MRM Research Roundup: Mid-September 2019 Edition

1 Min Watch By MRM Staff

This edition of Modern Restaurant Management (MRM) magazine's Research Roundup features news about the Achilles heel of August, peer pressure dining, the popularity of guacamole and UK eating habits.

The Achilles Heel of the Restaurant Industry

The sales slowdown continued for the restaurant industry in August as same-store sales fell again year over year. Growth was -0.7 percent for August, the second consecutive month in which the industry failed to grow its same-store sales. The last time the industry experienced two consecutive months of negative same-store sales growth was in January and February of 2018, when the weak sales could be largely attributed to bad winter weather. The latest disappointing results could not be attributed to any external factors, thus raising questions about the current health of the industry. This update comes from Black Box Intelligence™ data from TDn2K™, based on weekly sales from over 31,000 locations representing 170+ brands and $72 billion in annual sales.

Even though the latest results are discouraging for restaurants, they are not surprising. As the industry is into the second half of 2019, the sales comparisons become tougher year over year, given the industry’s stronger performance during the last two quarters of 2018.

“August’s same-store sales growth compared with the same month two years ago is actually an encouraging 1.2 percent,” commented Victor Fernandez, vice president of insights and knowledge for TDn2K. “The industry’s sales continue to be better than they were two years ago in comparable stores. Since the beginning of the year, only two months (February and July) have posted negative sales growth on a two-year basis. Between August 2017 and December 2018, only October – December of 2018 achieved two-year positive same-store sales growth. In other words, the industry’s performance has held up in recent months from a longer term perspective, but in this new world of persistently eroding guest traffic, strong year-over-year sales growth performance is simply not possible every year. A period of strong sales growth such as 2018 should be expected to be followed by a softer year, as we’ve seen so far in 2019.”

Same-store traffic growth was -3.9 percent in August. Along with -4.0 in July, the industry just experienced the two worst months in almost two years based on year-over-year traffic growth. The stark reality is that the average restaurant continues to see it's guest counts dwindle every year since the recession. If the industry is to consistently post healthy sales growth, this guest erosion needs to be solved.

Increasing average guest checks, even accelerating their growth in recent months, was not able to push the industry into positive sales growth territory given the abysmal traffic results during the last two months.

However, it is important to note that August of 2018 had the strongest traffic growth results of last year, albeit still negative. This meant a tough comparison to lap over. Much as what was discussed for sales, current traffic performance remains relatively unchanged when calculating growth on a two-year basis. August’s same-store traffic growth compared with August of 2017 was -4.6 percent; the average for the previous twelve months. “There is little comfort in knowing the industry keeps losing guests at the same pace as it has been for the last year,” continued Fernandez, “but at least the bleed is not getting worse.”

Fine Dining Continues To Outperform All Segments

Fine dining was the best performing segment based on same-store sales growth during August. For the last few years, guests looking for an upscale dining experience and that have the income to spend have responded well to the offerings by fine dining chain restaurants. This segment is also the top performer based on sales growth year to date and among the top two performing segments in each of the last two years.

The only other segment that was able to post positive same-store sales growth during August was family dining. This segment has been experiencing a sales resurgence since 2018.

Labor Market Key to Continued Consumer Spending; Recession an Emerging Threat

“The trade battle between the U.S. and China is creating enough collateral damage that there are now worries that a global economic slowdown is nearing,” stated Joel Naroff, president of Naroff Economic Advisors and TDn2K economist. “The U.S. economy continues to expand, but with new tariffs being imposed and more possible, the future is more uncertain. Europe is being battered by the weakening in its two major trading partners. Japan is hurting as well. The U.S. manufacturing sector is faltering. Indeed, the only positive segment of the economy is consumer spending. That is being supported by a solid job market and decent income gains.”

“But, payroll increases have slowed and the decline in the unemployment rate has stopped, raising questions about whether consumer confidence can remain high enough to sustain the spending. The labor market is the key. If jobs remain plentiful, households will have the funds to keep growth going. If it falters, it would likely take a sudden end to the trade war to prevent a recession.”

Employee Retention Still Troubling; Training and Development Part of Potential Solution

Restaurants are now adding declining sales growth to the challenge they have been wrestling with for years. Finding and retaining enough employees to keep restaurants fully staffed persists as one of the biggest headaches for operators according to the latest results from TDn2K’s People Report™. In July, rolling 12 month turnover rates for restaurant hourly employees and managers increased once more, keeping the industry at historically high levels.

Continued job growth coupled with difficulty finding capable job candidates has resulted in an increase in unfilled positions across the industry. Based on TDn2K’s Workforce Index, limited service brands (quick service and fast casual restaurants) have felt the most pressure on this front. While 29 percent of full service restaurants reported an increase in vacancies at the management level, 38 percent of limited service reported an increase. At the restaurant non-management level, 27 percent for full service and 44 percent for limited service reported an increase.

Compensation has typically been the key lever to use when competing for talent in an increasingly tight environment. But successful operators recognize that the employee value proposition goes well beyond pay. When asked what works to improve employee retention at all levels within their restaurants, operators frequently mention things like improved training as well as career development. And the data supports these responses. A recent TDn2K analysis revealed restaurant brands that invest in their managers’ leadership development and spend time training them on HR specific topics results in lower turnover.

The restaurant industry is expected to experience weak sales and traffic growth results for the last third of the year. Average same-store sales growth for the last four months of 2018 was 1.3 percent, compared with an average of 0.5 percent for the first months of last year. Given these tougher comparisons in the months ahead, small positive sales growth is a best-case scenario for the rest of the year. Flat to declining sales growth is a distinct possibility, especially if consumer confidence begins to suffer as news of trade wars continue fanning the recession flames.

Adding to the negative outlook for next month’s results is the fact that major areas of the country are being evacuated and possibly devastated by another major hurricane. This will undoubtedly hurt restaurant sales, particularly in those areas directly affected on the Atlantic coast. But restaurants in those areas hit by the storm are expected to see a jump in their sales in the recovery period in the months ahead.

Matching Meals

New research from Vanderbilt University about restaurant-goers' dining choices could help restaurants better understand how they market to their customers, watch video above. The research finds that diners tend to match their dining companions' orders on characteristics that can be measured or ranked, such as size or price, but differentiate on characteristics that can't, such as flavor or shape. The reason? Purely to avoid awkwardness and make sure that we and the people we are with feel comfortable. The theory explains why, for example, when we go out with a friend for ice cream, we'll order the same amount of scoops as our friend, but will likely choose a different flavor.

The research from Kelly Haws, Vanderbilt marketing professor and food decision-making researcher, can help restaurant managers and owners make better decisions about how to shape consumers' choices through store signage, employee interactions and other cues.

t’s a familiar scenario: You go out to eat with a friend, and he or she orders a Caesar salad. Your friend’s choice inspires you to order a salad, too—only you decide to mix things up a little and choose a chef salad instead. This scenario sits at the center of a persistent marketing puzzle: Why are we more likely to copy our friends in certain domains but not in others?

The theory developed by Haws, Anne Marie and Thomas B. Walker, Jr. Professor of Marketing at Vanderbilt’s Owen Graduate School of Management, suggests that we tend to want to match characteristics that can be measured or ranked, such as size or price, but feel free to diverge on characteristics that can’t, such as flavor or shape. And we do this to avoid awkwardness.

Her findings are reported in Mindful Matching: Ordinal Versus Nominal Attributes, forthcoming in the Journal of Marketing Research. Peggy Liu of the University of Pittsburgh and Brent McFerran of Simon Fraser University are her co-authors.

Through a series of 11 experiments, Haws and her co-authors explored a number of nuances that govern these decisions. While they focused on food choices, they also looked at a charitable giving scenario to test whether their findings could extend to other decision-making areas.

The Impact of Viral Allegiances

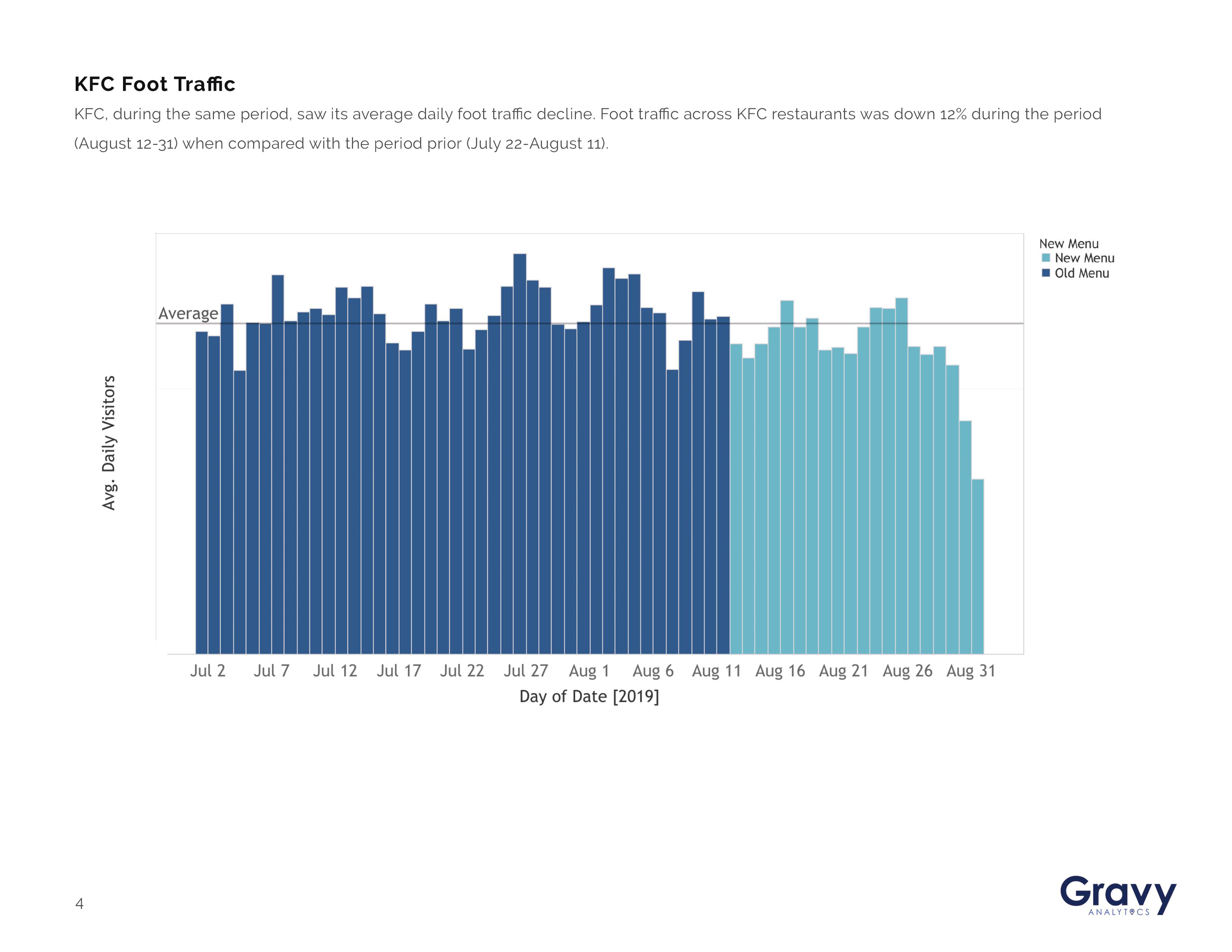

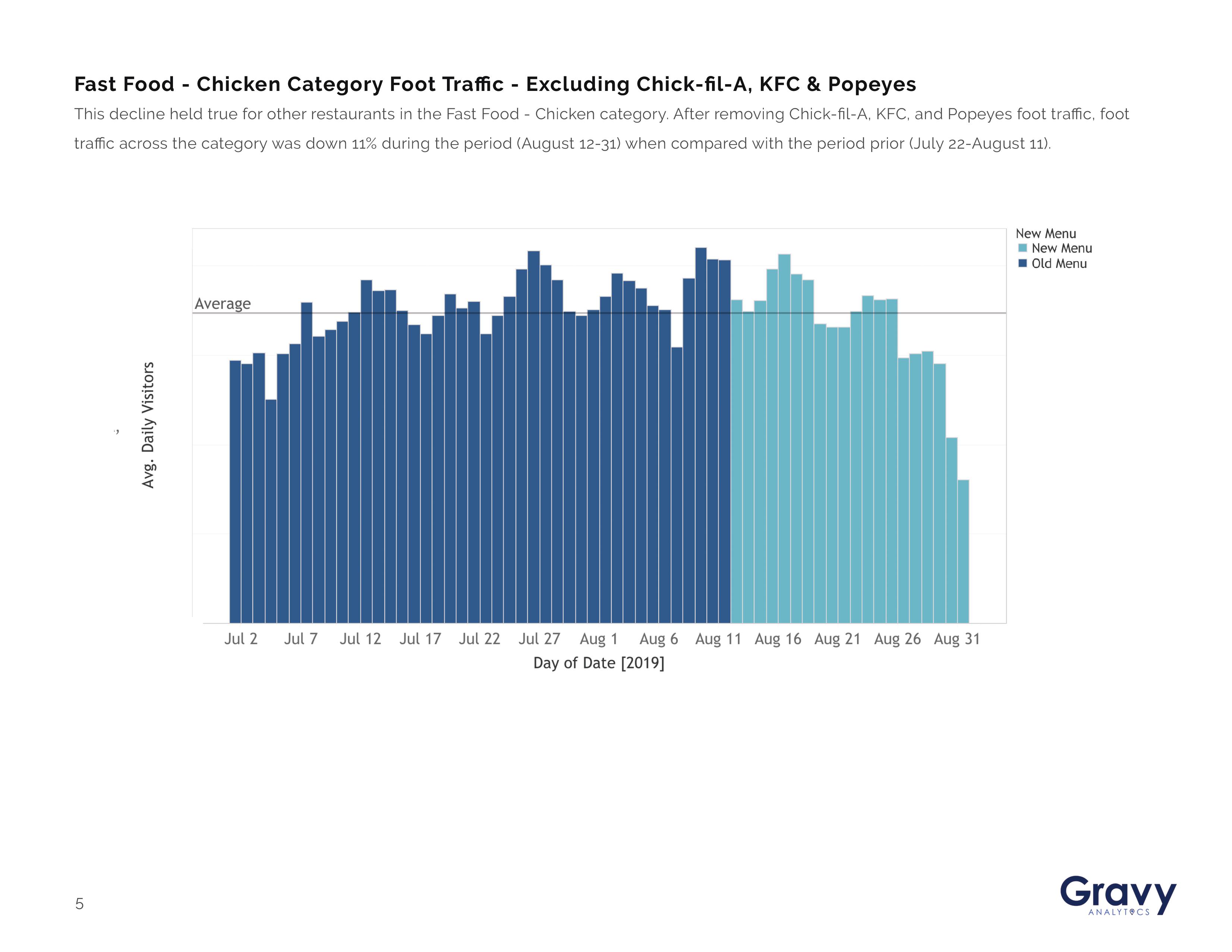

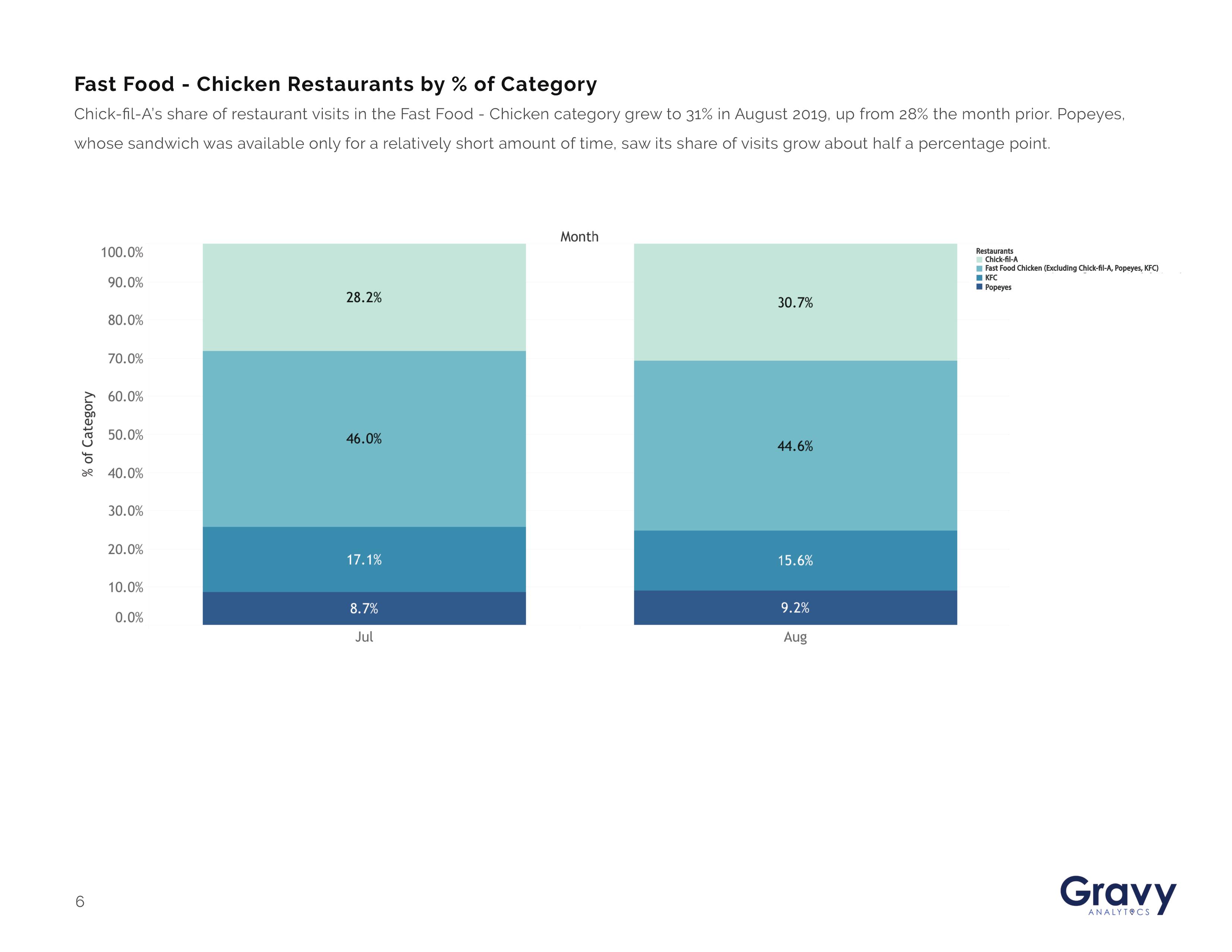

Gravy Analytics' most recent foot-traffic study that looks at how viral allegiances translated to real-world consumer behavior, comparing foot traffic at Chick-Fil-A, KFC, Popeye’s, and other fast food shops (in the chicken category)—following the viral chicken war.

The report found that Chick-Fil-A took the lead with a 16.5 percent increase in foot traffic after introducing mac n cheese to the menu and promoting their chicken sandwich as an alternative to the elusive new Popeye’s offering.

Interestingly, the entire “Fast Food – Chicken” category received about the same total foot traffic despite the viral posts. More people visited Chick-fil-A and Popeye’s, but that foot traffic came at the expense of other restaurants in the space.

One-Day Traffic Bonanza

KFC announced its partnership with Beyond Meat with a one day test in Smyrne, Georgia. Placer.ai found the daily traffic to the KFC branch had a huge spike on the day of the deal, August 27with nearly 1,500 visitors visiting the location that normally sees a third of that number as a strong day. And they didn’t just come to the location, they waited. The excitement generated pushed visitors to spend an average of 81 minutes at the location, more than double the normal average of 40 minutes for a visitor from the six months prior to the launch with lines around the block. Placer.ai concludes this golden age of reaching customers is hugely impressive and could spark a multitude of other creative approaches to garnering interest.

For additional information, click here.

The Guac Power

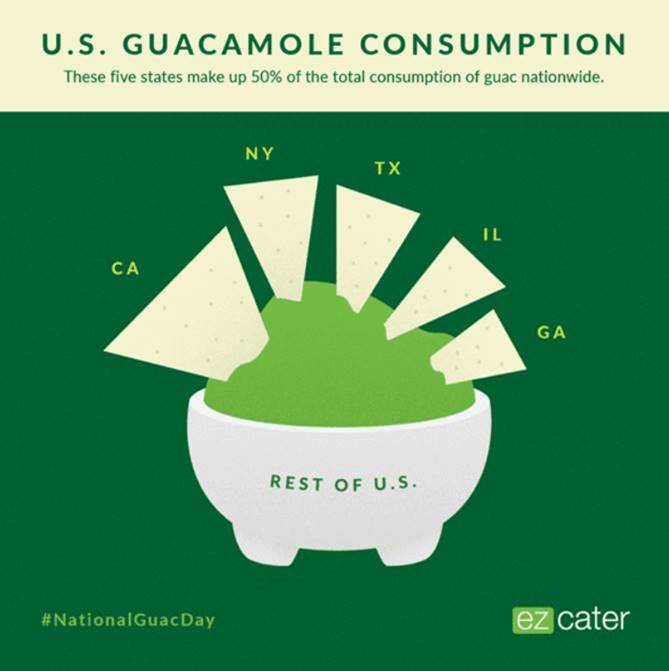

To celebrate the nation’s favorite green dip on National Guacamole Day, ezCater dug into reams of guac data from its catering platform (60,000+ restaurants) and found that U.S. professionals devoured nearly seven million pounds of guac at work alone over the past year. That’s an estimated 2.94 pounds per person –enough to full an Olympic swimming pool!

ezCater, which powers lunch at America’s offices, also found that businesspeople ordered 99 percent more guacamole this year than last year. And who loves guac most? The top 10-ordering states (in descending order):

- California

- New York

- Texas

- Illinois

- Georgia

- Massachusetts

- Florida

- Virginia

- Ohio

- Arizona

Light Meals in China

While eating light is now part of a trendy, healthy lifestyle, it seems Chinese consumers still have their reservations when it comes to light meals (eg congee, sandwiches, salad), with satiation and taste causing the most concern.

Indeed, latest research from Mintel reveals that more than a third (36 percent) of urban Chinese respondents who have not or barely had light meals in the last six months* say that the reason for this is because they get hungry easily after consuming them, while three in 10 (29 percent) say that light meals lack the feeling of satiety.

Meanwhile, considering how flavours can stimulate the taste buds, one-third (32 percent) of Chinese respondents who have not or barely had light meals in the last six months* cite a lack of taste as a reason for rarely, or not, consuming light meals.

Belle Wang, Associate Food and Drink Analyst, Mintel China Reports, said:

“Light meals have started to trend in China due to consumers' growing awareness of healthy diets. However, satiation and lack of taste are the main stumbling blocks among Chinese consumers. In this light, brands can consider pairing light meals with a variety of ingredients that satisfy hunger, while also highlighting messages like ‘super full’ or ‘one bowl is enough’ to assuage any concerns around satiety. Addressing the taste issue, brands can look into developing a range of accompanying, flavourful sauces, or pairing light meals with sides. For instance, instead of being a main course, salads are typically looked upon as a side or starter. With this in mind, businesses can explore offering flavourful sides or appetisers in small amounts to pair with light main courses like salads as a way to enhance the taste.”

Driving increased popularity among Chinese consumers

Mintel research reveals that almost two-thirds (63 percent) of Chinese respondents say that they are encouraged to buy a light meal if it contains nuts and seeds. This is followed by fruits, as well as grains, preferred by 59 percent of Chinese consumers respectively.

Along the lines of using side dishes to drive interest, light meals with healthy soft drinks can also encourage consumers’ uptake; over one-third of Chinese respondents say that they will buy a light meal set if there is yoghurt (39 percent), fresh fruit and vegetable juice (37 percent) or probiotic soft drinks (35 percent).

“Given that Chinese consumers are worried about feeling hungry after having light meals, brands can look at adding nuts, seeds, fruits as well as coarse grains to enhance feelings of satiety. Coarse grains, for example, are high in dietary fibre and easy to fill up on. In fact, our research shows that consumers have indicated that they will be more encouraged to buy a light meal if it contains such ingredients. In addition, light meals can also be paired with nutritious and functional beverages as a set. With health benefits being the main reason for having light meals, these product offering tactics will enhance the health benefits of light meals and also make them more filling—eliminating concerns around satiation.” Belle continued.

Opportunity for foodservice lies in workday lunch occasion

Finally, it seems the workday lunch occasion is where light meal foodservice businesses should focus their marketing efforts. Mintel research reveals that in the past six months*, over two in five urban Chinese respondents say that they have had home-made light meals for breakfast (44 percent) and dinner (42 percent) during workdays. Comparatively, just one in five (21 percent) have had home-made light meals during workday lunches in the same time period.

What is more, almost a third (31 percent) of light meal consumers say they have bought light meals from restaurants during the workday lunch occasion; this is higher than other channels including food delivery (29 percent), convenience stores (23 percent) or even those made at home (21 percent).

“Short lunch breaks are the reason why Chinese consumers tend to get their light meals from restaurants during the workday. Therefore, the light meals offered need to be convenient, nutritious and energy-boosting. Compared to convenience stores, restaurants offer more choices and seating areas. Consumers in China, especially management and white-collar workers, go to restaurants for the very purpose of stretching their legs after a sedentary morning at the office. They also choose to go to restaurants over food delivery because delivery times can be long and unreliable. In this case, restaurants need to improve the efficiency of in-store management to meet consumers’ expectations on eating time and environment.” Belle concluded.

Millennials Want Quality

Quality drives millennial food shopping, and they are willing to pay more for it, according to a new Whole Foods Market survey. Eighty percent of millennials value quality when it comes to food shopping, and nearly 70 percent are willing to spend more money on high quality foods.

These findings are part of a new survey released today that examines millennial food, health and grocery shopping preferences, which was conducted independently by YouGov on behalf of the retailer. The national online survey sampled 1,006 adults between the ages of 22 and 37 in the U.S.

Another trend that emerged is more informed purchasing decisions. A majority of millennials want to know where their food comes from and how it is sourced. Transparency in food sourcing is important to more than 65 percent of millennials, particularly for fresh meat and seafood. More than half of millennials will pay more for products that have adopted animal welfare standards and prefer to buy those responsibly sourced.

Food labeling and ingredient transparency are also key factors in millennials’ choices: Compared to five years ago, nearly 70 percent of millennials read labels more closely. More than 60 percent are more concerned about additives and growth hormones. Ultimately, half of millennials buy more organic products than they did five years ago.

“We’re always striving to better understand our customers’ passions when it comes to food,” said Sonya Gafsi Oblisk, Whole Foods Market’s Chief Marketing Officer. “Millennials don’t settle for just any food in their shopping carts, and neither do we. The stories of how food is produced and grown matter to them – and to us. That is why we ban more than a hundred ingredients in the food we sell. Going beyond the USDA requirements, we prohibit antibiotics and added hormones for all meats in our meat department, and we only sell sustainable wild-caught or Responsibly Farmed seafood. Our standards drive the work we do and if products don’t meet our standards, we don’t sell.”

- Nearly seven in ten millennials spent more on food than on travel in the past year. A majority of millennials surveyed considered themselves to be “adventurous” eaters when it comes to food, and more than 60 percent make an effort to cook new dishes.

- More than six out of ten millennials try to eat healthy daily. Plant-based and unprocessed foods are becoming more popular with 63 percent of millennials trying to incorporate them into their diets.

- Over the past year, nearly half of millennials have tried a special diet, such as Keto and dairy-free. Fifty-two percent restrict ingredients due to health reasons. More than half of millennials found that maintaining an alternative diet is often inconvenient so are willing to pay more for convenient, ready-made meals that are healthy and high quality.

- More than 60 percent are aware of the implications their food choices have on the environment. About half actively seek out food and beverages made of less packaging and plastic.

UK's Favorite Foods

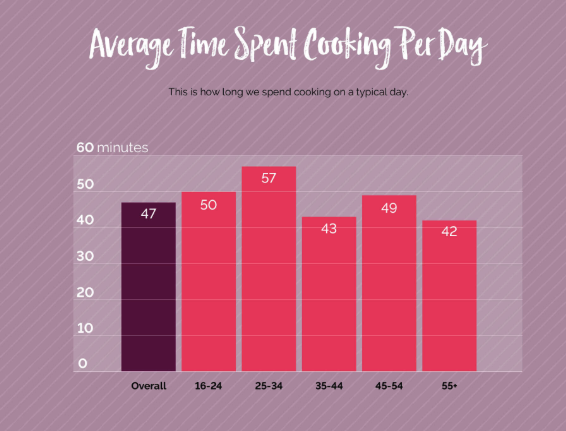

Leisure surveyed residents of the UK to find out more about their favourite foods, the most popular cuisines, who we eat with and how long we spend cooking.

Fish and chips, a Sunday roast, and a full English breakfast are just some traditional British meals that may spring to mind when someone asks you what British cuisine consists of. However, in a nation of foodies, we all have different taste buds to please – one person’s favourite meal may be another’s foodie nightmare. So how different are our eating habits in the UK? Which meals are our favourites? And how do our cooking habits vary from region to region? Leisure has surveyed over 1,000 UK residents to reveal the nation’s most interesting eating habits.

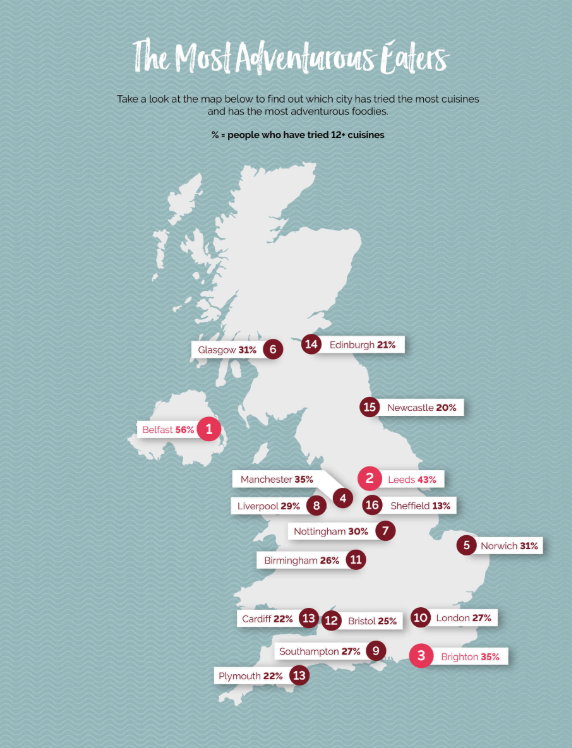

The UK’s most adventurous ‘foodie’ cities

Belfast was crowned as the most adventurous foodie city, with 56.3 percent of respondents from Belfast having tried 12 or more cuisines, followed by Leeds where 42.5 percent had tried 12+ cuisines. You can view the most adventurous foodie cities below.

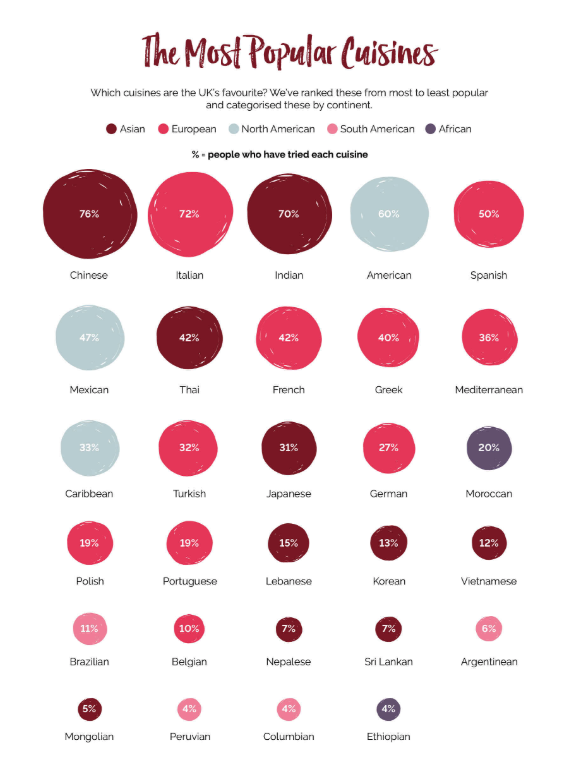

The most and least tried cuisines in the UK

Chinese food emerged as the most tried cuisine in the UK, with 72 percent of all respondents saying they had tried the Asian cuisine. Italian (72 percent), Indian (69.5 percent), American (60.4 percent) and Spanish (50.4 percent) followed in the top five most tried cuisines, with Mexican, Thai, and Greek cuisines also making the top ten.

Ethiopian, Columbian and Peruvian cuisines were amongst the least tried cuisines in the UK with less than five percent of respondents reporting to have tried these foods.

The UK’s loneliest eaters

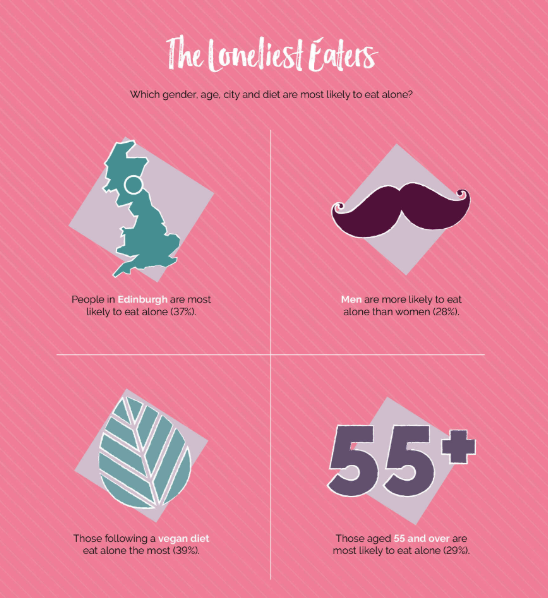

When asked with whom they usually eat their evening meals with, just over a third (33.6 percent) said their family, with almost a quarter of respondents (23.5 percent) saying they typically eat their evening meals alone. The majority (38.4 percent) said they ate their evening meal with their partner, whilst only 4.2 percent said they ate their meals with their friends.

Analysis of these responses revealed that people in Edinburgh are the most likely to eat alone, with 37 percent of respondents in Edinburgh commenting that they generally eat their evening meals without company. Furthermore, men are more likely to eat alone than women – as are those aged 55 and over (when compared to other age groups), and those following a vegan diet.

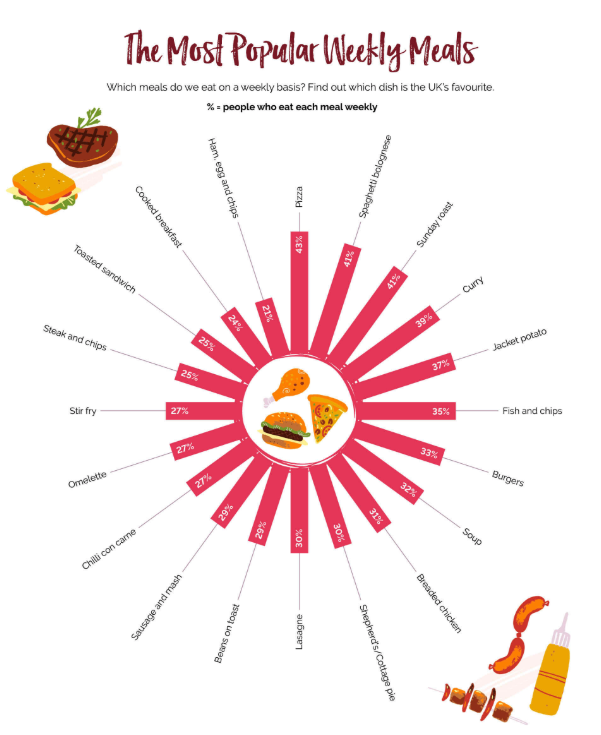

Britains’ weekly meal plan: Which meals do we eat on a weekly basis?

They asked those surveyed which meals they tend to eat at home in a typical week. The UK’s top ten favourite meals can be found below.

Gino Grossi, Marketing Manager at Leisure, said, “Our new research reveals we are a nation of adventurous foodies and it's great to see the variety of cuisines that make up the British weekly menu. From old favourites like Chinese and Indian to more new arrivals like Greek and Mexican, Brits love to treat their taste buds to a plethora of treats from around the world.

Whatever cuisine you're cooking up at home, be sure to keep the quintessential British adventurousness alive in your kitchen”

For more information on the UK’s eating habits, visit Leisure.