The Elusive Heavy QSR User Everyone is Missing

4 Min Read By Dana Baggett

If QSR brands are all targeting the traditional “heavy” fast food user, are they missing consumers that cross over to heavy users for short bursts throughout the year?

Take me as an example. If a typical marketer developed a persona around my purchases/locations frequented they would never suspect that I’m a heavy QSR user. Although I’m a busy working mom with two young boys, I find time to visit the farmer’s market to buy $6 free-range eggs and much to the amusement of the staff at Moe’s, my five-year old always loudly proclaims that he’s a flexitarian. To top it all off I’ve been a pescatarian for more than 20 years and vegetarians don’t typically make anyone’s QSR target list let alone heavy user list, but I should be on that list.

We know that being a busy parent increases QSR and pizza usage, but how do companies fighting for share of stomach capitalize on these trends?

At least I should be on their list during the summer, because changes in my summer behavior make me an elusive QSR heavy user. Looking at my own seasonal behavior made me wonder how much other consumers change their eating behaviors due to personal factors.

Do short- and long-term lifestyle changes such as moving, busy seasons at work or participating in seasonal sports temporarily change the way we eat? Trish Mueller, former CMO of The Home Depot says: “It’s evident that both big and small life changes influence consumer behavior; we can see it in data as well as in our personal lives. For example, I recently transitioned from the position of CMO at The Home Depot to launching my own consulting firm. This move not only changed my “personal trade area,” but it temporarily impacted where and how often I go out to eat as I adjust to my “new normal.”

Mueller continues to say, “It’s important for marketers to understand that consumers’ lives are fluid, with many micro-moments, which present an opportunity to better understand them through data, to better serve their needs. Gaining an ongoing view of our consumers is the holy grail of modern marketing. The key to success is using data to anticipate these consumer changes and quickly adapting marketing strategies to capitalize on these heavy purchase “waves.”

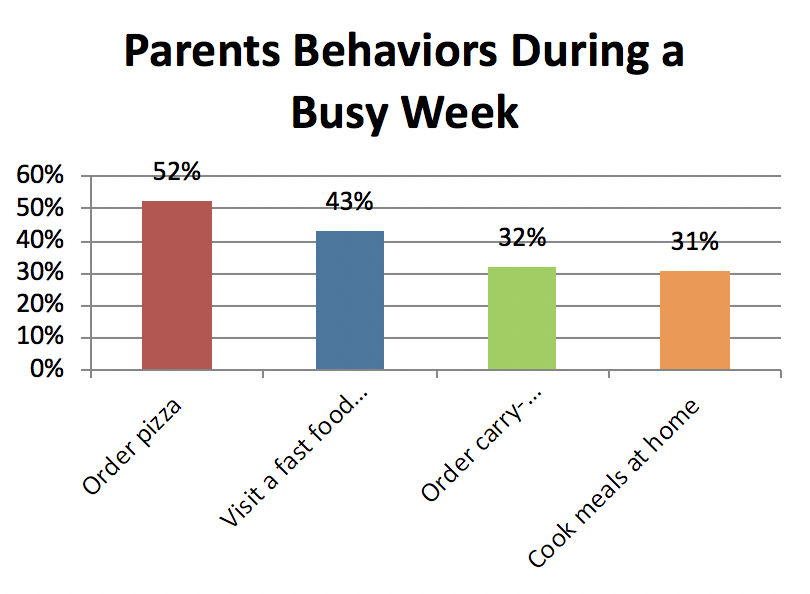

The need for convenience is a significant driver in influencing eating-out behavior, given how fluid and busy our lives can be. According to the Valassis Awareness-to-Activation Study (conducted by NPD) the top two behaviors for all parents with a busy week (activities/sports scheduled for their children) are to order pizza (56 percent) and pick up fast food (43 percent). What’s equally interesting is that 74 percent of millennial parents say their busy schedules influences whether they dine out, carry out or get delivery (147 index compared to all consumers).

Source: Valassis Awareness-to-Activation Study conducted by NPD. Question: Whenever you have a busy week with a lot of activities/sports scheduled for your child(ren), which of the following are you most likely to do? (Please select all that apply)

We know that being a busy parent increases QSR and pizza usage but how do companies fighting for share of stomach capitalize on these trends? And on a larger scale, how are industries pivoting to capitalize on the profound shift in the way they can gain and apply advanced consumer attributes?

John Ross, author of two books on consumer behavior and President and CEO of IGA, a 5,000+ store global grocery chain has tackled this issue. He acknowledges that retailers can get confused by consumer data and that consumers that just made a purchase are no longer in the market to buy and therefore shouldn’t be considered shoppers. “Shoppers are people about to buy, and they are much trickier to find. It is especially true with convenience-driven shoppers who may show up, shop and exit at such speed that it’s hard to understand how they shop and why they buy. Spontaneous shoppers often appear to be random and undisclosed, but that is usually not the case. Just because they make quick decisions and move from shopper to customer at speed doesn’t mean they aren’t thoughtful, discriminating and information hungry,” he says. “People in motion need answers fast and they consume media quickly to get the information they need to make smart decisions. They are often highly influenced by user reviews, in-store signage and recommendations. And they tend to over index on mobile usage too.”

I agree with Ross’ assessment that although shopping behavior can appear to be random, it can also be predictive. Capitalizing on four-dimensional data that includes data from past purchases and in-market signals can be used to identify a consumer’s most current purchase intent.

Understanding the consumer is a difficult task especially as consumer behaviors continue to evolve. Technology has finally advanced to capture data that just recently marketers could only dream of obtaining. Developing and targeting personas by looking at consumers in isolation over a short period of time has transitioned to include seasonal and personal modifications. It is now possible to identify prospects that not only look like your consumers, but also travel to or live in your restaurant’s trade area and regularly visit your competitors.

Layering mobile location data with shopping behaviors like purchases, content consumption, promotional/ coupon sensitivity and restaurant visits is the most sophisticated way to ensure you’re not missing key peaks in behavior that may otherwise be overlooked.