According to a Recent Survey/Study … Mid-December 2017 Edition

24 Min Read By MRM Staff

This edition of Modern Restaurant Management (MRM) magazine’s “According to …” research roundup includes exclusive results courtesy of the experts at Sense360 regarding Applebee’s Dollarita campaign, how specialty cheese sales rise during the holidays and a plethora of trends for 2018.

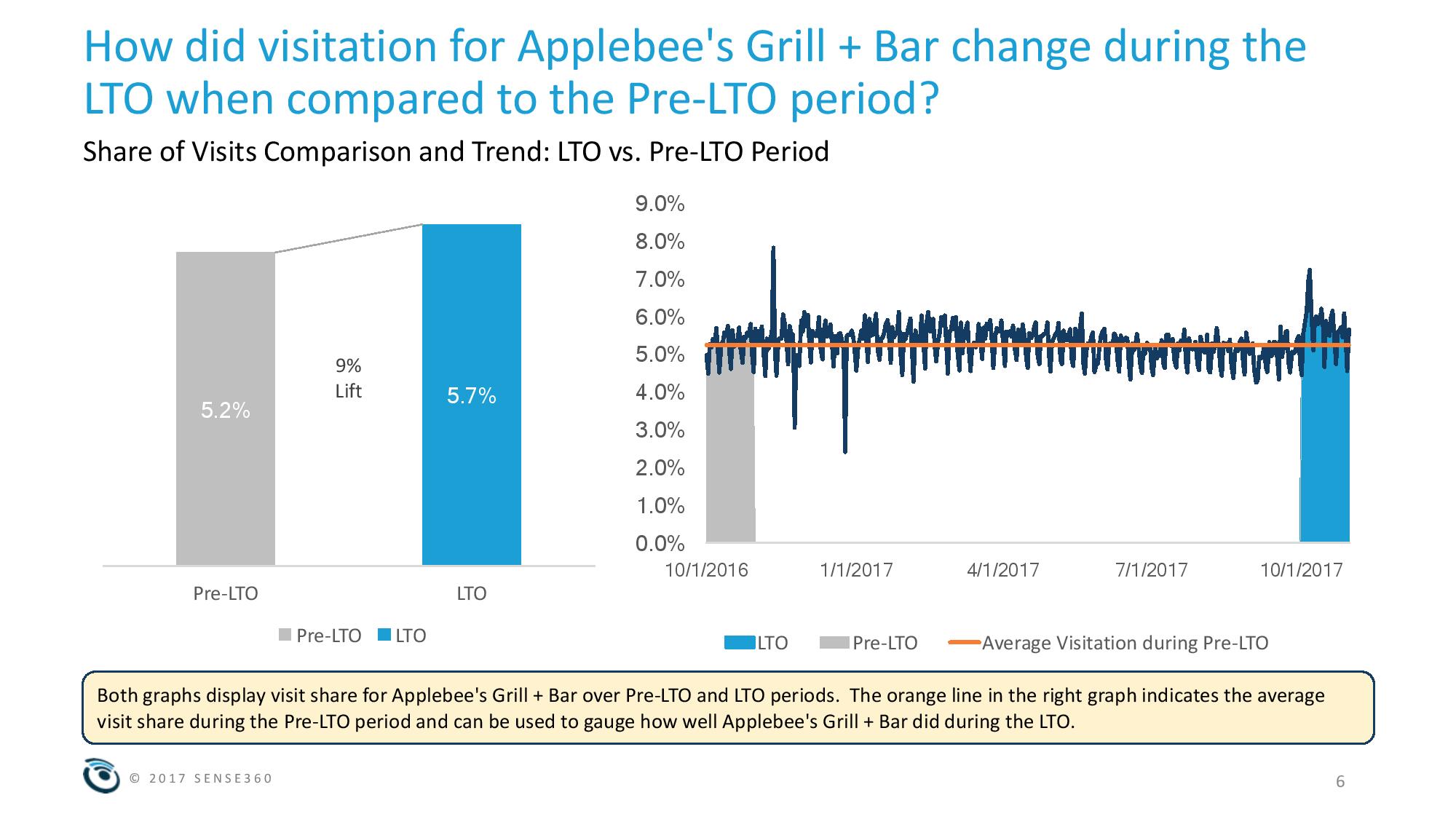

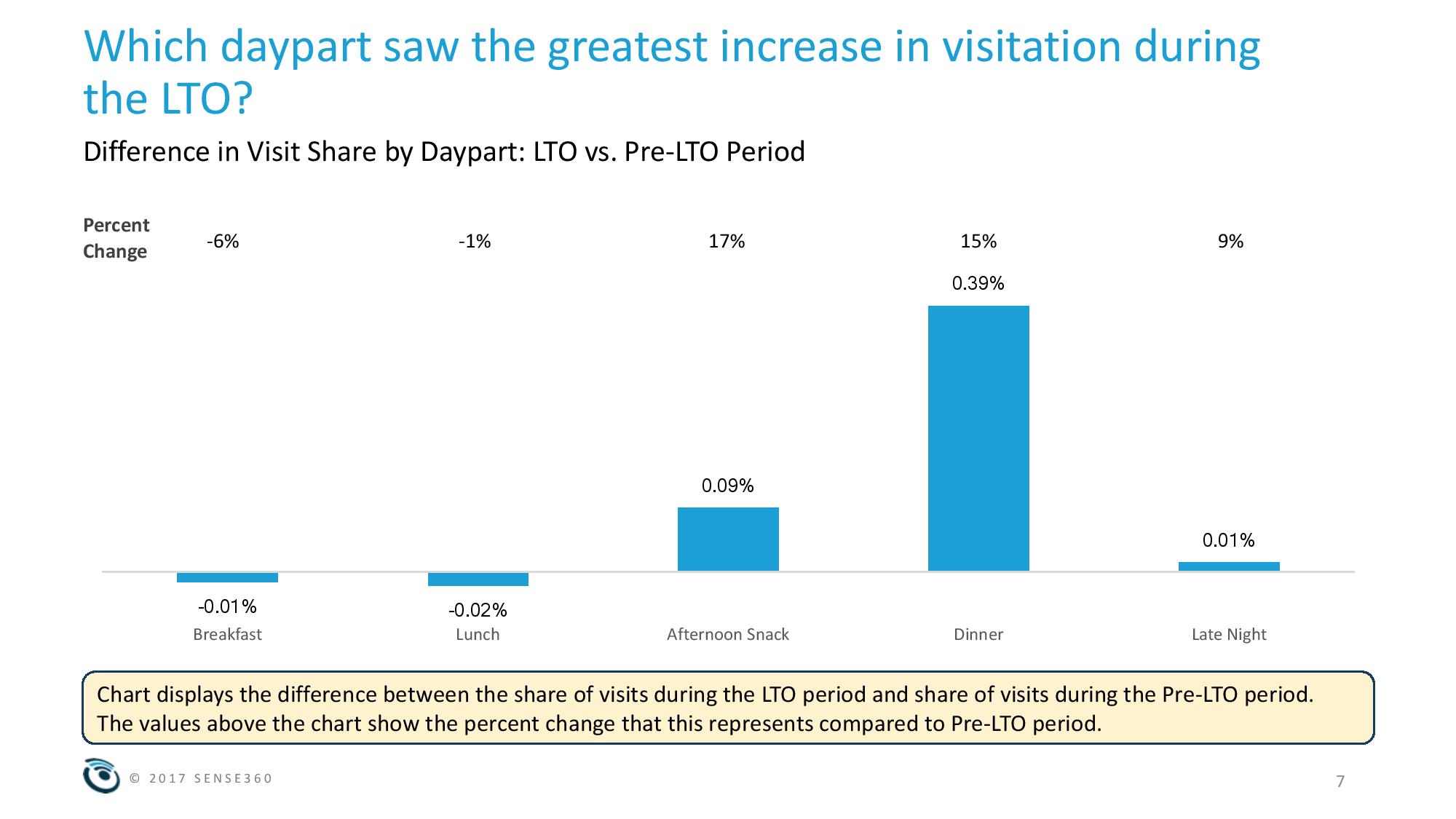

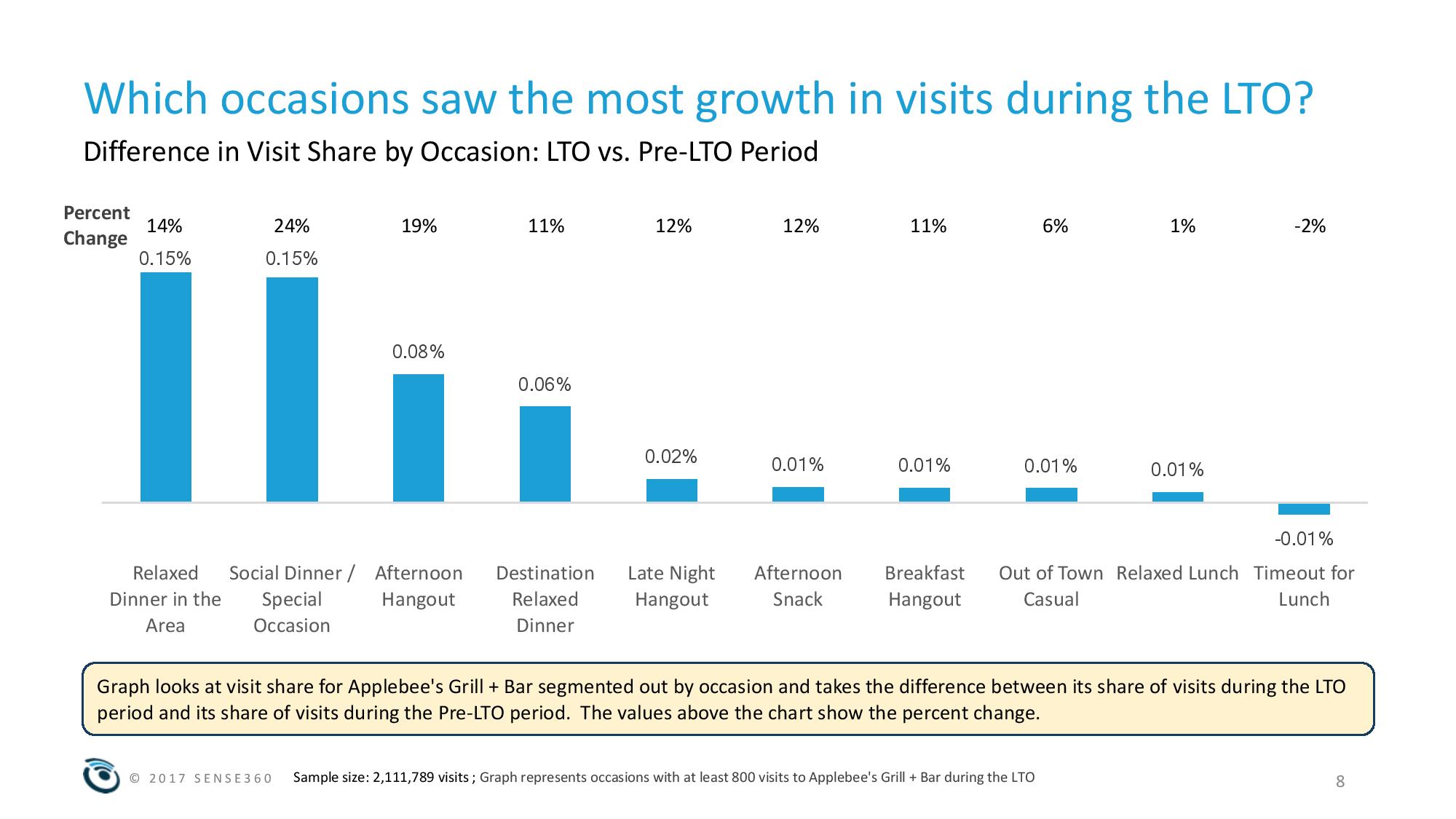

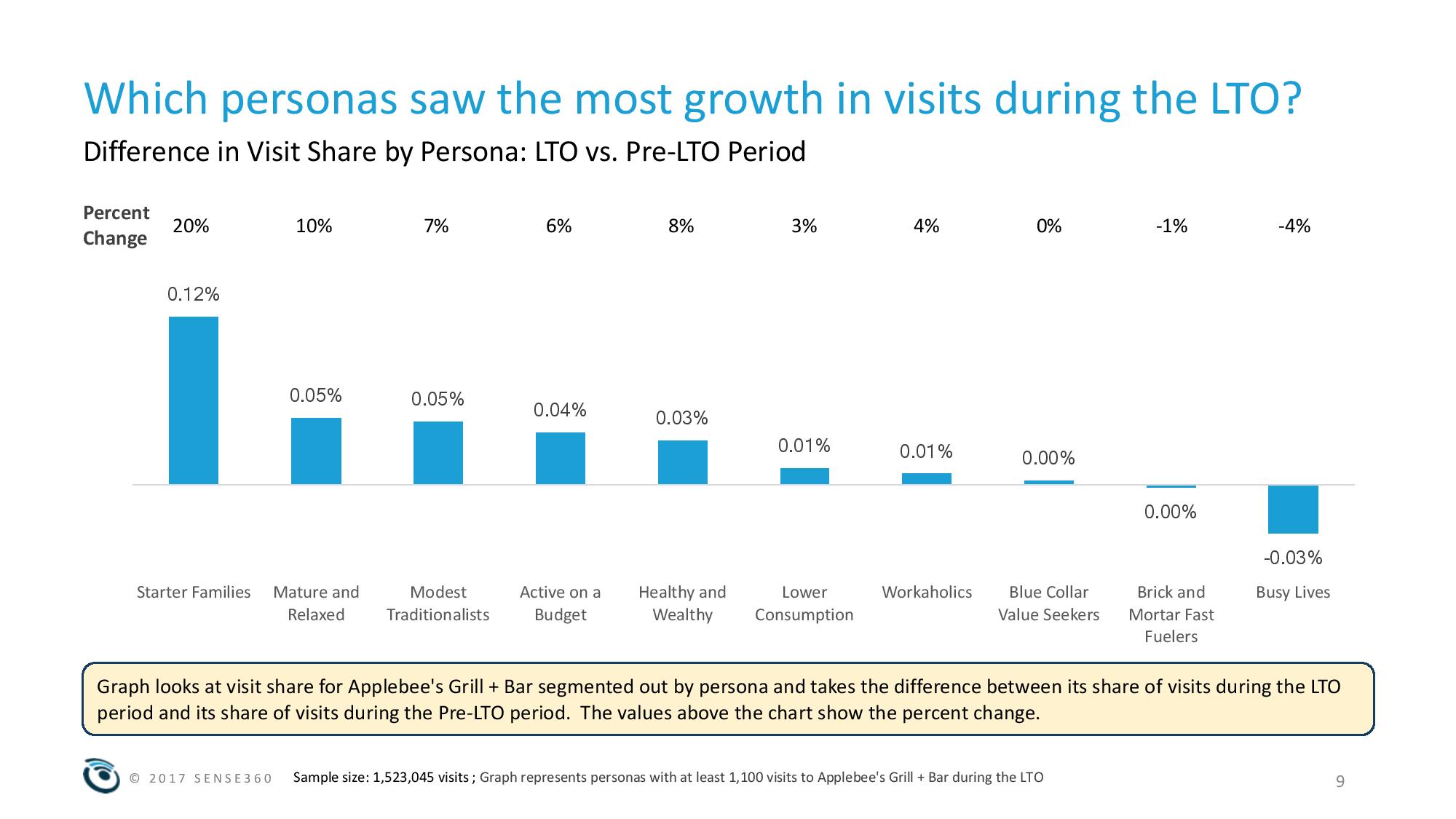

The Mighty Dollarita Impact

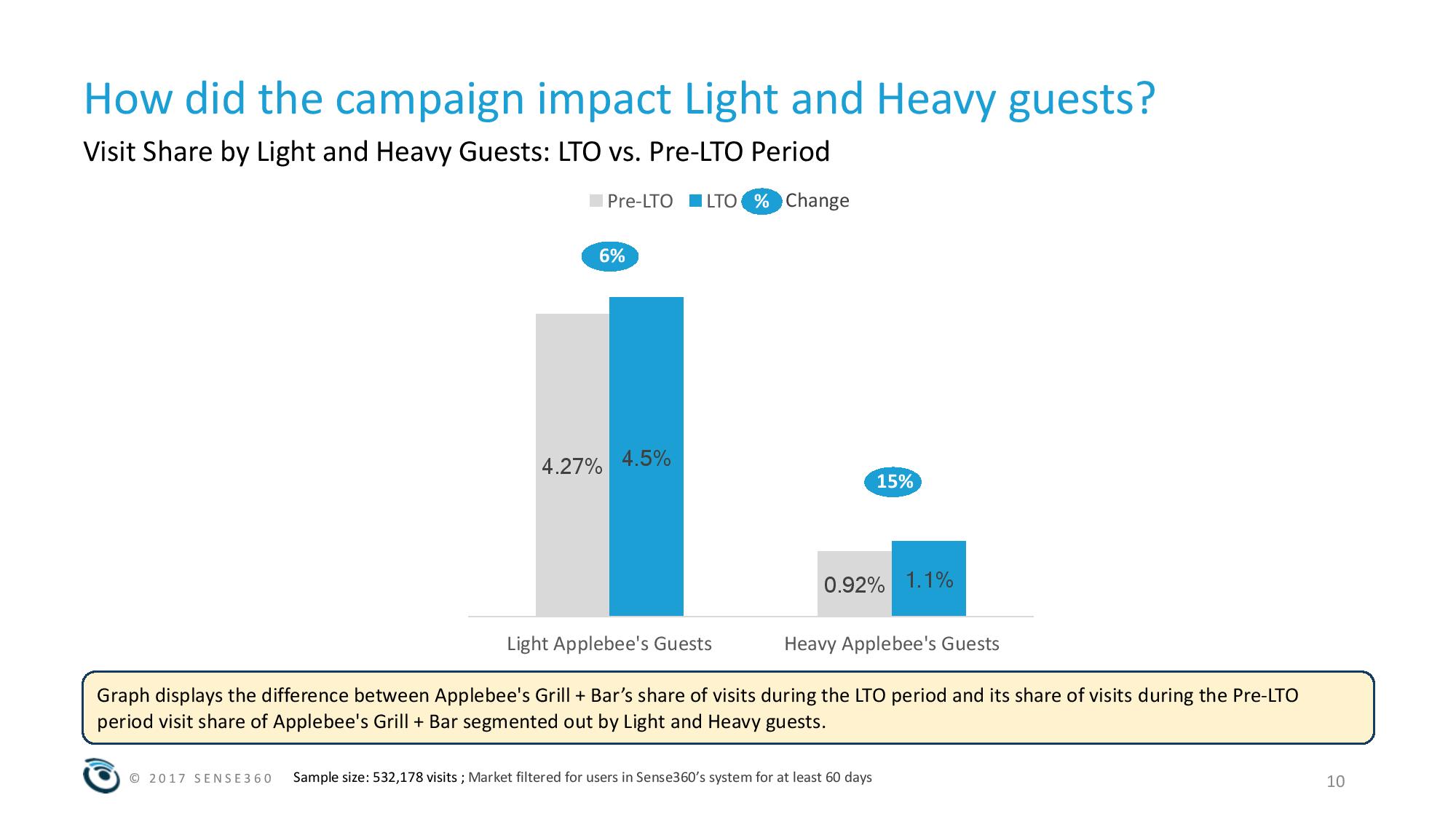

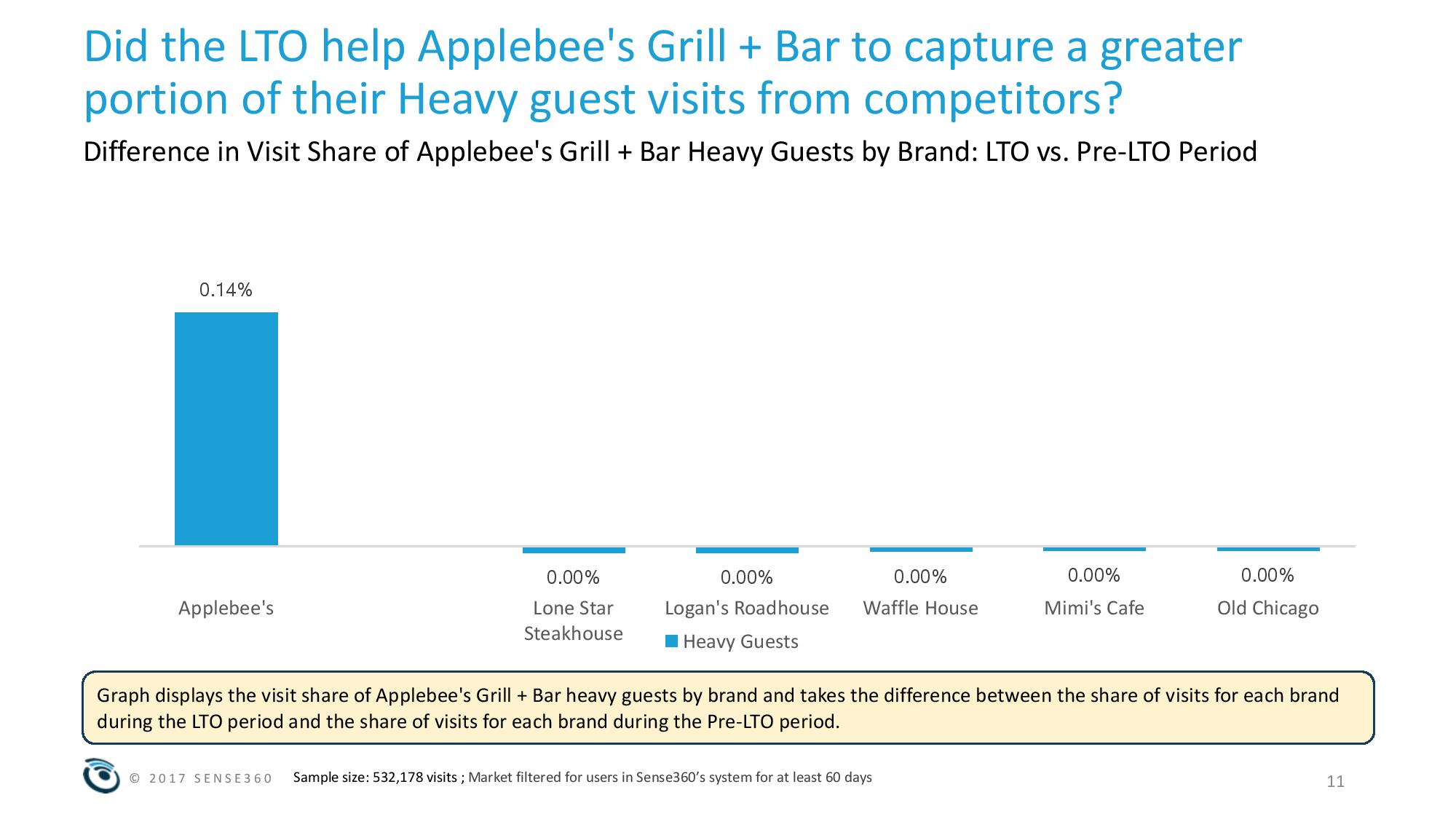

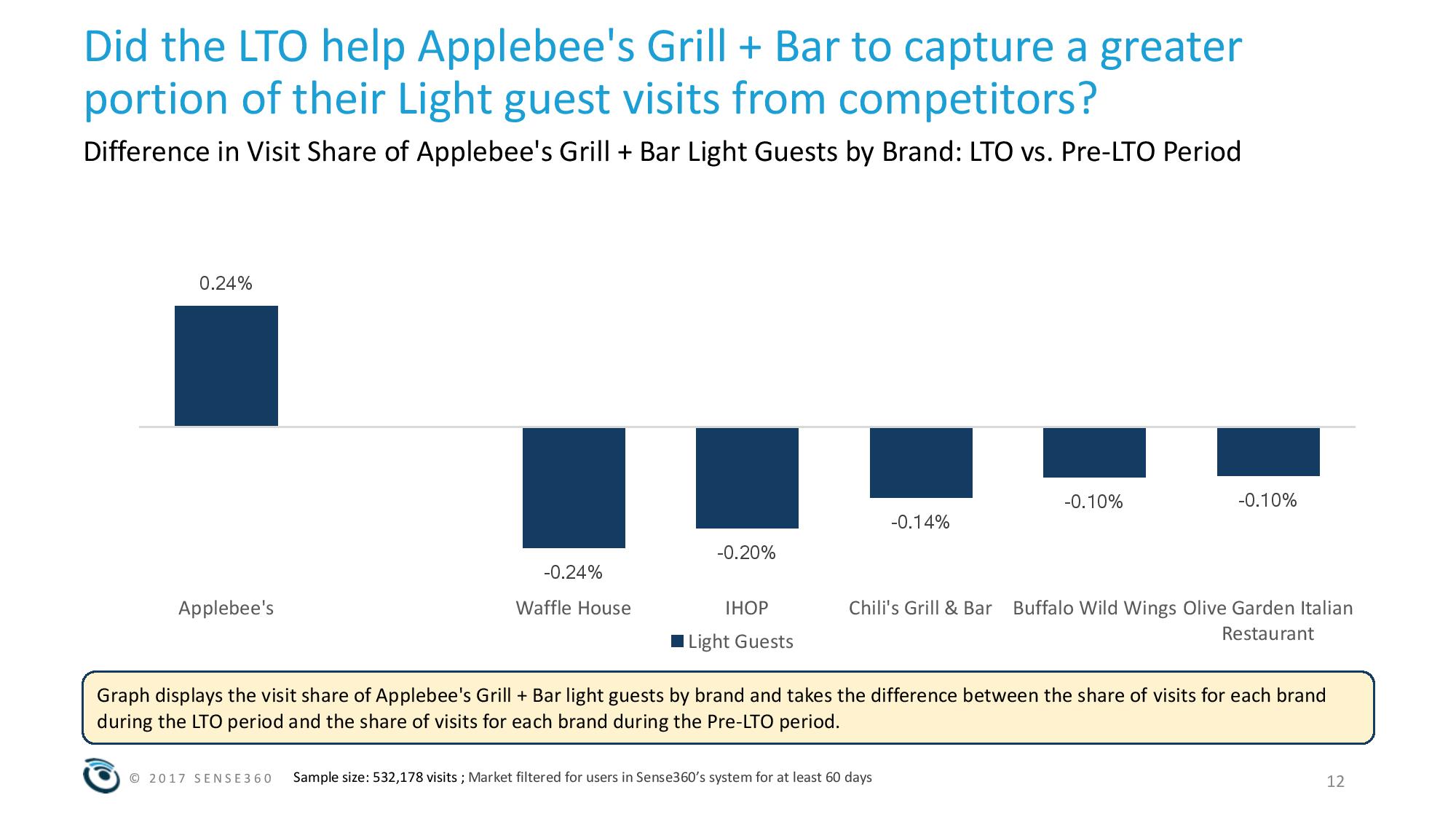

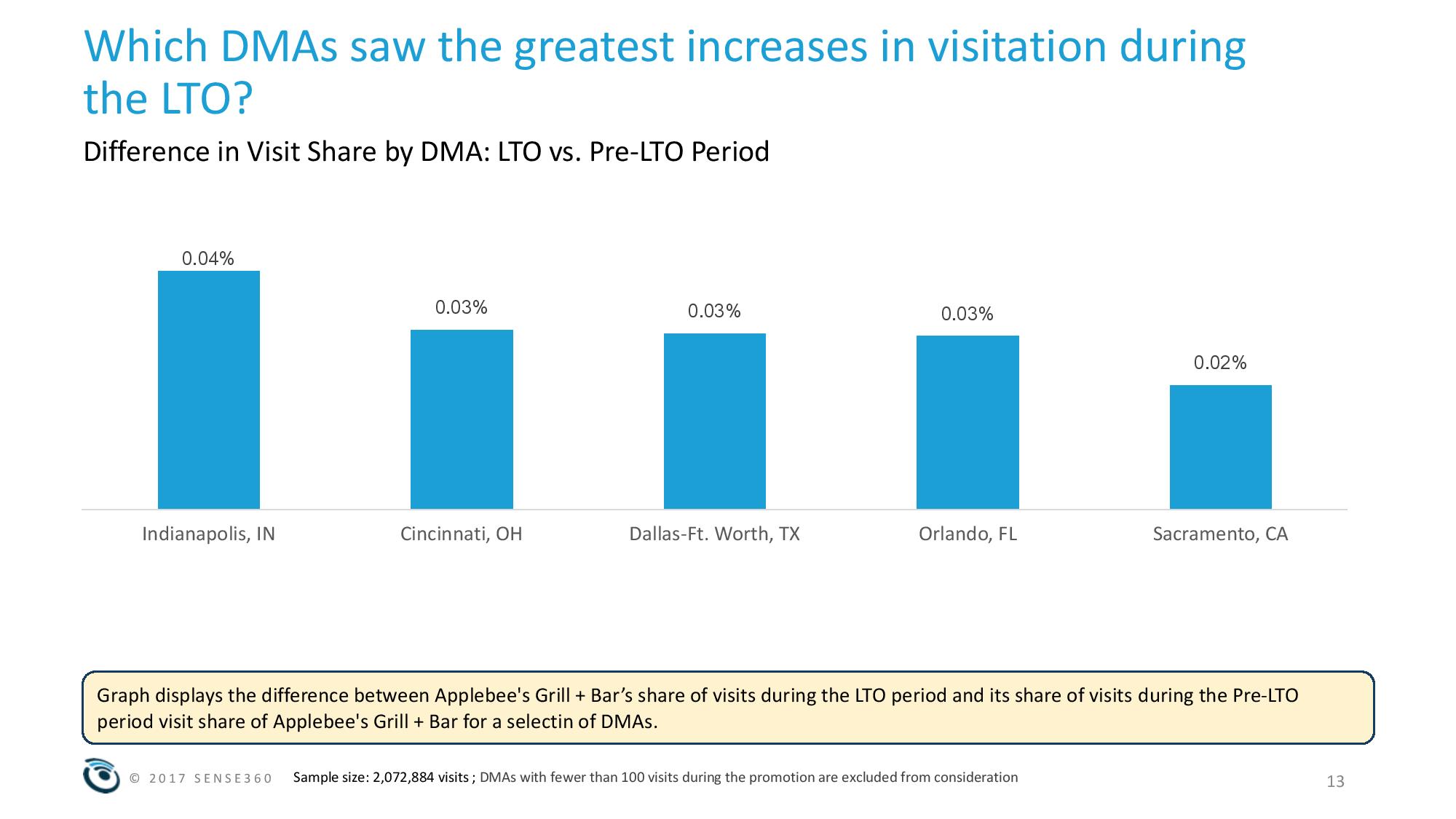

A Sense360 report investigated the effects of Applebee’s October Dollarita limited-time offering on visitation by observing visit patterns both before and during the campaign and highlighting the differences between the two periods. During October 2017 Applebees offered $1 Margaritas for guests. The firm looked at visit trends for that month and compared to October of 2016, but excluded Halloween in both instances.

Holiday Consumers Choose Cheese

Artisan cheesemaker Cello Cheese revealed the holiday season is the busiest time for cheese sales, with higher-end, specialty cheeses and formats used for entertaining such as wedges being sold 30 percent more during the holiday season than the everyday variety.

Consumers are more indulgent with their cheese selections during the holidays as they prepare to host friends and family. People are more concerned with entertaining and putting together a meal their guests are going to enjoy, and are less concerned with the price. This means there is a spike in overall sales of at least 10 percent greater during the holidays driven by higher-end cheeses versus any other time of year.

It is also a time when consumers are more adventurous with their cheese choices as they put together cheese boards and experiment with combinations of fruit and cheese, and spices and cheese. While they may not cook with adventurous cheeses every day, they want to incorporate these types of unique offerings into charcuterie boards to impress their guests.

“The holiday season is when most people really look for quality over price when it comes to cheese, with people investing in indulgent cheeses and unique flavor combinations to make their cheese boards stand out,” said Allison Schuman, a fourth-generation Schuman Cheese family member and cheese expert. “Holiday celebrations also represent a chance for people to show off their foodie knowledge by bringing out cheeses that pair well with other holiday foods and drink, such as cranberry, nuts, fig paste and even honey. This is where higher-end, specialty cheeses are most popular.”

Founded nearly 30 years ago, Cello is the flagship cheese brand of Schuman Cheese, the artisan cheesemaker established in 1945.

Restaurant Recovery Continues

The positive momentum in restaurant sales continued into November as the industry slowly recovers from disappointing third quarter results. Same-store sales remained flat year over year for the month. While not on par with October’s 0.9 percent growth, November was considerably better than the average -1.6 percent sales decline over the first nine months of the year. Operators and observers are cautiously optimistic that the industry is beginning to show some signs of strength after struggling for almost two years. These insights come from TDn2K™ data through The Restaurant Industry Snapshot™, based on weekly sales from 30,000 restaurant units, 170+ brands and representing $68+ billion dollars in annual revenue.

“Our concern is that these improved trends come despite the fact that the industry has not cracked the code on declining guest visits,” commented Victor Fernandez, executive director of insights and knowledge for TDn2K. “Brands have come to rely on rising checks to overcome the steady loss of traffic.” Same-store traffic dipped -2.5 percent in November, a 0.9 percentage point drop from October. It’s been almost three years since restaurants experienced a month of positive guest counts.

The Economy Continues to Pick Up Steam

“While the negative impacts of the hurricanes were not great, the rebuilding and replacement of losses have hyped growth. Job gains are strong, though wage increases continue to lag. Consumers’ confidence is high and as a result, they are willing to cut into savings in order to maintain their standard of living. While that is supporting growth now, it could create spending issues next year” stated Joel Naroff, president of Naroff Economic Advisors and TDn2K economist.

“As for the tax bill,” continued Narorff, “the impacts on the restaurant industry could vary greatly. Lower and lower middle-income households benefit modestly, middle-income households a little more and upper-income households a lot. Thus, additional spending on eating out will depend upon the income level of the restaurant’s clientele. It should not be assumed that all restaurant chains will benefit significantly from the tax cuts.”

Guest Check Growth Continues to Accelerate

Despite many brands focusing on price promotions to drive sales and traffic, average guest check growth has accelerated in recent months. Check average was up 2.4 percent in November and 2.5 percent in October. Both figures are higher than the 2.0 percent for the first nine months of the year. “Higher check average increases are risky in a market with steadily decreasing traffic, but brands may be using price to support margins as they face rising labor and operating costs,” said Fernandez.

Counter Service Brands Dominate Market Share Battle

The continued pace of new store openings adds to market saturation that almost certainly dampens same-store sales growth. While comparable sales have suffered, total industry sales have grown almost 3.0 percent in 2016 and the first three quarters of 2017.

As total sales go up, the portion of those sales devoted to counter service brands is also increasing. Based on TDn2K’s Black Box Intelligence™ research encompassing a sample of over 125,000 restaurant locations, over 70 percent of all dollars spent in chain restaurants in the first three quarters of 2017 have gone to quick service or fast casual brands.

These segments are not only large, but they’re also the fastest growing. Quick service, in particular, had a significant increase in market share during the third quarter. Consumers seem to be reacting positively to the value strategy being promoted by many of the segment’s leading brands. The gains in quick service and fast casual are coming primarily at the expense of casual dining.

Rising Management Turnover Remains Major Headache for Operators

TDn2K’s research over the last year has shown that guests’ perception of service is a key differentiator between top and bottom performing restaurant brands. Not surprisingly, turnover, especially at the manager level, is strongly linked with guest service scores.

Hourly employee turnover is stabilizing after years of increasing rates and even dropped slightly during October. However, it still remains at the highest levels in over ten years. But perhaps the biggest challenge facing operators continues to be restaurant management retention. According to TDn2K’s People Report™ data, turnover for management positions is also at historically high levels and continued to rise in October.

Fourth Quarter Predictions

“A strong economy and high consumer confidence give us reason to be cautiously optimistic about December,” commented Fernandez. Sales for the first two months of the quarter are up marginally (+0.4 percent). We expect that visits to brick-and-mortar retailers will again influence restaurant sales during the busy holiday season. But if current trends continue, it will mark the first quarterly sales increase for the industry in two years.

Foodservice Trends for 2018

Mintel announced four key trends set to impact the US foodservice market over the coming year. Mintel predicts that 2018 will see the blurring of retail, foodservice, and social media, as well as health and indulgence. Food incubators will foster creativity, with shared kitchens and small spaces giving chefs the ability to let their creativity flourish. Automated order and delivery processes will meet the need for convenience as consumers become more comfortable with and reliant on restaurant technology. As Americans prioritize self-care, food and drink offerings that are both functional and flavorful will rise to the top. Finally, the routine use of social media will impact the creation of next-level menus and food presentation.

Mintel’s Foodservice Trends for 2018:

- Co-op Cuisine: The high cost of entry for new restaurants will drive chefs to concept test in shared spaces.

- The Need for Speed: Time-strapped diners value convenience and affordability more than ever and operators will respond by leveraging technology advances, all in the name of food—fast.

- Foodceuticals: The intersection of food and function will become more apparent as menu items focus on consumers’ well-being from the inside out.

- Feed the Feed: The blurred line between social media aspiration and reality is challenging foodservice operators to create a menu that can live up to both expectations.

Amanda Topper, Associate Director, Foodservice Research at Mintel, said, “While the dining out landscape is in a state of continual evolution, what is clear is that Americans want innovative and convenient dining out options that are nutritious, but also enjoyable to eat and photograph. In the year ahead, expect to see operators across segments shift to meet diners’ various needs as speed, innovation, and category competition become more pressing in 2018 than ever before.”

Restaurants Ready for Innovation

In collaboration with Bank of America Merchant Services and Bypass Mobile, PYMNTS.com launched its first-ever Restaurant Readiness Index that assesses the level of innovation in the U.S. quick-service restaurant (QSR) industry. The index measures QSRs’ use of online ordering, in-store beacons, alternative payment methods and other capabilities that make things easier and more convenient for guests.

PYMNTS.com studied 178 QSRs and tracked the presence or absence of key convenience features when customers order and pay in-store, on a mobile device or via the web. Of the 178 QSRs analyzed, 172 operated between eight and 2,630 locations. These include burger, bakery/café, chicken, frozen dessert, Mexican, sandwich, and soup/salad/bowl chains.

Among the most notable findings:

- The innovations most likely to place a QSR at the top of the index include accepting new and alternative payment methods, kiosks to enable self-service ordering, and cloud-based point-of-sale systems. Most QSRs, however, are failing to implement those features.

- The soup/salad QSR segment ranked highest for innovation. At the other end of the spectrum, restaurants serving frozen desserts performed the worst.

- 15 percent of QSRs analyzed accept payments via digital wallets. The coffee/tea segment owned the highest implantation score for this feature.

Some of the most recognized QSR brands earned top rankings in the index. Among the attributes that made them stand out: their likelihood of offering QR code, inventory checking, online-ordering/in-store pick up, and saved-payment-method capabilities.

To read the Restaurant Readiness Index, click here.

The Importance of Bar Programs

Drink sales remain a dynamic and important part of the restaurant and bar business, but finding growth continues to be a challenge for operators and brand marketers alike. Slowed consumer traffic at on-premise locations and stagnancy in occasions involving adult beverages translates to flat total alcohol volume in restaurants and bars in 2017, according to the recently released On-Premise Intelligence Report, jointly developed by Technomic and Beverage Marketing Corporation.

Key report findings include:

- Adult beverage category dynamics continue to evolve, with spirits outpacing beer in volume growth.

- Wine is challenged, experiencing its fourth consecutive year of volume decline on-premise in 2017.

- Year-end dollar sales are expected to increase 2.1%, driven primarily by raised drink prices and continued growth of premium products at the bar.

- The appeal of differentiated and flavorful adult beverages and the importance of supplier support is evident in the roster of fastest-growing brands on-premise, led by Tito’s Handmade Vodka.

“Growth categories remain aged spirits—whiskey, brandy, cognac and aged rum—while vodka volume is down slightly,” observes Eric Schmidt, director, alcohol research at Beverage Marketing Corporation. “In beer, imports and craft are gaining share, propelled by Mexican brands and smaller craft labels. We are tracking mixed results from leading domestic table wine brands, while imported sparkling wine continues to find relevance at the bar.”

While volume growth is elusive, drinks remain an important aspect of going out for consumers, according to Donna Hood Crecca, associate principal at Technomic. “Consumers prioritize adult beverages, with one-third overall and half of those aged 21 to 34 confirming that the drink offering influences their decision of where to go,” she says. “Today, consumers have more choices, as venues ranging from sports stadiums to winery and brewery tasting rooms are in the consideration set, which raises the bar for traditional locations like restaurants. Improving and differentiating the drink experience is key to success.”

The On-Premise Intelligence Report includes channel, category and brand performance metrics, consumer and operator insights, and menu trend information developed via primary research conducted by Technomic and Beverage Marketing Corporation.

Food Safety Training Trends

Alchemy Systems released the results of the fifth annual Global Food Safety Training Survey in the “Building Strong Food Safety Cultures with Effective Training Programs” report.

The survey is jointly sponsored by Alchemy Systems, Campden BRI, Safe Quality Food Institute, British Retail Consortium, Grocery Manufacturers Association’s Science & Education Foundation, NSF Latin America, SGS, and TSI. The survey solicits data on food safety training programs worldwide. Food safety professionals working at 1,400 companies across 20 food industry sectors responded to the survey.

Survey responses indicate that companies are highly committed to building strong food safety cultures and are investing to continually improve their programs. Specifically,

- 74 percent believe they have a clear vision for improving food safety;

- 55 percent responded that their company is a leader in food safety; and

- 83 percent believe they are able to provide the food safety training needed to drive behaviors.

“The survey shows a strong management commitment to food safety, but there are execution gaps that still need attention,” said Raj Shah, chief strategy officer of Alchemy Systems. “For example, 67 percent of respondents indicated that they still have employees not consistently following their food safety procedures.”

The top three food safety training challenges identified by the survey respondents are:

- Scheduling the time for training employees;

- Verifying the effectiveness of training, and

- Organizing refresher training.

It takes just one unfortunate food incident to cause irreparable damage to people, profits, and brands. Leading companies are tackling these safety training challenges with best practices including shorter training sessions, automating learning records, and providing tablets and training tools to supervisors so they can train and coach employees directly on the facility floor.

“The survey is a great tool for companies to benchmark compared to their peers, and continuously improve their own food safety training programs,” said Laura Nelson, vice president of food safety at Alchemy Systems.

Download the report for additional details.

MAFSI Trends

The Manufacturers’ Agents Association for the Foodservice Industry (MAFSI) released their annual Commercial Foodservice Market Forecast for 2018; a 24-page member-sourced report compiling industry intelligence from the leading sales and marketing agencies in the foodservice equipment and supply industry, in the United States and Canada.

Per the quarterly MAFSI Commercial Foodservice Business Barometer, from 2011 through 2016, overall sales per quarter moved within a healthy, steady, range of +4 to +5 percent. Beginning in Q1/17, sales growth slowed to +3.3 percent, followed by +3.5 percent in Q2/17. Throughout the six-and-a-half-year period, foodservice moved at nearly twice the growth rate of the overall economy. With these factors combined, MAFSI representatives are forecasting industry growth of +3.7 percent in 2018.

After trailing U.S. growth for several years, Canada is forecasted to lead the way at +4.6 percent, followed by the Northeast at 4.3 percent, the South at 3.6 percent, the Midwest at +3.5 percent, and the West at +3.4 percent.

Major product categories (equipment, supplies, tabletop, and furnishings) are remarkably consistent with Equipment at +3.8 percent, Supplies at +3.7 percent, Tabletop at +3.6 percent, and Furnishings at +3.4 percent.

For the 2018 equipment sub-categories (including primary cooking equipment, refrigeration and ice machines, storage and handling equipment, food preparation equipment, serving equipment, warewashing, and ventilation) respondents forecast Primary Cooking Equipment at +3.8 percent, Refrigeration & Ice Machines at +4.2 percent, Food Preparation Equipment at +3.4 percent, Serving Equipment at +3.5 percent, Storage & Handling at +3.3 percent, Warewashing at +3.4 percent, and Ventilation at +2.7 percent over 2017.

MAFSI rep members continue to add janitorial and sanitation (“JanSan”) manufacturers to their portfolio of represented lines, and JanSan manufactures continue to join MAFSI for sales and marketing representatives. To capture more data relevant to these members, the report includes JanSan categories in 2018; the first time in the Forecast’s history. Respondents forecasted JanSan Disposables at +3.6 percent, JanSan Supplies at +3.4 percent, and JanSan Equipment at +3.2 percent over 2017.

The 2018 Market Forecast also includes further measurements of business prospects in both Quoting Activity changes and Consultant Activity changes. Quoting Activity for 2018 is forecast at 50 percent same, 41 percent more, and only nine percent less. Consultant Activity is identical for 2018, and is projected at 50 percent same, 41 percent more, and nine percent less. While slightly less exuberant than in the recent past, these figures are still very positive.

The fastest growing end-user segments were identified as Chain Accounts, Schools (K-12), Healthcare, Business and Industry (B&I), and Independent Operators.

Although the industry growth rate moderated in 2017, and is forecasted for more of the same in 2018, the market is still growing faster than the overall U.S. economy as measured by GDP.

Healthy Eating Trends

For the sixth consecutive year, food expert Mareya Ibrahim serves up the top eight healthy food and beverage trends to try in 2018.

1) ROOT TO TABLE

By the time fresh produce arrives on your plate, it has lost a ton of nutrients – up to 77 percent of Vitamin C within just a week of harvesting, according to theUniversity of California, Davis.1 Look for a new crop of “living” produce sold with the roots on for heightened freshness and prolonged shelf life, lasting up to 18 days as compared to an average 3-5 days for your typical bagged salad.

2) GOOD GUT HEALTH 2.0

Probiotics are already BIG, with gut health-boosting, bacteria-rich foods like kimchee, kefir and craft kombucha growing in popularity. In 2018, the focus will shift to PREbiotics. Think of them as the fertilizer that helps your good bacteria grow. Look for prebiotic fiber powders containing ingredients like Jerusalem artichoke, inulin, acacia, and chicory root, and try products like boosted MCT oil to get your daily dose.

3) COLLAGEN COMPLEX

Paleo diets put protein on a pedestal, and now, collagen is getting its turn in the spotlight. Think of it as the “glue” for your hair, skin, nails, bones, tendons and ligaments, with a full spectrum of action-packed amino acids. Shoppers are looking for their fountain of youth in the form of flavored bone broth powders, heat-and-sip organic beverages and collagen protein at your local smoothie bar.

4) BOOSTED BASICS

You used to buy basics like flour, peanut butter, sugar, water, milk, coffee and bread, but in 2018, look for products that are pumped up with multiple nutrient boosting add-ons, including antioxidants such as Camu Camu, Sacha Inchi Seed and Baobab, plant-based Omega 3’s like flax meal, chia seeds and hemp seed, antioxidant herbs like turmeric, clove and cinnamon, plant-based protein and activated charcoal.

5) ALT COFFEE

Trying to find more caffeine free zen in your cup? Look for coffee alternatives made from brain-boosting mushrooms and herbs like dandelion root. You’ll also see loose teas that are brewed like coffee with Mokapots, and ground roasted cocoa beans for your Aeropress and pour-over cones.

6) HOT SH*T!

Inspired by YouTube eating contests, get ready to torch your taste buds with spices like ginger, black pepper and clove that add sweet heat to desserts, beverages and liqueurs. Peppers like Carolina Reaper – at over 2 Million SHUs – will light up the obvious hot sauces and also make its way into snacks, drinks and chocolate.

7) THE NEXT ‘IT’ SUPERFOOD – TART CHERRY

Tiny but mighty, tart cherries have one of the highest ORAC scores, with a mega boost of anthocyanins to battle free radicals and repair cell damage. Tart cherry is also known to reduce pain and inflammation, and is a natural source of sleep-inducing melatonin. Find it fresh, frozen, dried, chocolate covered, juiced and in concentrated powders, or try it in gourmet jams and pastries.

8) SAY HELLO TO SHISHITO PEPPERS

Taking over where fried calamari and jalapeno poppers once reigned as a shareable appe-teaser, cancer-fighting Shishito peppers are full of active capsaicin and antioxidants. Just toss with a little coconut oil and roast or grill on a flat top until soft and blistery, add a dash of smoked sea salt, then pop the whole thing into your mouth (removing the stem).

Food Price Increase in Canada

The annual food expenditure for a family of four is expected to rise by $348 to a total of $11,948 in 2018, according to “Canada’s Food Price Report 2018.” The 8th edition was released by Dalhousie University and the University of Guelph.

“Canadians want to know what will impact the prices of their food,” says Sylvain Charlebois, lead author of the report, and dean of the Faculty of Management at Dalhousie University. “The report continues to provide the information they are looking for – around food quality, trends and impacts on the price of food in their region.”

The report forecasts modest increases in many food categories, but the price of vegetables is expected to rise by 4-6 percent because of unaccommodating climate conditions such as La Niña, explains Charlebois.

The authors predict that as Canadians increasingly prioritize convenience, they will continue to spend more in restaurants or consume ready-to-eat products. “Canadians will eat out more frequently in 2018, and that will come at a cost,” says Charlebois.

Food categories such as dairy, bakery products, meat and seafood are not expected to rise by more than 2 percent.

Expected Price Increases:

Restaurants 4 percent – 6 percent

Dairy 0 percent – 2 percent

Fruits 1 percent – 3 percent

Bakery 0 percent – 2 percent

Meats 0 percent – 2 percent

Vegetables 4 percent – 6 percent

Seafood 0 percent – 2 percent

Food 1 percent – 3 percent

Food price increases are expected to affect most provinces, but be consistent with the general inflation rate. Atlantic Canada will likely see food prices rise after a year of stagnation. For British Columbians, prices will continue to increase due to a higher general inflation rate. Both Ontario and Alberta will face a more competitive marketplace, which will entice grocers to keep prices low.

The report also looks at food trends for 2018. Simon Somogyi, co-author of the report and a professor in the Faculty of Agriculture at Dalhousie looks at the changing retail environment.

“The recent purchase of Whole Foods by Amazon is having a significant impact on the Canadian food retail sector,” Somogyi says. “Other major food retailers are now changing their business models, particularly in how they sell to consumers, including online offerings.”

Airline Food Choices

There will more than 51 million passengers traveling during this holiday season (Dec. 15th -Jan 4th) according to trade group Airlines for America . Knowing what are the ”best” and “worst” choices is a valuable tool for any traveler, so Dr. Charles Platkin, the director of the Hunter College NYC Food Policy Center and editor of DietDetective.com., once again studied the best “Calorie Bargains” and “Calorie Rip-offs” at 35,000 feet.

Hunter College NYC Food Policy Center and DietDetective.com have released the 2017-18 Airline Food Study, rating foods for twelve (12) airlines. The study assigned a “Health Score” (5 stars = highest rated, 0 star = lowest rated) based on criteria including healthy nutrients and calorie levels of meals, snack boxes and individual snacks, level of transparency (display of nutrient information & ingredients), improvement and maintenance of healthy offerings, menu innovation and cooperation in providing nutritional information. The survey includes health ratings, average calories per airline, comments, best bets, food offerings, costs, and nutrition information (e.g., calories, and exercise equivalents).

“This year Delta and Virgin America share the top spot as the airlines with the ‘healthiest’ food choices in the sky. with Air Canada and JetBlue tied for second,” says Charles Platkin, PhD, JD, MPH, the executive director of the Hunter College NYC Food Policy Center and editor of DietDetective.com.

The average number of calories per menu choice was 360 in 2012; in 2013 it was 388; in 2014 it was 397; in 2015 it was 400; in 2016 it was 392; and this year it’s 405 calories, a 13 calorie increase over last year. However, calories are not everything; the survey also looks at the nutrients in the foods when they are provided (they are requested each year), as well as innovations moving towards healthy, tasty, inexpensive, sustainable foods.

Here are the major airline food headlines:

-

Delta is the clear leader among the major carriers and is tied with Virgin America this year as the healthiest airline.

-

Alaska Air purchased Virgin America, and the goal is to maintain the status-quo when it comes to food in all categories until next year.

-

American and Delta have once again started offering complimentary meals in economy class on domestic flights, something we haven’t seen in more than 15 years.

-

Airlines are eliminating those oversized packages of snack foods and offering individual smaller packages or eliminating individual snacks altogether.

-

Some airlines are going back to serving individual complimentary snacks, but they’re not very healthy. How about an apple or an orange, or maybe a Clementine or a Halo (mandarin orange).

-

The “Shame on You” award goes to Hawaiian, United Airlines and American. Hawiian just does not respond while United’s food and beverage department seems put-out by the process, and it shows in their responses to queries. American Airlines is not much better, with a media rep who also seems annoyed by the process.

-

Note to all airlines: It is not difficult to get nutritional information for all foods. Every airline uses detailed recipes; all they have to do is put the ingredients into a free online food calculator and in a few minutes they could have complete nutritional information.

Summary of Health Ratings (5 Stars is highest): Delta 4 stars, Virgin America 4 stars, Air Canada 3.75 stars, JetBlue 3.75 stars, Alaska Air 3.5 stars, United Airlines 2.75 stars, American 2.5 stars, Frontier Air 2.25 stars, Southwest Airlines 2 stars, Allegiant Air 1.75 stars, Spirit Airlines 1.75 stars, Hawaiian Airlines 1 star

Packaging’s Role in Food Waste

According to Mintel, packaging will play a pivotal role in reducing global food and product waste. Online brands will reinvigorate their packaging in order to enhance the e-commerce experience. Brands who adopt clear and succinct package messaging will be rewarded as consumers prefer brands that embrace minimalism. Brands will be called to keep marine conservation at the forefront of packaging development and to anchor the circular economy for future generations. Contemporary packaging formats will see the centre-of-store take centre stage.

Looking ahead, Benjamin Punchard, Global Packaging Insights Director at Mintel, discusses the major trends set to influence the packaging sector worldwide in 2018, including implications for consumers, brands, and manufacturers.

Packaged Planet

The throwaway culture of today will evolve into one that understands and embraces the role of packaging as a primary means to reduce global food and product waste.

Consumers have long considered packaging as often unnecessary, and ultimately as just waste to be disposed of. But that misconception is now changing. A focus on package innovations that extend food freshness, preserve ingredient fortification, and ensure safe delivery is increasingly benefiting consumers. Brands will need to act fast by exploiting on-pack communication tools to educate consumers to the benefits packaging can bring, from extending shelf life of food to providing efficient and safe access to essential products in developed and underserved regions of the world.

As more and more consumers embrace online shopping, packaging will play a pivotal role in brands’ and consumers’ e-commerce experiences.

Online shopping is becoming increasingly widespread around the globe and is near ubiquitous in some markets. However, while online shopping’s key advantage is convenience, consumers expect more from their favoured brands. When designing packaging to be viewed online, and transit packaging to be opened upon delivery in the home, the experience of e-commerce packaging must reflect consumer expectations from shopping with that brand in-store.

Clean Label 2.0

Aiming for packaging designs that enlighten consumers’ purchase decisions, brands will reject approaches that offer too much or too little as they can leave shoppers more confused than informed.

Today’s consumers are more informed than ever; however, brands are in real danger of being rejected if consumers feel overloaded with information, leading to the questioning of provenance, authenticity, and transparency. The ‘essentialist’ design principle bridges the divide between not enough and just enough of what’s essential for consumers to make an enlightened and confident purchasing decision. Brands must bring the next generation of clean label to packaging design to provide a moment of calm and clarity for shoppers in an increasingly hectic retail environment.

Sea Change

Plastic packaging adrift in the world’s oceans will become the catalyst driving brands to rethink packaging in a context consumers can understand and act upon.

Concerns over safe packaging disposal will increasingly colour consumers’ perceptions of different packaging types, and impact shopper purchase decisions. Only by communicating that a brand is working towards a solution will this growing barrier to purchase be overcome. While collecting waste plastic from the sea to recycle into new packaging can raise consumer awareness, it won’t solve the problem. In order to keep plastic out of the sea, a renewed effort towards the circular economy is needed to keep packaging material in use.

Brands will look to contemporary packaging formats to help reinvigorate the centre-of-store aisles less visited by younger consumers.

Young shoppers are increasingly ‘shopping the periphery’, visiting the fresh and chilled aisles around the store perimeter and turning their backs on processed, ambient, and frozen offerings in the centre of the store. The use of transparent materials, contemporary design, recyclability, or unique shapes can help draw in younger consumers to the store centre, making it as appealing as the burgeoning perimeter to younger consumers.

Benjamin Punchard, Global Packaging Insights Director at Mintel, said, “Our packaging trends for 2018 reflect the most current and forward-looking consumer attitudes, actions, and purchasing behaviours in both global and local markets. Such trends as those we see emerging in e-commerce packaging have stories that are just now being written. Others, such as the attack on plastics, are well into their third or even fourth chapters, but with no clear ending in sight. It is those backstories and future-forward implications that position Mintel’s 2018 Packaging Trends as essential to retailer, brand, and package converter strategies during the coming year and beyond.”

Nutritional Trends for 2018

Sun Basket released five category predictions for 2018 that spotlight growing consumer trends for healthy cooking and eating. Sun Basket’s team has identified emerging specialty ingredients, nutritional interests and more, all of which are expected to go mainstream in 2018.

- The Year of Intuitive Clean Eating – New food fads and diets crop up all the time. With so many conflicting paths to well-being, younger consumers are less focused on “being on a diet” and more in search of foods that make them feel energized, improve their digestion, and reduce inflammation. For some, it’s a move toward more plant-focused eating, either vegan or vegetarian, sometimes with occasional animal-based proteins. Pescatarians, flexitarians, reducitarians, and “chegans” (vegans who cheat) are indicators of this trend. No matter which path they take, consumers are making the commitment to cleaner, more mindful eating.

- Mediterranean on the Rise – Clinical studies have long shown that the cuisines of Greece, Southern Italy, and Spain are among the world’s healthiest, and consumers are rediscovering the robust flavors of these regions. “It’s the best of both worlds,” Sun Basket Registered Dietitian Kaley Todd says. “The flavors are amazing, and the health benefits are measurable. It’s one of the best examples of how nutritious food can also be delicious.” With its focus on abundant seasonal produce, lean meats and seafood, and liberal use of olive oil, the Mediterranean diet is both easy to adopt and to stick with, and not just because it’s delicious. Research has shown that the Mediterranean diet can be healthy for the heart and brain, may help prevent breast cancer, and stave off the negative effects of aging.

- Personalized Nutrition Through Food – Today, consumers are looking to make cooking easy, delicious, and personalized for their healthy lifestyle. Brands are moving from selling mass-market products to health-focused, niche offerings that meet their customers’ unique dietary and taste needs, resulting in a much more personal relationship between customers and their food. According to Adam Zbar, CEO and Co-Founder of Sun Basket, “We’re committed to developing clean, delicious food products that meet our customers’ unique dietary needs, delight their taste buds, and are quick and easy to prepare. Currently, over 70 percent of our customers select meals personalized for their diets, including Paleo, Gluten-Free, Vegan, Vegetarian, and Lean & Clean (weight management) options.”

- Alternative Proteins and Dairy – As consumer interest in plant-based eating continues to grow, the demand for proteins and dairy products not made from animals is also increasing. Soy products from tofu to tempeh remain popular, and consumers are increasingly turning to legumes, seeds, pseudocereals, whole grains, and nuts for protein. Nuts in particular continue to gain in popularity as a source for alternative dairy products, from milk to cream sauces and even aged cheeses.

- Healthy Time-Savers With Big Flavors – Thanks to quick cooking hacks from platforms like Buzzfeed’s Tasty, “instant chefs” are more inspired to experiment in the kitchen—as long as there is the time commitment is minimal. Consumers look to tools and techniques like the Instant Pot, sheet-pan meals, and 20-minute recipes to make meals that are healthy, fast, and delicious.

“I’m constantly looking for ways to minimize cooking time without compromising flavors,” said Sun Basket’sExecutive Chef and Co-Founder, Justine Kelly. “Today’s busy consumer wants the satisfaction of a delicious, home-cooked meal, but struggles to find time to commit to the process. Sun Basket’s meal kits are intentionally designed to be quick and easy while delivering exciting flavors in a healthy way for our customers.”

Holiday Meal-Prep Stress

According to a new survey from Bob Evans Farms, the maker of refrigerated mashed potatoes and macaroni & cheese, half of respondents believe the most stressful part of Christmas dinner is timing the cooking so that each dish is ready on time. Women were more likely to be stressed about timing than men, 55 percent vs. 45 percent respectively. On the flip side, men (9 percent) were significantly more concerned with having drinks that all the guests would like than their female (3 percent) counterparts.

What is the most stressful part of Christmas dinner?

50 percent Timing so all the food is complete at the same time

14 percent Preparing the main dish

11 percent Making all the side dishes

11 percent Meeting the dietary restrictions of guests

6 percent Having drinks your guests will like

5 percent Serving the food

3 percent Preparing the appetizers and dessert

Additional findings:

- On average, male respondents were more stressed about meeting the dietary needs of their guests than female respondents.

- Meeting the dietary needs of their guests stressed 17 percent of East Coast respondents while much fewer West Coast respondents, only 7 percent, reported similar stress.

- Millennials were more concerned about having the right drinks for guests than any other generation.

- Millennials: 9 percent

- Generation X: 5 percent

- Baby Boomers: 3 percent

“Making sure all your dishes are ready at the same time can be tough. That’s where Bob Evans mashed potatoes come in: ready in just 6 minutes, you know you can have them ready to serve when you need them,” said Chris Lambrix, SVP Retail Business Development at Bob Evans Farms. “With a variety of options to accommodate your family favorites, these ready-in-minutes sides make easy taste delicious so that you can spend your time where it counts – with family.”

Theme Park Food and Beverage Preferences

Seventy-five percent of U.S. visitors say they often or occasionally decide against buying food and beverage at a park because of queuing, while 65 percent take the same view with regard to buying merchandise. However, by deploying the right technologies, theme parks could see visitor spending on food, beverage and merchandise increase significantly with the availability of consumer-friendly technology solutions, research by Omnico has found.

The visitors who would spend more if these technologies were in place, would increase spending from $45 to $250 per head on food and merchandise if mobile apps, self-service kiosks and robot deliveries to avoid queues were available, the research reveals. The figures are part of the Omnico Theme Park ROI Barometer, which surveyed 683 consumers from the US who have visited a park within the last two years, along with 2,653 from the UK, Japan, China and Malaysia.

Fifty percent of U.S. visitors say they will spend up to four times more than normal on food and beverage if they can use mobile phone apps to order in advance. 47 percent will quadruple their spend if they can use self-scan apps on their phones or touchscreen kiosks for ordering in food outlets, while 46 percent will spend up to four times more on merchandise.

“Our research confirms that advanced point-of-sale technology will transform the revenues of US theme parks,” said Mel Taylor, CEO, Omnico. “US visitors want technology that makes visits more convenient and now we can see how such innovations will have massive positive impact on the bottom line.”

Retail spending, for example, will increase from an average $24 to $64 per head if mobile self-scan apps and self-service kiosks are available in park stores. And expenditure on food and beverage will increase from $21 to $59 if the same technologies are implemented in fast-food outlets or restaurants.

If virtual reality guides and experiences, or artificial intelligence-powered recognition systems are used to make their visits easier, 43 percent of US visitors say they will spend up to four times more than average on an admission ticket.

Commercial Espresso Market Forecast

Technavio announced the top six leading vendors in their recent global commercial espresso machines market report from 2017-2021. This market research report also lists 17 other prominent vendors that are expected to impact the market during the forecast period.

Competitive vendor landscape

The global commercial espresso machines market is a highly competitive market. The prominent vendors hold maximum share in the market. They compete based on various strategies that are primarily focused towards design of the product, variants of products, innovation, after sales service in the least amount of time possible, and brand equity.

According to Manu Gupta, a lead analyst at Technavio for food service research, “Many vendors offer a vast product portfolio that fulfills every need of the end-users. This leads to high customer satisfaction, easy customer retention for the vendors, and high brand equity for the company. Some vendors are also involved in refurbished business or remanufacturing business where they repair old products and sell those products at lower prices. This is to target those group of end-users who cannot afford high-value machines.”

Technavio market research analysts identify the following key vendors:

Breville Group

Breville Group deals in the area such as equipment related to beverages, cooking, and food preparation. The company manufacture equipment such as juicers, espresso machines, milk frothers, blenders, coffee grinders, citrus press, ovens, toasters, grills, deep fryers, food processors, mixers and others. The company sells various models of commercial espresso machines through its brand Breville.

BUNN

The company deals in products related to coffee, water, and tea for both commercial and household customers. BUNN also deals in equipment related to hot dispensed beverage, cold dispensed beverage, frozen dispensed beverage, and serving equipment. By channel the company offer products to FSRs, QSRs, healthcare, college, university, and many more.

De’Longhi Appliances

De’Longhi Appliances manufactures equipment such as coffee machines, kitchen appliances, floor cleaning equipment, ironing appliances, air treatment equipment, air conditioning equipment, and portable heating equipment. The company manufactures products for both home and commercial use. The company is part of De’Longhi Group.

Gruppo Cimbali

The company specializes in the manufacturing of coffee machines. Besides coffee machines, Gruppo Cimbali also offers professional dishwashers and ice machines. The company has brands such as La Cimbali, FAEMA, Casadio, and Hemerson. The company also operates Museum of Espresso Coffee Machines (MUMAC).

La Pavoni

The company operates globally and specialize in manufacturing coffee machines for home use as well as commercial use. For domestic products, the company offers lever machines, dual boiler machines, combined machines, pump machines, and coffee grinders. In commercial space, La Pavoni mainly deals in coffee machines and grinders.

RANCILIO GROUP

RANCILIO GROUP offers various products such as coffee machines, coffee grinders, and bar equipment. The company operates globally with branch offices in many countries such as Spain, Germany, the US, and many more. RANCILIO GROUP has received certifications such as ISO 9001, ISO 14001, and ISO 18001. The company is part of the Ali Group.

Candy is Dandy

The winter holidays are filled with family traditions, often with chocolate and candy as the centerpiece of the fun. This December, the National Confectioners Association is sharing four festive facts about the most wonderful season of all.

“The winter holidays are a special time in the candy industry,” said NCA President and CEO John Downs. “From hanging candy canes on the Christmas tree to sharing chocolate snowmen with family and friends, there are dozens of ways Americans celebrate with confectionery this time of year. And behind those special treats are 55,000 confectionery employees in communities across the country working hard to make the treats that Americans will enjoy as part of a happy, balanced lifestyle – at the holidays and throughout the year.”

Fun Facts: How Americans Enjoy Holiday Treats

#1 –90 percent of Parents Teach Their Children about Balance During the Holiday Season

Americans know that candy is a treat. Throughout the year, Americans eat candy just two or three times per week – averaging about 40 calories per day. A full 90 percent of parents use the holidays to prioritize setting guidelines and talking to their children about balance. While most report having these conversations year-round, many use the holiday as a conversation starter.

#2 – Good Things Come with More Information, Options and Support

Earlier this year, America’s leading chocolate and candy companies announced that they are coming together for a five-year commitment with the Partnership for a Healthier America to provide consumers with more information, options and support as they enjoy their favorite treats. The companies participating include Mars Wrigley Confectionery, Nestlé USA, Ferrero, Lindt, Ghirardelli, Russell Stover and Ferrara Candy Company.

#3 – Americans of All Ages Share Holiday Treats

More than 3/4 of Americans say they will likely include chocolate and candy in stockings or give confections as gifts to friends and family this holiday season. Foil-wrapped chocolates (36 percent) and candy canes (22 percent) top the list of the best candy for stocking stuffers, while peppermints, gumdrop-adorned ginger bread houses and chocolate coins all play a special role in important holiday traditions.

#4 – Americans will spend $1.9 Billion This Year on Winter Holiday Treats

NCA estimates that Americans will support U.S. confectionery workers this holiday season by spending $1.93 billion on sweet treats. Beyond the industry’s 55,000 jobs, this economic boost helps an additional 410,000 Americans employed in candy-supported industries like retail, transportation and agriculture.