Should You Pass on Credit Card Fees to Your Customers?

4 Min Read By Ellen Cunningham

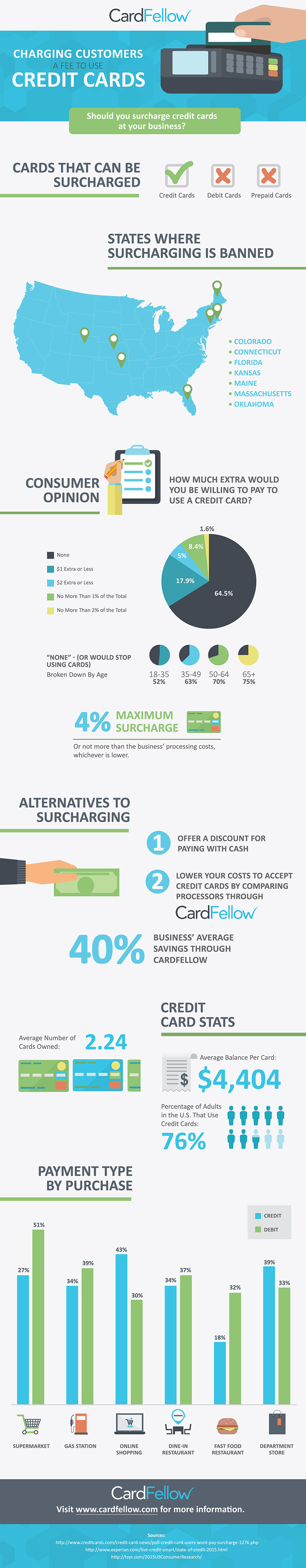

In all but a few states, it’s legal (and permitted by merchant agreement) to add a fee when customers pay by credit card. Known as “surcharging,” adding a fee enables restaurants to recoup the costs of accepting cards.

Let’s take a look at the rules surrounding surcharges and questions to ask yourself to determine if it’s right for your business.

Understanding Surcharging

Surcharging means adding a fee to a credit card transaction. Until 2013, it was prohibited by merchant agreements, and, in some states, by state law. In 2013, a class action lawsuit led to the removal of the surcharge prohibition from the card brands, meaning that businesses could add fees to credit card purchases unless they were in a state that prohibited it by law.

However, even where legal, there are rules. Currently, if you want to surcharge a transaction, you must:

- Only apply the surcharge to credit card purchase.

- Surcharges cannot be applied to debit card purchases, even if the debit card is “run as credit.”

- Not charge more than 4 percent or the actual cost of processing, whichever is lower.

- Disclose the surcharge prior to checkout.

- Notify Visa and Mastercard of your intent to surcharge at least 30 days before beginning to surcharge.

- Keep in mind that “surcharges” are different than “cash discounts.”

Surcharges vs. Cash Discounts

There’s a lot of confusion around surcharges and cash discounts. The distinction sounds minor, but it’s actually very important for complying with surcharge rules.

A surcharge refers to adding a fee on top of the regular price. You post the price of a dish on your menu and then add a fee at checkout if a customer uses a credit card to pay for their meal.

A cash discount refers to giving a discount on the regular price. You post the price of a dish on your menu and then subtract a percentage at checkout if a customer pays with cash.

Unfortunately, there are several companies that are offering “cash discount” programs that are really surcharge programs in disguise. What happens is the company claims that you’ll post the “cash price” on your menu, and then charge a “service fee” at checkout. The “service fee” will be removed if the customer pays with cash, giving an “immediate discount” of the service fee. That’s not a discount, and does not qualify as a cash discount program. A cash discount has to offer a discount on the menu price, not an “instant discount” by eliminating an extra fee.

There are no situations in which you can post the “cash price” on the menu, add a “service fee”, remove the “service fee” for cash customers, and call it a cash discount program. Any time that you add a fee to the menu price at the register, it’s a surcharge program. In fact, Visa even issued a statement about the distinction.

Why does it matter if it’s a surcharge or a cash discount?

There are a few reasons. Surcharging has specific rules regarding how much you can charge, how it must be disclosed, etc. Not meeting the requirements can bring fines or a shutdown of your merchant account.

Additionally, surcharging is still against the law in some states. The last thing your restaurant needs is a complaint to your state’s attorney general’s office. Cash discounting is legal in all states, but you’ll need to ensure it’s a true cash discount program.

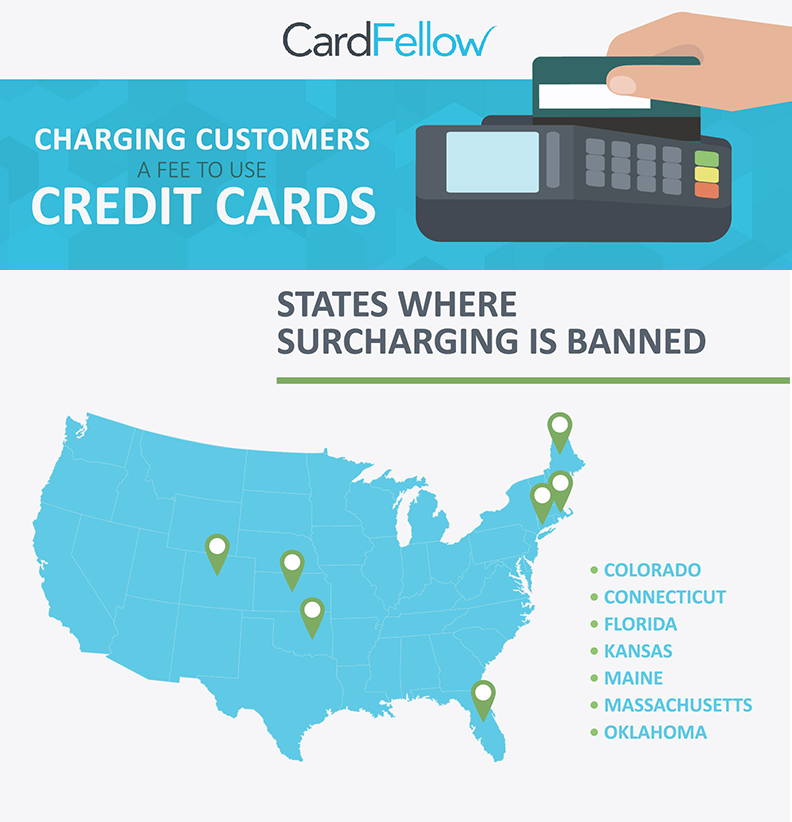

States Where Surcharging is Prohibited

Initially, when surcharging became permissible by the card brands, there were 10 states that prohibited it by law. However, several of those states have lost court battles brought by businesses that wanted to surcharge. Now, the list is down to seve states, and it’s likely that surcharging may become legal in all states in the future.

At the time of writing, the seven states that prohibit surcharging are:

- Colorado

- Connecticut

- Florida

- Kansas

- Maine

- Massachusetts

- Oklahoma

If you’re in one of those states, you cannot surcharge credit card transactions. However, you can offer a cash discount, provided you’re offering a true cash discount. (Remember the section on the differences from earlier in this article!)

If you’re unsure if your state laws have changed, you can contact your state attorney general’s office for the most up to date information.

Questions to Ask Before Surcharging

Restaurant owners in states where surcharging is legal should still ask themselves questions before surcharging.

- Do competitors surcharge?

- Is your target customer against surcharging?

- Would offering a cash discount cause less problems?

- Do Competitors Surcharge?

If surcharging is uncommon in your area, you might get a reputation as the restaurant that “nickel and dimes” customers. Additionally, if you have a lot of competition, it may encourage your customers to go elsewhere. On the other hand, if you’re in an area where surcharges are common or there aren’t many restaurants that are similar to yours, you may have more leverage to impose surcharges with less resistance.

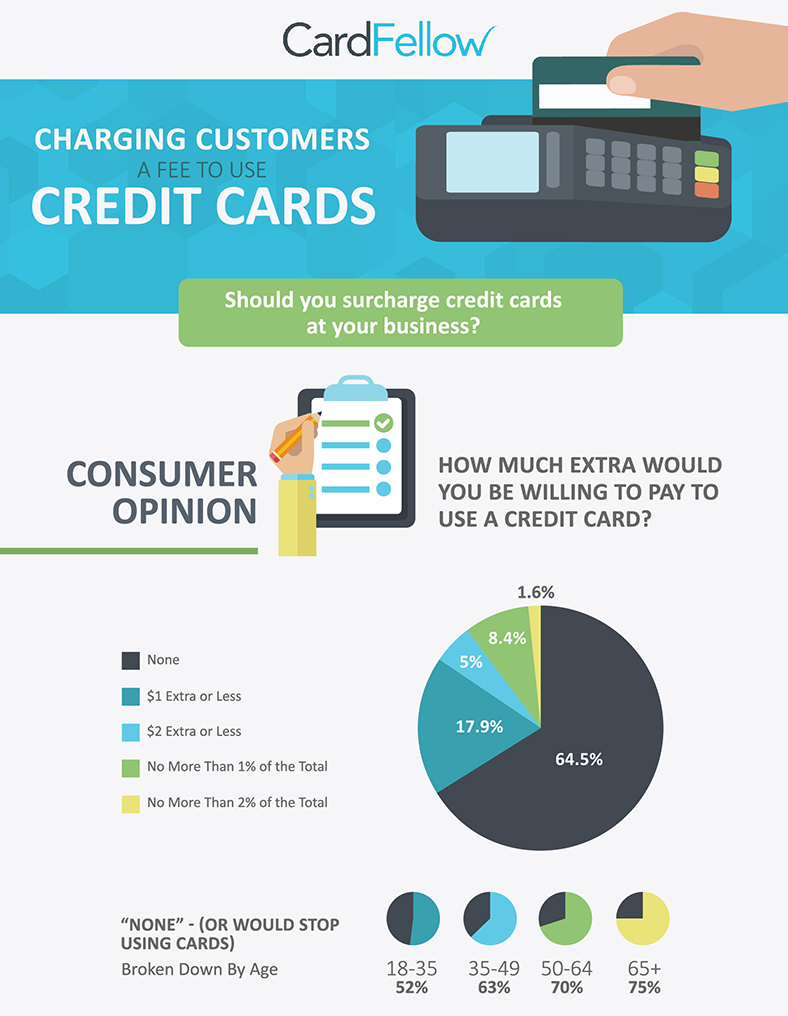

- Is Your Target Customer Against Surcharging?

In one consumer opinion study, researchers found that 64.5 percent of people say they would not be willing to pay extra to use a credit card. Of that group, older people are more likely than younger people to say they would stop using cards.

Take a look at your target customer. Do they fall into a demographic strongly against surcharging? If so, you might want to consider alternatives.

Would Offering a Cash Discount Cause Less Problems?

In many cases, customers respond more positively to a cash discount (even if they ultimately choose not to pay with cash) because they see it as a perk. By contrast, they see a surcharge as a punishment. If it’s possible to raise your prices to cover the cost of credit card acceptance and then simply offer a cash discount, it won’t matter how your customers choose to pay. The card cost would already be baked in to the menu price, so if customers don’t opt for the cash discount, it doesn’t matter to your bottom line.

If you do decide to surcharge, be sure to monitor its effect on customer satisfaction so you can revert if necessary.