearly one in five would like to eat frogs legs (20 percent).

To celebrate the mouth-watering combination of food and travel, renowned food artist Carl Warner has created a unique collection of artworks bringing top foodie destinations Paris, Rome and Toyo to life. Each city scene, captured in HD photography, is deliciously constructed with famous foods from each location. Parisian markets and the Eiffel Tower are built with decadent chocolate and blue cheese; the Pantheon and a cobbled back street in Rome are brought to life with pasta, Parma ham and Parmesan cheese; while a serene zen garden and tea ceremony are imagined with Maki rolls, ginger and shiitake mushrooms overlooking Mount Fuji, in Warner’s tribute to Tokyo. Watch them being built in the video above.

Food artist and photographer Carl Warner, said, “When Hotels.com approached me with the idea, I instantly knew this project was right up my bean-cobbled, blue cheese street! It was a great opportunity for me to bring images and scenes of these hugely popular foodie destinations to life in an exciting and contemporary way. I hope that these images will not only blow people away, but inspire them to get online, get booking and not just ‘sight-see’ but ‘sight-taste’.”

The Tasty Travels research also revealed that it’s no longer about the five-star dining experience that costs the same as a house deposit; millennials worldwide now prefer street food (20 percent) to Michelin star restaurants (19 percent). Eating experiences are in fact now so high on the millennial travel tick-list, 76 percent of travelers said foodie experiences stand out the most in their vacation memories. This topped spending time with their travel buddy (22 percent), and even an exciting adrenaline activity (11 percent) #TastyTravels.

Johan Svanstrom, president of Hotels.com comments: “The love amongst millennial travelers for what we at Hotels.com have dubbed #TastyTravels, stems from food being one of the most connective and rewarding currencies there is. Experiences are the new wealth and food provides one of life’s most pleasurable experiences, where there’s always something new to try when you travel. So, it’s understandable that younger generations of travelers are defining their holiday by what they can eat, how they eat it, and how good the ‘Grams’ will be while they’re away.”

Restroom Cleanliness

According to a survey of 101 restaurant industry professionals at the National Restaurant Association Show, May 19-22 in Chicago, nearly all (98 percent) agree that restroom cleanliness in a restaurant impacts customer satisfaction. Conducted by Sofidel, a leading global provider of paper for hygienic and domestic use, the survey also found that nearly 7 in 10 respondents (69 percent) would be willing to invest in paper products that are proven to reduce the risk of toilet clogs.

“Customers today consider the entire experience when dining out, from the ambiance of the restaurant to the service to cleanliness,” said Fabio Vitali, Vice President AFH Marketing & Sales for Sofidel America. “Our survey indicates that the industry recognizes that restroom cleanliness can positively impact business. By stocking their foodservice establishments with products that reduce toilet clogs, these professionals can encourage praise from customers, repeat business and reduced downtime for plumbing emergencies.”

Sofidel’s survey revealed numerous benefits related to clean restrooms. Eighty-three percent of restaurant industry leaders believe well-kept restrooms are a strong indicator that the kitchen is also clean. Two in five professionals agree that clean restrooms can result in positive reviews on social media and review sites. Meanwhile, 43 percent of those surveyed claim restaurants can secure repeat business when restrooms are maintained properly.

Restaurant professionals also ranked the following as key indicators of a quality restroom:

- Toilets free of clogs and messes – 84 percent

- Stocked essentials like soap and paper towels – 79 percent

- Floors free of puddles and sticky residues – 79 percent

- An absence of unpleasant odors – 71 percent

- Soft, absorbent toilet paper – 47 percent