Talking With: Suneera Madhani, CEO of Fattmerchant

4 Min Read By MRM Staff

Credit card processing fees are just one more of the expenses that cut into already small margins for restaurants and other small businesses. More than 95 percent of American restaurants accept credit cards and have to deal with fees for PCI compliance, the IRS and more making it hard to estimate monthly expense sheets. Seeing a new way to do things that provides an advantage for small businesses, Suneera Madhani established Fattmerchant, a transparent subscription-based merchant services. In Modern Restaurant Management’s “Talking With” series, she discusses creating value for businesses, entrepreneurial spirit and what’s behind the company name.

Please explain Fattmerchant’s origin story?

I worked in the payments industry, particular in merchant services, for several years prior to establishing Fattmerchant. After hearing customers’ stories and dissatisfaction with the amount they were paying in merchant processing and its lack of transparency, I took the idea to my bosses to offer our clients a flat monthly fee for the transaction costs. They laughed and questioned why they would only want to make a fraction of what they could make by sticking with the traditional route. That’s all I needed to hear to venture out on my own and found Fattmerchant in 2014.

Why did you strike out on your own? Did you always intend to be an entrepreneur?

I grew up in an entrepreneurial family, but never saw a clear path towards owning my own company until the above experience. I always knew I had it in me and was capable, but I needed an idea I was passionate about, transparent merchant processing, to make it happen.

Please give a few examples of how it works in action at restaurants?

Every time a customer swipes a credit or debit card to pay for their meal, there are rates associated with each transaction called interchange. These rates are set by the credit card companies themselves and can’t be changed. However, traditional merchant service providers charge rates on top of interchange along with additional fees and contracts. That’s where Fattmerchant comes in, giving the power back to the merchant.

Why is Fattmerchant designed for the restaurant industry?

Fattmerchant is designed for a variety of different industries and businesses, but restaurants can specifically benefit from the technology because most customers and patrons pay for their meal using a credit or debit card. Instead of restaurant managers stressing over the amount they will owe in merchant processing each month, Fattmerchant has a subscription-based plan ensuring that restaurant owners always know exactly what they will be paying at the end of the month.

What problems does Fattmerchant provide solutions for?

Fattmerchant offers credit card processing for every kind of business while reducing merchant processing costs by 40 percent. We are able to save merchants so much money each month by never adding mark-ups or other fees, and providing free equipment, no contracts and no ancillary fees. We also offer restaurant owners a level of service that has never been seen before in the industry. With no 1-800 numbers and voice to the phone service, there is always a real human at Fattmerchant HQ ready to help you!

Who are your customers and how do you raise awareness?

Fattmerchant has a wide range of customers in more than 50 industries, including restaurants, hotel management, ecommerce, salon and spas, construction, professional services and sports management, to name a few. We raise awareness by reaching out to publications like yours to tell our business story as well as to reach out to other businesses we can help with their bottom line and to make life easier. In addition, many of our customers refer us to their friends and fellow business owners also looking to save on merchant processing.

What are challenges do you see facing the restaurant industry?

Currently, very few restaurants are set up with EMV technology. This is because their merchant services providers are not providing them with up to date technology that allows them to accept the new chip cards. This leaves restaurants vulnerable to security breaches they could be avoiding. Fattmerchant always provides the newest technology, including EMV, to ensure our merchants are ahead of the curve.

The hospitality industry is not known for being a technology trendsetter, so how do you approach an industry with a product that’s technologically savvy?

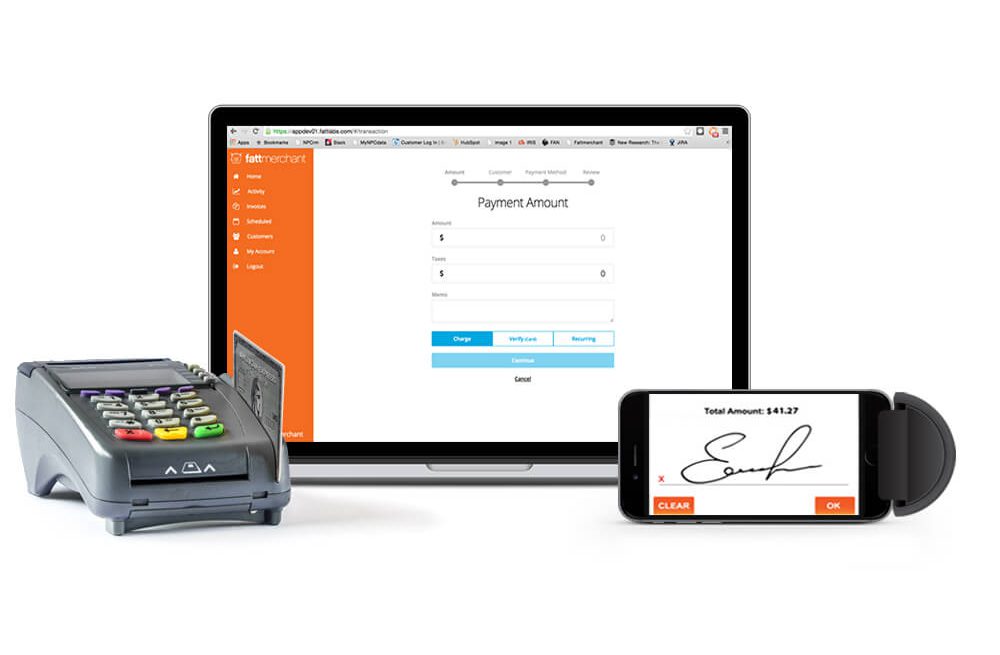

Our system is so intuitive and user friendly that even individuals who are not technologically savvy are able to use and understand it. When we work with business owners in the hospitality business, we always focus on breaking down the process and language into manageable pieces so they are able to understand the services Fattmerchant offers and how we can affect their bottom line at the end of the year.

Our main goal is to help business owners save money by cutting down their monthly payment processing bills and our team is always available and transparent and available to answer questions and provide customer service.

How are you poised to compete? Do you have direct competition?

As with any business model, there is always competition, but Fattmerchant was created with a unique business model in mind, and operates without any hidden fees. Unlike the rest of our competitors, we offer all of the following:

- Zero Percent Markups

- Free Equipment

- Full Service

- No Ancillary Fees

- Next Day Funding

- No Contract

- Analytics Dashboard & Tools

- 24 hour, real human service

What is the story behind the name Fattmerchant?

The name “Fatt” in Fattmerchant stands for Fast Affordable Transaction Technology. We say that we make your wallet fat and we wanted a name that was memorable in the world of the payments industry, while also bringing a fun user experience to our members.