MRM Research Roundup: End-of-November 2018 Edition

29 Min Read By MRM Staff

Modern Restaurant Management (MRM) magazine's "According to a recent study/survey …" column has been rebranded as MRM Research Roundup.

This time, we feature factors shaping the restaurant of the future, feelings about payment processing, holiday party feedback, top nightlife influencers, 2019 trends, 3ES and most popular songs at Waffle House.

Spontaneity, Robots and Veganism

Twenty percent of millennials go out less to restaurants now due to food delivery, shifting £1bn a year to delivery services

Over half of millennials (52 percent) would dine in a restaurant where aspects of service are automated

Millennials predict vegan restaurants will be in the most demand in the next two years

Results from a new survey, sponsored by Planday, the workforce collaboration software company, reveal three key drivers that millennials indicate will shape the restaurant sector of tomorrow.

Driver 1: Millennials are more spontaneous and are shifting around £1 billion in spend a year to delivery services

Restaurants face increasing challenges in forecasting demand and must rethink how they structure service, as home delivery orders become more popular and very low numbers of people make advanced reservations for in-restaurant dining.

A fifth of millennials (20 percent compared to 9 percent Gen X) say they go out less to restaurants now because they are getting more food delivered that they would previously have gone out to eat. This represents a shift worth around £1 billion a year towards food delivery and away from in-restaurant dining

Only 9 percent of millennials now say they are likely to make restaurant bookings and are willing to spend on average 14 percent less than Gen X on a meal

Driver 2: Millennials embrace robots and automation

Majority of UK millennials say they are ready for some restaurant services to be delivered by robots, allowing staff to focus on important 'human' interactions.

52 percent of millennials indicate they would dine in a restaurant where ordering and payments are fully automated, compared to only 39 percent of Gen X diners

Over two thirds of millennials (71 percent) say they wouldn't be against their food being delivered by a robot

However, millennials still crave human interaction in their dining experiences as over half (51 percent) would still like to give a compliment or complaint to a person rather than a machine

Driver 3: Consumers turn away from fast food and expect more sustainable, healthy options:

Consumer tastes are changing as millennials see a future where plant-based, environmentally friendly approach will win out over traditionally unhealthy fast foods.

For millennials the future is vegan – nearly half of all millennials (49 percent) predict vegan restaurants will be the most in demand in the next two years

In fact, 75 percent of millennials thought at least one of the following types of restaurants would be most in demand: vegan, vegetarian or those with good environmental credentials. In comparison only 25 percent of millennials thought fast food restaurants will be in the most demand over the next two years

Nearly half (47 percent) of all respondents placed reduced food waste as their top sustainable priority. Only 11 percent of consumers indicated that sustainability didn't matter to them

John Coldicutt, Chief Commercial Officer for Planday commented: "The UK restaurant sector has seen multiple high-profile closures in the last 12 months, as well-established chains struggle to correctly predict and match market demand. This survey gives us insight into the complex and changing consumer expectations, from younger to older diners, contributing to this challenging environment. We know from our own customer base that things are only likely to get less predictable as just under two thirds (63 percent) of our customers who are restaurant managers expect the percentage of food orders from online delivery services to increase over the next year. In order to stay competitive and profitable, restaurants need to listen to changing consumer preferences and use the available technologies to cater to an increasingly unpredictable environment."

Vegan restaurant entrepreneur Loui Blake commented: "The results of this survey absolutely reflect what we are starting to see and are responding to with our two vegan restaurants, Erpingham House in Norfolk and soon to open Kalifornia Kitchen in London. For us it is about listening to what the customer wants and delivering the highest quality food and service we can. We are thoroughly embracing the popularity of delivery services like Deliveroo, adjusting our menu slightly to ensure that we offer a menu where the food will travel well and not offering deliveries when it will put too much pressure on the restaurant to service in-house and external orders. We also know how important sustainability is to our customers and how crucial it is that we clearly communicate all the steps we take, from using Vegware plastics to carbon offsetting schemes, to reassure our customers that both we, and they, are dining without costing the earth."

The survey was conducted online across 2008 respondents in October 2018 by YouGov. Half of the sample are respondents classified as "millennials", aged (20-35), and "Generation X", aged (36-51). The survey was weighted to ensure a nationally representative sample of the respondents.

Payment Processing Survey

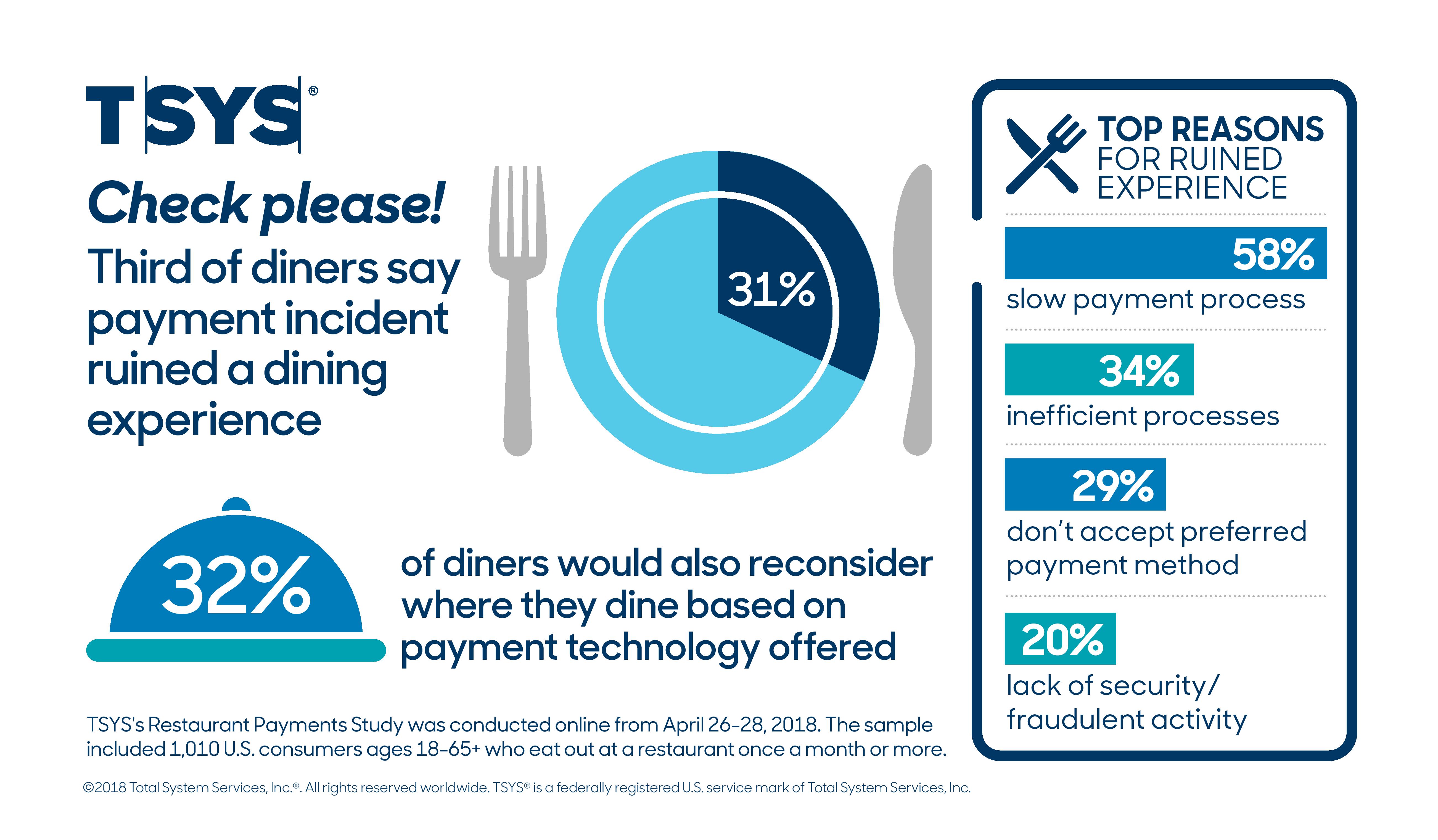

TSYS recently conducted a study to understand how consumers feel about the payment technologies they encounter at restaurants. Of particular interest is a finding that one in five consumers have had a slow payment process incident ruin a dining experience. In fact, this is the most common payment experience to ruin a dining occasion.

Among the findings:

- If a data breach occurred with a restaurant, 34 percent said they would not return (but 40 percent said they would)

- Mobile ordering is among the top conveniences that consumers desire; a combined 70 percent rank it first or second (that ties with the drive thru)

- Overall, 31 percent of consumers said a payment incident has ruined a dining experience (e.g., slow, lack of security, don’t accept payment method, etc.)

- Most consumers would prefer to pay at the table (48 percent) – especially millennials (72 percent)

- A restaurant’s payment technology is considered very or somewhat important by 58 percent of diners (69 percent of millennials)

- One third (32 percent) say they would reconsider dining at an establishment based on the payment technology they use

Holiday Party Feedback

To kick off the holiday season, Tripleseat conducted a survey in an effort to learn more about company holiday parties from employees and event planners, collecting over 1,100 responses.

Some of the key findings within the 2018 Holiday Party Feedback Survey included:

- 66 percent of employees attend their company holiday party, if offered

- 30 percent are held at restaurants, with the office being a close second

- 36 percent of parties consist of snacks and beverages, while 3.5 percent of companies just drink

- Less than 10 percent of all holiday parties are hosted at a bar, while 13 percent are held at unique venues

- Nearly 30 percent of company parties do not occur in December

- Ugly Sweater is still a common theme among companies, nearly 20 percent

- 57 percent of employees have seen their colleagues intoxicated

- A third of company holiday parties are held at restaurants, with the office is a close second

Nightlife and Dining Power List

Observer released its inaugural Nightlife and Dining Power List, a comprehensive look at the most influential players in America's nightlife and dining industry. The list offers a definitive survey of the restaurateurs, chefs and group owners making the biggest impact on the food and beverage business in 2018, from the investors and decision-makers behind the scenes to the game changers in dining tech and operations who are driving innovation and clearing the path for what's next.

"The Nightlife and Dining Power List provides our audience of urban professionals a truly robust resource to find information about the people changing the restaurant and nightlife worlds," said Observer Media President James Karklins. "Plenty of food-world stories exist in other publications, but the Observer will differentiate itself by not just focusing on chefs, but the power and money behind them. These powerful players are reinventing the traditional dining experience and forcing change on how the industry operates."

The Most Powerful People on Observer's 2018 Nightlife and Dining Power list:

|

Grant Achatz |

Co-Owner, The Alinea Group |

|

Richie Akiva |

Founder, The Butter Group |

|

Jose Andres |

Executive Chef and Founder, Think Food |

|

Dan Barber |

Executive Chef, Blue Hill and Blue Hill at |

|

Ashtin Berry |

Bartender and Advocate |

|

Kevin Boehm and Rob Katz |

Co-Founders, Boka Restaurant Group |

|

Anthony Bourdain |

Writer and Television Personality |

|

Patrick O. Brown |

CEO, Impossible Foods |

|

Mario Carbone, Rich Torrisi and Jeff |

Founders, Major Food Group |

|

David Chang |

Founder, Momofuku and Majordomo Media |

|

Roy Choi |

Co-owner, Founder and Chef, Kogi BBQ, |

|

Ashley Christensen |

Chef and Proprietor, Ashley Christensen |

|

Ravi DeRossi |

Founder, DeRossi Global |

|

Vinny Dotolo and Jon Shook |

Co-Founders, AnimaL |

|

Tom Douglas |

Chef and Founder, Tom Douglas Seattle |

|

Aaron Franklin |

Founder, Franklin BBQ |

|

Ken Fulk |

Founder, Ken Fulk Inc. |

|

Benjamin and Max Goldberg |

Co-Founders, Strategic Hospitality |

|

David Grutman |

Founder, Groot Hospitality |

|

Calvin Harris |

DJ |

|

Josh Harris |

Founding Partner, The Bon Vivants |

|

Jen Hidinger-Kendrick |

Co-Founder and Spokesperson, The Giving Kitchen |

|

Martha Hoover |

Founder and CEO, Patachou, Inc. |

|

Daniel Humm and Will Guidara |

Founders, Make It Nice Hospitality |

|

Meherwan Irani |

CEO, Co-founder and Executive Chef, Chai |

|

LeBron James |

Investor, Blaze Pizza |

|

Thomas Keller |

Founder, Thomas Keller Restaurants |

|

Amanda Kludt |

Editor-in-Chief, Eater |

|

Jessica Koslow |

Chef-Owner, Sqirl |

|

Ben Leventhal |

Co-Founder and CEO, Resy |

|

Donald Link |

Executive Chef and CEO, Link Restaurant |

|

Barbara Lynch |

Chef-Owner, The Barbara Lynch Collective |

|

Danny Meyer |

Founder and CEO, Union Square |

|

Amy Morris and Anna Polonsky |

Co-Founders, The MP Shift |

|

Gabriel Orta and Elad Zvi |

Co-Founders, Bar Lab |

|

Tejal Rao and Pete Wells |

The New York Times Restaurant Critics |

|

Clare Reichenbach |

CEO, James Beard Foundation |

|

Brooks Reitz |

Leon's Oyster Shop, Little Jack's Tavern |

|

Charlie Reyes |

Founder, Audio Culture LLC |

|

Caroline Rosen |

Executive Director, Tales of the Cocktail |

|

Sebastien Silvestri |

COO, The Disruptive Group |

|

Mike Solomonov |

Cook 'N Solo Restaurant Partners |

|

Stephen Starr |

Founder and CEO, Starr Restaurants |

|

Michael Symon |

Chef and co-owner, Lola Bistro, Angeline, |

|

Noah Tepperberg |

Co-Founder, Strategic Hospitality Group |

|

Mike Thelin |

Founder, Bolted Services |

Do The Right Thing

afandco. debuted this year’s trends report. Do the Right Thing: Stand for What You Believe In is a preview of the hottest trends and predictions that will shape the hospitality industry in 2019. This comprehensive annual report identifies key influences in restaurants, hotels, hospitality marketing, food, and beverage.

Now in its eleventh edition, afandco.’s trends report has become an industry standard in anticipating market demand and consumer feedback. Compiled from extensive year-long research, the report is intended to serve as a guide to help operators prepare for the coming year.

The theme of the 2019 trends report is Do the Right Thing because restaurants and hotels have been heavily affected by the tumultuous state of the world, and it’s driving the hospitality industry, like many industries, to reflect on its actions, step up, and do the right thing. From focusing on health and sustainability to embracing global cultures and supporting meaningful causes and partners, there's a renewed energy and deeper sense of caring to do the right thing for yourself, others, and the world at large.

“The hospitality industry is leading the charge in creating the world we want to live in. Restaurants and hotels are gathering places for people to connect, creating the perfect grounds for people to come together, get personal, and embrace forward-thinking ideas,” says Andrew Freeman, founder of afandco. “The industry is speaking up about equal rights, food waste, health and wellness, and much more. There’s a lot to be hopeful about in 2019. It has been incredible to see the hospitality industry step up and do the right thing.”

In addition to delving to this year’s theme, the report highlights the hottest food trends, cuisines, food cities and more.

Do the Right Thing!

Whether it’s fighting for gender equality in the kitchen, representing immigrants, or embracing sustainability, restaurants are helping to create the accepting world we want to live in and are raising money for deserving groups through creative marketing initiatives.

Examples:

-Cocktail for a Cause at Curio (SF), which currently supports the Calfund Wildfire Relief Fund by donating $1 from the sale of every Sphinx cocktail to help support intermediate and long-term recovery efforts for major California wildfires, such as the Camp Fire, as well as preparedness efforts

-“Bake the World a Better Place” bake sale at Bluestem Brasserie (SF) benefitting CUESA and The Ferry Plaza Farmers Market's Foodwise Kids, a free program for elementary school classes that uses the Ferry Plaza Farmers Market as a classroom for empowering the next generation of healthy eaters

-Jose Andre’s nonprofit World Central Kitchen

Meat the Future: Cell-based Meat and Vegan “Meat”

Plant-based “meat,” including the Impossible Burger, is showing up on menus throughout the country. And this trend isn’t slowing down – we’re expecting to see vegan seafood on menus in the near future.

Examples:

-Restaurants are using the Impossible meat in creative ways, such as the meatballs at barbacco eno trattoria (SF)

-Vegan seafood from Good Catch (National)

-Impossible Burger at Gott’s Roadside (Multiple Locations)

Globally-Inspired Breakfast

Get ready for breakfast around the world without leaving your town. Globally-inspired breakfast and brunch menus have taken off, including the modern Indian brunch at ROOH, Israeli breakfast at Oren’s Hummus, and Japanese breakfast at Cassava.

Examples:

-Israeli breakfast at Oren’s Hummus (SF)

-Japanese breakfast at Okonomi (Brooklyn, NY)

-Italian breakfast at Poggio (Sausalito, CA)

-Mexican breakfast at Fonda (NYC)

Dessert of the Year: Doughnuts

Savor these treats… literally. Artisanal doughnut shops are popping up throughout the country and unexpected savory flavors and fillings are showing up in traditionally sweet places.

Examples:

-Chicken liver doughnut with black honey glaze at Grand Cafe (Minneapolis, MN)

-Everything spice doughnut at Doughnut Project (NYC)

-Passionfruit cocoa nib donut at Blue Star (Portland, OR)

-Potato doughnut tikki with spinach pakoda, yogurt mousse, and raspberry at ROOH (SF)

Dish of the Year: Khachapuri

Georgian cuisine is having a moment, and leading the way is the photogenic, Instagram favorite dish Khachapuri. Featuring a cheese-filled bread boat topped with a runny egg, the egg and cheese are mixed together tableside. To enjoy, guests tear off pieces of the crust to dip in the cheesy middle. Bread… runny eggs… cheese… what’s not to like?

Examples:

-Supra (DC)

-Cheeseboat (Brooklyn)

-Barbounia (NYC)

Time for Tea

Tea is a huge trend for 2019… but not but your traditional tea! We’re anticipating a rise in moringa tea (a popular superfood), cheese tea (yes, cheese), and mushroom tea. Guests are expecting more from tea programs, prompting the rise of tea sommeliers and elaborate tea programs.

Examples:

-ROOH (SF) features an elaborate tea menu and tea sommelier

-Mushroom tea from Four Sigmatic

-Cheese tea at Little Fluffy Head Cafe (LA)

-Sparkling matcha tea at Stonemill Matcha (SF)

Robotic Restaurant Revolution

Stay on the lookout for food-making robots! Silicon Valley-based food robotics company Chowbotics is rolling out Sally the Robot at airports, convenience stores, offices and more – serving up vibrant, forward-thinking meals via touchscreen interface 24 hours a day, seven days a week. Popular robotic restaurants including Creator and Spyce are further proof that robots are here to stay.

Examples:

-Sally the Robot from Chowbotics

-Creator (SF)

-Spyce (Boston)

Waste Not, Want Not

The hospitality industry is increasingly passionate about reducing food waste and finding ways to increase their sustainable operations. Today’s diners care that operators don’t waste ingredients, they want to know how and where products are grown (locally, ideally!)

Examples:

-Amazing Pasta Straws, a company that creates sustainable straws out of (you guessed it!) pasta

-James Beard Foundation’s “Waste Not” food waste initiative

-Austin (TX) food waste ordinance preventing restaurants from disposing of food waste in landfills

Digital Detox: Going off the [Hotel] Grid

Hotels are offering digital detox packages, allowing guests to lock up their phones (literally) in exchange for discounts. Everyone wins – hotels benefit (guests often use more amenities when they aren’t on their phones) and guests revel in the relaxing experience.

Examples:

-The Mandarin Oriental Hotel (NYC) offers a digital wellness package that includes spa therapies to target back and neck strain from device use

-The James Hotel (NYC) offers a portable safe to lock up your digital devices, with the combination and timer set by the front desk team. Guests that participate receive 10 percent off their room rate

-Hotel chains including the Wyndham Grand have begun offering promotions to guests willing to give up their devices during their stay

Seed to Table

So long, farm to table. Seed to table is the new trend! What does it mean? Chefs are working directly with farmers to grow vegetables that put flavor (not yield, shelf life, or uniformity) first. Leading the charge is Row 7 Seed Company, launched by Chef Dan Barber and his seed-breeder partners. By working together in the field and kitchen, they test, taste and market delicious new plant varieties to make an impact in the soil and at the table.

Examples:

-Row 7 Seed Company

-SPQR (SF) works closely with a local farmers to cultivate uncommon items

Third-Party E-Sourcing Impact

The percentage of street operators purchasing goods online has dramatically increased since 2014, with over 40 percent saying they use third-party e-sourcing (3ES) at least once a month. According to Technomic's 2018 E-Sourcing Impact Study, supplies, disposables, specialty foods and shelf-stable foods represent much of what is purchased.

"Our research suggests that street restaurant operators are bullish on the future of third-party e-sourcing," said Joe Pawlak, managing principal. "Today, operators are most inclined to purchase products in the nonfoods and shelf-stable space but are reluctant to source frozen and perishables from 3ES. However, they can envision a giant like Amazon developing a solution to make operators comfortable purchasing these products online."

Key takeaways from the report include:

- Unless 3ES can compete beyond price and many of the unique benefits that distributors provide, they will never become the primary source for operators

- As a result of new purchasing expectations from the younger tech-savvy generation, distributors are evolving and investing in developing user-friendly online ordering platforms and apps to mirror Amazon's interface

- Some distributors report that operators are using 3ES for price checking, sometimes finding lower prices on Amazon and trying to negotiate price on this basis

Compiling findings from interviews with restaurant operators, noncommercial establishments and broadline distributors, the 2018 E-Sourcing Impact Study serves as a guide for foodservice professionals to uncover the evolution of operator purchasing behavior as well as the opportunities and threats these channels pose to the foodservice market.

Number One Restaurant in the World

Le Bernardin was named the number one restaurant in the world by La Liste, the global restaurant guide and ranking system of the world's top 1,000 restaurants. Joined in a tie with Guy Savoy, Le Bernardin was previously ranked the number one restaurant in the United States and number two in the world. Le Bernardin is one of only three New York City restaurants within the top 10 restaurants in the world and one of only nine United States-based restaurants in the top 100, in addition to its new number one ranking.

Of the win, chef and co-owner Eric Ripert said, "We are delighted to be recognized by La Liste. It's a great motivation for the team, who work so hard throughout the year to deliver a special experience to our guests time and time again."

La Liste debuted in 2015, providing an objective and democratic ranking of the world's most outstanding restaurants powered by a proprietary algorithm that gathers information from over 600 leading food guides, user-generated review sites and global publications such as The New York Times, Michelin Guide, TripAdvisor and more. Commentary directly from restaurant guests is also weighed within the algorithm. Based in Paris, La Liste reviews nearly 16,000 restaurants, with the resulting restaurants located in 180+ countries, on five continents.

Le Bernardin was also awarded three stars from the 2019 Michelin Guide this year for the 14th consecutive year and has continued to maintain a four-star rating from The New York Times, receiving four stars in each of its five reviews since its opening. Le Bernardin is also ranked number 26 on the annual World's 50 Best Restaurants list.

UItimate Pizza Road Trip

RAVE Reviews published a list of "The Ultimate Pizza Road Trip Across America," available here.

"Just about everyone loves Pizza, so it only made sense for us to make it easier to hit all the best spots in the U.S. Our hope is that people share their Pizza Road Trip experience with others. It isn't just about the Pizza, but also the journey to get there," said Hillary Miller, Managing Editor for RAVE Reviews.

The methodology for the ranking was based on an analysis of three main taste factors; Dough, Sauce, and Crust. These factors were then combined with a detailed analysis of online reviews and comments.

The full list of featured Pizza companies includes:

- 1880 Pizza Napoletana | Kansas City, KS

- A16 | San Francisco, CA

- Al Forno | Providence, RI

- All Souls Pizza | Asheville, NC

- Ambrogio 15 | San Diego, CA

- Apizza Scholls | Portland, OR

- Bacio Pizzeria | Washington D.C.

- Bar Cotto | Seattle, WA

- Bazbeaux's Pizza | Indianapolis, IN

- Buddy's Pizza | Detroit, MI

- Crust | Cleveland, OH

- D'Allesandro's Pizza | Charleston, SC

- Di Fara | Brooklyn, NY

- Driftwood Oven | Pittsburgh, PA

- Five Points Pizza | Nashville, TN

- Frank Pepe Pizzeria Napoletana | New Haven, CT

- Grimaldi's | Brooklyn, NY

- Gusto Pizza Co. | Des Moines, IA

- Home Slice Pizza | Austin, TX

- Impellizzeri's Pizza | Louisville, KY

- Isabella's Brick Oven Pizza and Panini | Baltimore, MD

- La Nova | Buffalo, NY

- Lou Malnati's Pizzeria | Chicago, IL

- Luna Pizzeria | Houston, TX

- Melo's Pizzeria | St. Louis, MO

- Mikey's Late Night Slice | Columbus, OH

- Nuch's Pizzeria | Salt Lake City, UT

- O4W Pizza | Atlanta, GA

- Orsi's Italian Bakery and Pizzeria | Omaha, NE

- Pequod's Pizza | Chicago, IL

- Pizzeria Bianco | Phoenix, AZ

- Pizzeria Lola | Minneapolis, MN

- Pizzeria Mozza | Los Angeles, CA

- Regina Pizzeria | Boston, MA

- Rubino's Pizza | Columbus, OH

- Sally's Apizza | New Haven, CT

- Santarpio's Pizza | Boston, MA

- Secret Pizza at Cosmopolitan | Las Vegas, NV

- Serious Pie | Seattle, WA

- Steve's Pizza | Miami, FL

- Tacconelli's Pizzeria | Philadelphia, PA

- Totonno's Pizzeria Napolitano | Brooklyn, NY

- Tony's Pizza Napoletana | San Francisco, CA

- Transfer Pizzeria and Cafe | Milwaukee, WI

- TriBecca Allie Café | Sardis, MS

- Varasano's Pizzeria | Atlanta, GA

- Via 313 | Austin, TX

- Wiseguy Pizza | Washington D.C.

- Wood Stone Craft Pizza and Bar | Fayetteville, AR

Most Popular Meal Preps

Imgur released a data study on the most popular meal prep subscription box in every state. It illustrates how each state's taste differs, and could even inform restauranteurs about their audience's preferences.

The study used Google search interest data for each state to determine which meal prep box was most popular. The top five overall, when looking at count of states, are Plated (13 states), Home Chef (9), Dinnerly (7), and Hello Fresh (5), and Foodstirs (4). It was put together by the team at Empire Today.

Global Bakery Market

Reforms in lifestyle preferences, changes in dietary habits, and high demand for low trans-fat and gluten-free products would drive the growth of the global bakery ingredients market.

Allied Market Research published a report, titled, Bakery Ingredients Market by Type (Enzymes, Starch, Fiber, Colors, Flavors, Emulsifiers, Antimicrobials, Fats, Dry baking mix, and Others) and Application (Bread, Cookies and Biscuits, Rolls and Pies, Cakes and Pastries, and Others): Global Opportunity Analysis and Industry Forecast, 2018-2025. The report provides detailed analyses of the top winning strategies, growth factors and opportunities, market size and forecast, major market segments, and competitive landscape. As per the report, the global bakery ingredients market generated $12.59 billion in 2017, and is expected to reach at $18.60 billion by 2025, growing at a CAGR of 5.0 percent from 2018 to 2025.

Changes in lifestyle preferences and dietary habits coupled with growing demand for low trans-fat and gluten-free products drive the growth of the market. However, increased consumption of cereals as a replacement for bakery products along with stringent regulations and implementation of international quality standards hinders the market growth. On the other hand, rise in demand for frozen bakery foods and increase in RandD activities to reduce production costs and improve shelf life of edibles would offer new opportunities to the market.

Dry baking mix segment contributed nearly one-fourth share of the total revenue in 2017 and is expected to maintain its dominance throughout the forecast period. This is due to its increasing usage in preparation of baked food products including cakes, waffles, muffins, biscuits, breads, and pizza dough. However, enzymes segment would register the highest CAGR of 8.5 percent from 2018 to 2025, owing to rise in demand for chemical-free natural products among consumers. The report also analyzes starch, colors, fiber, emulsifiers, flavors, antimicrobials, fats, and others.

Bread segment accounted for more than two-thirds share of the total market revenue in 2017 and is projected to maintain its lead position by 2025. This is due to bread being a staple food in developed countries and increase in consumption of low sugar and low carbohydrates bakery products. However, rolls and pies segment would register the fastest CAGR of 6.1 percent from 2018 to 2025, owing to hectic lifestyle and preference for ready-to-eat foods. The report also analyzes cookies and biscuits, cakes and pastries, and others.

Europe contributed more than one-third share of the total revenue in 2017, owing to busy lifestyle of people in the region, high product diversification, and development of new packaging materials. However, Asia-Pacific region would grow at the fastest CAGR of 6.0 percent from 2018 to 2025, owing to increase in demand for processed bakery products, rise in consumer awareness toward healthy ingredients and clean label products, and surge in disposable income.

The key market players analyzed in the report are Archer Daniels Midland Company, Bakels Group, Associated British Foods Plc., Dawn Food Products Inc., Cargill Incorporated, Ingredion Incorporated, E. I. du Pont de Nemours and Company, Koninklijke DSM N.V., Kerry Group, PLC, and Lallemand Inc. These market players have adopted different strategies including collaborations, joint ventures, partnerships, expansions, mergers and acquisitions, and others to gain a strong position in the industry.

Animal Welfare Impact

With Thanksgiving behind us, Americans are thinking about their upcoming holiday meals, many of which will involve ham, beef, chicken, turkey (again) and other meats. We asked people their opinions on quality, price and animal rights and according to YouGov Omnibus here is what they had to say:

- 46 percent say that they care about price vs. quality equally (as a group), but ages

- 55 percent of baby boomers stated this was important vs. 37 percent of millennials

- 77 percent say that they care about animal rights

- Women (84 percent) are more likely than men (69 percent) to say they “care a lot” or “care somewhat”

Furthermore, attitudes about animal welfare may influence purchasing decisions. More than six in ten (63 percent) Americans say that if they found out a company had a bad reputation for animal welfare, it would make them less likely to buy meat

See full results here.

Meal Kit Trends

When meal kit delivery services first emerged in Sweden back in 2007, the premise seemed simple enough: offer busy customers the chance to save a lot of time, have access to a wide variety of food choices, eat healthily, improve their cooking skills, and limit the amount of food waste. In the decade since, meal kits have largely delivered on their profitable potential as companies emerged to bring easy to prepare meals to doorsteps around the world, including expansion into several more European nations (Germany, Austria, the Netherlands, Belgium, and the United Kingdom) and at least three more continents (Asia, Australia, and North America).

Shortly after reaching America more than five years ago, market research firm Packaged Facts estimated meal kits had become a fast growing billion-dollar business in the U.S. Since then, time has tempered both growth and expectations for meal kits though the future remains promising. Meal Kits: Trend and Opportunities in the U.S., 3rd Edition, a new report by Packaged Facts, forecasts the industry will continue to expand and grow healthily through 2023—albeit at rates more modest than previously anticipated.

Packaged Facts estimates the U.S. meal kit market had sales of $2.6 billion in 2017 and will grow almost 22 percent by the end of 2018 to reach $3.1 billion. Growth is forecast to steadily decline from double-digit gains over the next few years to single-digit gains by 2023.

Packaged Facts anticipates that the market for subscription meal kit delivery services will mature rapidly as other methods of meal kit sales become available and even preferred, such as one-time online orders from a meal kit website or app, online orders from a grocery store website or app, and in-store sales. As a result, future growth in the market will require industry leaders to continue pivoting and adjusting their business models to retain current customers and reach new clientele. Long-term, Packaged Facts concludes that as more traditional stores offer meal kits as a product rather than as a service, the market will stabilize and become similar to other convenience grocery items that sell for a premium, such as pre-cut fresh produce that is ready-to-eat.

"The meal kit market is highly dynamic and prone to fluctuations, with the top meal kit providers falling in and out of favor since their introduction in the past few years," says David Sprinkle, research director for Packaged Facts. "Further complicating things, market expansion is expected to be much more reliant on alternative purchase venues than the traditional subscription delivery model due in part to the convenience and flexibility of online shopping."

The advent of online grocery shopping has made customers more comfortable than ever with ordering fresh food online and has contributed to the expansion of the online market for meal kits. However, the problem for traditional subscription model is that the "on-demand" nature of online shopping through companies such as Amazon and the evolution of e-commerce over the past few years has led to consumers expecting convenience and near-instant gratification.

The subscriptions most meal kit delivery services provide often clash with the "on-demand" mentality of potential meal kit customers, who want to be able to buy the products they want whenever they want. Subscriptions attempt to entice more purchases and even when flexible, can lead to customers purchasing more than they want to buy at a given time to avoid increased fees. People who have felt these pressures are more likely to cancel their subscriptions, and many consumers never become customers because they do not like the idea of being "locked in" by a subscription.

"It is unsurprising that many meal kit companies have been struggling to attract new customers and maintain existing ones under the subscription model. Paired with the retention problem is the struggle with attaining profitability due to the high costs of shipping fresh ingredients directly to consumers," says Sprinkle. "These challenges demand that meal kit companies tweak their business models and find alternative ways to reach customers, as the potential market for meal kits as a product is much larger than the interest in meal kit delivery services as they currently exist."

Views on Meat Consumption

Holiday hosts planning this year's festivities may want to take into account the latest research from Dalhousie University. Canadians are changing their perspectives on meat consumption, with 6.4 million already restricting or eliminating meat from their diets. While the millennial and Gen Y demographic make up 63 percent of those who are Vegan, 42 percent of Flexitarians – flexible vegetarians, with some meat consumption – are Baby Boomers. Reasons cited for the dietary shift include added health benefits of vegetarianism, environmental concerns, meat prices and animal activism.

While the festive turkey and ham may still be on the menu, ensuring all guests get up from the dinner table satisfied has home chefs exploring new options. Sweet Potato Chronicles' cookbook authors and bloggers Ceri Marsh and Laura Keogh, who focus on "the never-ending story of the well – fed family" have created quick and easy vegetarian options that will appeal to all dinner guests. Marsh and Keogh are conscious of what they are feeding their families but have a realistic approach in juggling busy schedules with healthy meal planning. "There are so many excellent meatless, plant-based options available that whipping up a totally vegetarian menu is easy, delicious and healthy", says Keogh. The duo have developed a vegetarian holiday menu that includes everything from hors d 'oeuvres to main dishes.

"Our cucumber hors d'oeuvres topped with ricotta cheese and Yves Veggie Bacon take literally less than 15 minutes to make", says Marsh. For the main course, consider putting a unique spin on a classic. "Who doesn't love lasagna?" adds Keogh. "We created a sweet potato lasagna that swaps out noodles for sweet potatoes and incorporates Yves Italian Ground Round. These subtle changes to a well-loved dish make it a healthier option, while still satisfying that comfort food craving." Other recipes include veggie Italian sausage and fennel prepared in a sheet pan, Yorkshire pudding bites prepared with veggie ground round, mushrooms and horseradish and zucchini enchiladas. If the crew is craving the next day left over traditional turkey sandwich, the grilled veggie turkey slice, camembert with cranberry sandwich will fit the bill.

"Another added benefit of a vegetarian holiday meal is that the prep time is considerably shorter," says Keogh. "You can spend time with friends and family without spending six hours in the kitchen stressing that the turkey is under cooked or over cooked."

On-Premise Alcohol Consumption Trends

On-premise consumption of beverage alcohol fell 1.1 percent overall in 2017, to 1.7 million cases, according to the Beverage Information Group's 2018 Cheers On-Premise Handbook. Much of that is due to the 1.6 percent decrease in cases of beer sold on-premise, while wine was up just 0.5 percent.

Spirits continues to be the bright spot, up 2.5 percent in 2017, although that's down from the 4.7 percent increase the segment saw in 2016. Craft and classic cocktails are driving spirits sales in bars and restaurants, and consumers are also still interested in brown spirits, namely bourbon: On-premise sales of American whiskey increased 4.2 percent in 2017.

Although total consumption was down, retail dollar sales of beverage alcohol on-premise increased a bit in 2017, an indicator of the continuing premiumization trend. For instance, retail dollar sales of spirits grew 8 percent, wine rose 2.2 percent and beer was up 3.2 percent over 2016.

Wine consumption in the U.S. is driven primarily by women, who account for 52 percent of all on-premise wine consumers. Millennials have been an increasingly driving force in the wine category as they are an explorative group, and a generation more interested in trying new flavors than adhering to one style or one brand.

Champagnes and sparkling wines in particular are gaining share of on-premise consumption. The segment now comprises 7 percent of all on-premise wine. Thanks in large part to the continued prosecco boom, imported Champagne/sparkling wines grew 8 percent vs. domestic options, which increased 7 percent.

Why is beer struggling on-premise? Wine and spirits have been stealing the spotlight at traditionally beer-dominated events/venues, such as sporting events, concerts, outdoor activities and festivals. And while people are still interested in craft and imported beer, the strong economy, low unemployment and high consumer confidence is inspiring some guests to turn away from the beer category in favor of spirits and wine.

Global Coffee Market

Global Coffee Market is expected to grow at a significant CAGR in the upcoming period as the scope and its applications are rising enormously across the globe. Top ten countries for Coffee Market are United States, Canada, England, China, South Korea, France, Japan, Germany, Italy, and India. England may account for the substantial market share of Coffee and is estimated to lead the overall market in the years to come. The reason behind the overall market growth could be high demand from consumers. The United States, India, and China are also estimated to have a positive influence on the future growth. India and China together are estimated to grow at the fastest pace in the years to come. The reason behind the overall market growth could be high demand from the young consumer base, developing manufacturers, and a rise in coffee consumption. The key players of Coffee Market are Dunkin' Donuts, Eight O' Clock Coffee, Nestle S.A., The J. M. Smucker Company, Starbucks Corporation, Jacobs Douwe Egberts, Kraft Heinz Inc., and Ajinomoto General Foods, Inc. These players are concentrating on inorganic growth to sustain themselves amongst fierce competition.

Small Business Saturday Growth

The ninth annual Small Business Saturday kicked off the holiday shopping season for consumers and small, independently owned businesses with record levels of reported spending. Total reported spending among U.S. consumers who said they shopped at independent retailers and restaurants on the day reached a record high of an estimated $17.8 billion, according to data released today from the 2018 Small Business Saturday Consumer Insights Survey from American Express and the National Federation of Independent Business (NFIB). Based on this annual survey over the years, Small Business Saturday spending has now reached a reported estimate of $103 billion since the day began in 20101.

Communities across the U.S. and Puerto Rico celebrated this Small Business Saturday with special events and activities. From lighting up the Empire State Building blue in New York to crafting a life-sized Shop Small® gingerbread shop in San Diego, to block parties featuring local jazz and salsa bands in San Juan, businesses and neighborhoods showed what makes their communities unique and vibrant. An estimated 104 million U.S. consumers reported shopping or dining at local independently owned businesses on Small Business Saturday, according to the same survey.

“Millions of shoppers came together to show their support for small, independently owned businesses this Small Business Saturday,” said Elizabeth Rutledge, Chief Marketing Officer at American Express. “The Shop Small movement has become a national celebration – people all around the country are turning out to back the small businesses that make our neighborhoods and communities thrive.”

The survey also found that an estimated seven in ten (70 percent) American adults are aware of Small Business Saturday. Among consumers who said they shopped small on the day, 42 percent reported shopping with family and friends at independently owned businesses, and 83 percent reported encouraging others to also shop or dine small. Shoppers also turned out for online small businesses – among consumers who said they participated on the day, 41 percent reported that they shopped small online on November 24.

In a separate, new survey of small business owners with storefronts, American Express and the NFIB explored the importance of the holiday shopping season. Small business owners expect an average of 29 percent of their total annual sales to take place during the holiday shopping season, and 59 percent said Small Business Saturday contributes significantly to their holiday sales each year, according to the 2018 Small Business Owner Insights Survey from American Express and the NFIB.

The survey took place November 5-12, in advance of Small Business Saturday, and two-thirds of small business owners surveyed (66 percent) said they were planning promotions, sales or activities during the shopping days following Thanksgiving (i.e., Black Friday, Small Business Saturday and Cyber Monday) to take advantage of the holiday shopping season. Among companies that were planning promotions on Small Business Saturday, 92 percent said the day helps their business stand out during the busy holiday shopping season and that the benefits of participating include bringing in more and new customers (74 percent), improved sales (70 percent), raised awareness of small businesses in their community (69 percent) and the day helps their local neighborhood and community prosper (66 percent).

Looking at the full shopping period between Thanksgiving and Christmas, small business owners are optimistic about the holiday shopping season. More than eight-in-ten (83 percent) said they have a positive outlook on their business’s holiday sales this year, and more than two-thirds (69 percent) of those surveyed expect their holiday sales to be stronger than in 2017. To meet the holiday demand, half (51 percent) of surveyed business owners reported they will extend their store hours beyond the normal business hours and more than one third (36 percent) of respondents plan to hire more staff for the holiday season.

“Small and independent businesses depend on holiday sales and the shoppers that Small Business Saturday brings into their stores and online shops,” said NFIB President and CEO Juanita D. Duggan. “Small businesses contribute so much to the economy and unique character of our communities, and we’re proud to join American Express to support them on Small Business Saturday and throughout the year.”

Beer Market Forecast

The beer market in the US is expected to post a CAGR of over 2 percent during the period 2018-2022, according to the latest market research report by Technavio.

A key factor driving the growth of the market is the rapidly increasing number of craft breweries. Over the years, the demand for craft beer has grown significantly in the US. The segment covered an estimated 23.34 percent of the overall beer market in the US. The growth of the craft beer market in the US has also increased the number of craft brewers in the US in various states. The increasing and rising rapid expansion of breweries in the US has contributed to an increase in the availability of beer in the market. Most of the breweries have introduced their own and unique beers. This has given customers increased opportunity to try new beer flavors. Thus, the demand for craft beer has led to the growth of the beer market in the US.

In this report, Technavio highlights the introduction of new beer flavors as one of the key emerging trends in the beer market in the US:

Beer market in the US: Introduction of new beer flavors

The growing popularity of flavored beer in the US is attributable to the increasing volume of consumers in the beer market in the US. The introduction of new flavors in the craft beer segment has led to a boost in the beer market in the US. Flavors set a beer apart from one another and act as a point of differentiation for the consumers. The millennials, one of the largest demography in the US population, is a targeted segment of breweries. The preference of millennials towards flavored beers has seen breweries adopting and incorporating newer flavors in their beer offerings. For example, in April 2018, AB InBev launched Bud Light orange, an orange flavored Light in an aim to capitalize on the popularity of flavored lagers. Thus, the increasing demand for new flavors is expected to lead to the introduction of new flavored beers during the forecast period.

“Along with introduction of new beer flavors, another major factor boosting the growth of the market is multicultural millennials. These millennials are open to experimenting with new products and flavors. The increasing demand for different beers styles and flavors among millennials is driving the growth of the craft beer segment in the beer market in the US,” says a senior analyst at Technavio for research on alcoholic beverages.

Beer market in the US: Segmentation analysis

This market research report segments the beer market in the US by product (craft beer and non-craft beer).

The non-craft beer segment led the market in 2017 with a market share close to 77 percent, followed by the craft beer segment. However, during the forecast period, the craft beer segment is expected to register higher incremental growth as compared to non-craft beer, which will see a commensurate decline in its market share.

Tech in APAC Foodservice

The advent of technology has transformed various industries and the foodservice industry is no different. Foodservice operators should use technology to better target emerging consumer trends such as customization, on-the-go experience and health and wellness across emerging countries in the Asia-Pacific (APAC) region to stay ahead of their competitors, says GlobalData, a leading data and analytics company.

The company’s report, ‘Foodservice Insights & Trends – Technology’ reveals that convenience, growing health awareness and adventurous palates looking for customized experiences among consumers are driving the use of technologies such as artificial intelligence (AI), visual recognition, 3D printing and robotics in APAC foodservice industry.

Sumit Chopra, Research Director for Consumer at GlobalData, said: “Technology is the lifeblood of every industry and it has undoubtedly created opportunities for the foodservice operators to add the wow factor. Operators are pouring in investments in developing technologies as the foodservice sector is currently on a massive growth phase, largely powered by small and medium size businesses relying on dedicated suppliers and utilizing increasingly powerful logistics algorithms.”

This is substantiated by the company insights, which show that leading foodservice operators in Asia are embracing the latest technologies to understand the customers’ preferences and serve them better. For instance, KFC in Beijing has partnered with Chinese search engine giant Baidu to develop facial recognition software that can suggest dishes for consumers based on a demographic profile. Other key players such as Starbucks in Japan has joined hands with Uber Eats to roll out the Starbucks menu directly to customers while in China it tied up with Alibaba Group Holding’s Ele.me unit to do customer deliveries.

Chopra concludes: “APAC foodservice operators are using technology to analyse consumption data, digital payments & transactions and order pattern to align their offering with the consumer preferences and ensure their supply chain and production processes are as efficient as possible.”

Tunie Awards

Khalid and his hit "Location" scores the top song played on the TouchTunes Jukeboxes in 1,900+ Waffle House® restaurants as announced on the first-ever Tunie™ Awards show.

Khalid edged out Sam Hunt, Justin Timberlake and Ed Sheeran to take the number one spot in this year's list. The results are based on the 30-million songs played on Waffle House/TouchTunes Jukeboxes over the past 12 months. Last year's number one song, "Blue Ain't Your Color" by Keith Urban, came in at number five this year.

Waffle House Jukebox Top Ten Songs of 2018:

"Location" by Khalid

"Body Like A Back Road" by Sam Hunt

"Can't Stop the Feeling!" by Justin Timberlake

"Shape of You" by Ed Sheeran

"Blue Ain't Your Color" by Keith Urban

"Tennessee Whiskey" by Chris Stapleton

"Uptown Funk" by Mark Ronson feat. Bruno Mars

"Thinking Out Loud" by Ed Sheeran

"Too Good at Goodbyes" by Sam Smith

"Can't Feel My Face" by The Weeknd

Michael Jackson was the most played artist in 2018 and also won the award for the Best Pop Artist. Beyonce won the award for Best RandB/Hip Hop Artist, and Lynyrd Skynrd won the Best Rock Artist award.

Chris Stapleton had the most country songs played and took home the Tunie™ award for Best Country Artist.

"I've had a lot of dreams come true," Stapleton said as he accepted his award. "One of the dreams I wanted is to have a song on the Waffle House jukebox. Not only did I get a song on the Waffle House jukebox, I got this fantastic award. So thank you very much."

Imagine Dragons won the Tunie™ award for the most played rock song with their hit "Thunder."

"That means the world to us," Imagine Dragons drummer Dan Platzman said on the show. "This is like you basically took our hearts, and you scattered, smothered, double-covered and peppered them."

Country Music Hall of Famer Whispering Bill Anderson received the Jukebox Legend Award. Shinedown won Best Audience Participation for their Atlanta concert, and newcomer Paul Pelt won the Scattered, Smothered and Discovered New Artist Award and performed on the show.